Anniversary Retrospective

Pinebrook’s Substack Turns 2

Two years ago, I launched this Substack after years of posting content on X (formerly Twitter) and participating in podcasts.

The initial motivations for posting were twofold:

1. Be a voice of reason in an increasingly unhinged social media space that rewarded drama and amplified some of the most insane takes. Calls of imminent U.S. treasury market collapse and the end of the dollar reserve currency come to mind.

2. Sharpen my own thinking. When you write something down for the world to see, you put your thought process on display and time either proves you right or wrong.

I received a lot of encouragement from people that had been following my work. I was shocked they wanted to hear more of what I had to say. Podcast opportunities popped up. I was asked to speak at investor conferences. Other influencers amplified my work. 🙏🏼

The most important feedback I received was from people thanking me for keeping them from following widely amplified viral takes that would have cost them money, or from people who had already been baptized in the waters of financial loss and were looking for some sanity.

Equally rewarding was explaining concepts to people on subjects that I was genuinely interested in and had spent years teaching myself, either as a practitioner in the field of financial markets, or as a nerd reading things late at night I should have not been reading and should have been sleeping instead.

Things like understanding the FOMC policy making process, how financial markets price and respond to incoming data, understanding what data points really matter for the business cycle and which are just noise in a sea of indicators. One can never stop learning these things, but it is nice to share and help others.

On September 28, 2023, the inaugural post went up. Another 164 posts have followed since, not including this one.

Looking back and reading one’s own words can be a cringe experience, or one of pride as the benefit of time allows one to judge the quality and accuracy of the output, along with the consistency of the former and latter.

I will leave it to readers to render their own judgement. For now, I would like to highlight some publications of pride, as well as embarrassment, by removing a few paywalls. Nothing has been changed. Readers will get the full scope of my spelling errors and terrible non-AI, excel-based charts.

On November 19, 2023, the soft landing was called. For those keeping score at home, that was over 2,000 S&P500 points ago, and the cope and disbelief lasted throughout the index’s 23.3% price return in calendar 2024.

The call was premised on non-housing core inflation being below 2% and a labor market that was still intact and not on the verge of falling apart. The rest was noise.

The cringe worthy part of this note was making a call on housing market acceleration given peak in inflation and a pending rate cutting cycle.

One of my most consequential notes was published on June 20, 2024. On the surface, the big call was in flagging a false positive of an expected slowdown in the U.S. labor market. Anyone can get lucky, and I certainly did.

The innovation was in understanding how demographic shifts, particular those driven by immigration, clouded our understanding of the labor market. This framework has been subsequently relied on in my work on the state of the economy this year, which has guided my risk-on posture.

The housing call persisted, and it simply didn’t pan out.

Rates > risk worked out well, and this trade was shut down on August 25th when the growth scare was shot in the head.

In anticipation of the Fed’s initiation of its cutting cycle, I made the forceful argument that the Fed had waited too long and was falling behind the curve, and stated “Thus, the Powell Fed will likely be forced to cut more than what is currently priced by markets”.

I subsequently walked this back a week later on the basis of institutional inertia.

I was wrong and the Fed ended up cutting 50-basis points. Womp womp.

As 2024 was coming to a close, I made a VERY out of consensus call for a year-end 2025 S&P500 target of 7,434. This blasphemy flew in the face of street calls that were in the single digits or even negative due to a loss of economic growth momentum three years into a bull market.

The street is now looking for 7,000 – 7,200 close.

Precision is a fool’s errand in this business. Being more right than wrong and by a bigger margin matters more for making money.

Perhaps my biggest miss was not appreciating the market implications of the incoming Trump presidency.

Tarriff talk was in fact the signal, not the noise as I had thought.

Price action was rationalized by macroeconomic word salad cope.

Never judge a person by their mistakes, but rather in how they respond to those mistakes. Self-awareness is a superpower. As the proverbial shit hit the fan in March of 2025, two things become very evident to me.

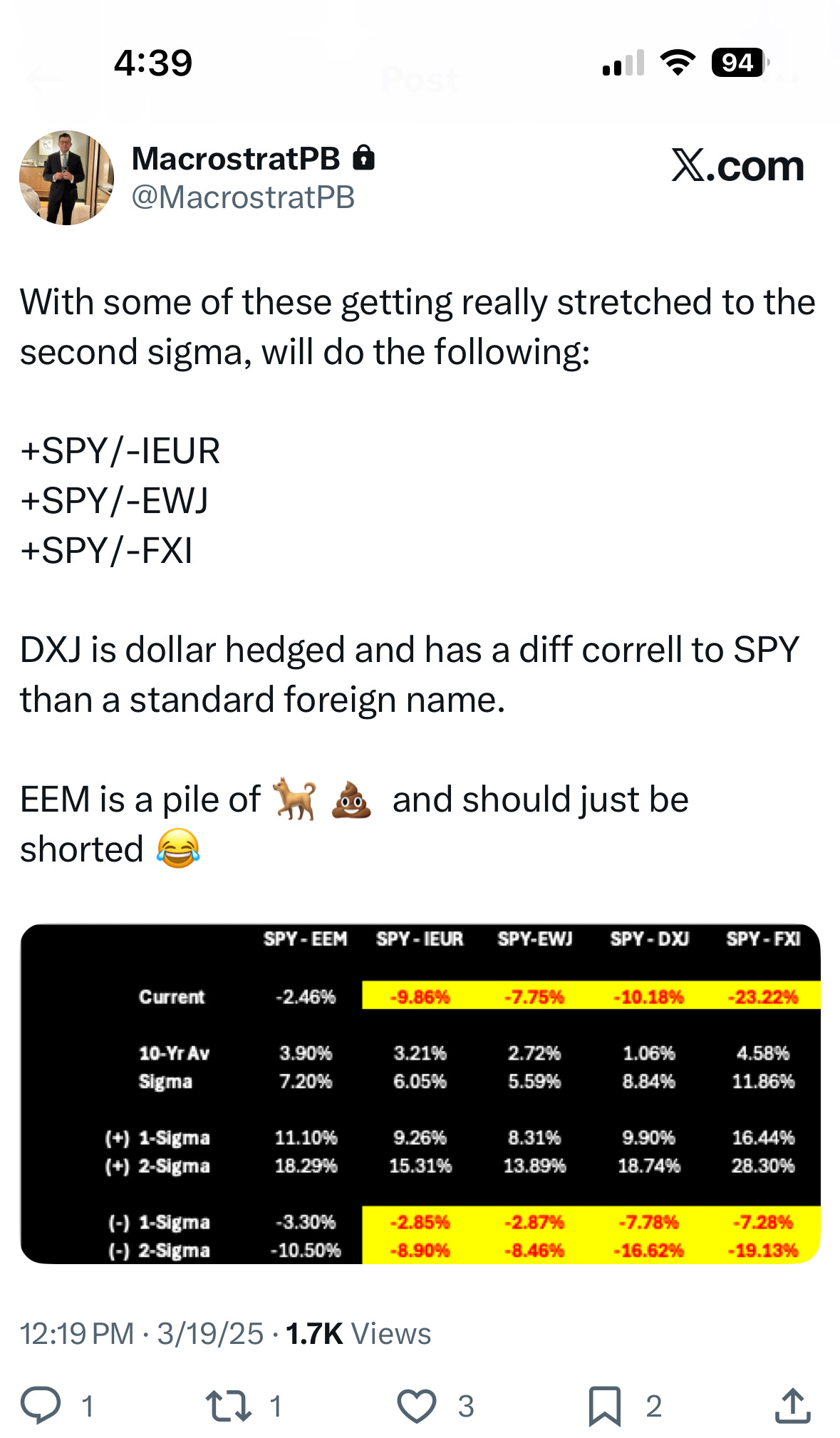

Rest of world (RoW) assets were statistically overbought relative to the USA by anywhere from 1-2 standard deviations.

If the USA was going down, it was taking RoW down with it and thus RoW assets had more room to fall given their then-recent appreciation.

This hedge was a PNL lifesaver and provided the margin of safety to get temporarily long during TACO and then again strategically on April 23, 2025.

Before it became consensus, I argued that a reversal of prior labor market and immigration dynamics was taking place. A shrinking of labor market would lower non-farm payroll prints without a big accompanying increase in the unemployment rate.

By May 11, 2025, it became evident that the post TACO bounce was durable.

Lowered the 2025 YE price target. Mistake.

Had the sense not question it and do something stupid once it was surpassed. Appropriate reaction to the mistake.

Instead of the above, I listened to what the market was telling me, as suggested by Hayek.

Writing for two years with a paper trail that is 165 posts long allows one to reflect on things. I think I got most of the big calls right, and when wrong, corrected the ship pretty quickly. I am not one to scream at the moon.

One can argue that I have been lucky by simply being on the right side of the big macro trade since I started writing. Everyone is a genius in a bull market.

My response to that is that being on the right side of the trade consistently is a skill in itself.

Anyone can throw shit at the wall and get lucky when it sticks.

Doing so consistently and getting it to stay stuck is the flex.

A lot of people cut bait and pull the ripcord in the middle of bull markets because of some bubble indicator or historical analog, which is just sloppy thinking. As Soros said, “When I see a bubble forming, I rush in to buy, adding fuel to the fire”.

There were many potential pivots points when it was unclear if we were still in a bull market. Hard calls were in fact made. It’s never easy.

To my subscribers, thank you for being with me on this journey. To new readers, I invite you to join and become members before prices increase at the end of September 2025.

As Joe Biden showed us, people hate inflation.

Don’t be Joe Biden.

Get after it and front run that shit.

Don’t be poor either. It sucks.

Let's nominate David for Fed chair

Thank you for the consistent sanity!