Market Commentary

2025 Outlook: Average is Lazy

As we close out 2024 and look forward to 2025, the usual suspects are putting out their 2025 market forecasts. Most of these forecasts are worthless before the compliance people even approve them, much less when they hit their destination email in-boxes.

This is not due to their accuracy, or lack thereof. After all, the writers are human, all too human, as Nietzsche said, even if they are smart and AI assisted when making guesses about a distant future full of random variables.

What makes these forecasts deficient is their lack of imagination and their reliance on the historical averages: average growth rates, average returns, and average distributions – all with the caveat that history doesn’t really repeat but it sure does rhyme.

“This happened in the past, it may or may not happen again, but an outcome close enough to something resembling that past is highly likely”. While there is a logic to understanding that the sun will rise again, this kind of analysis is not helpful because we know the sun will rise again, and therefore have no new marginal information on which base decisions regarding the allocation of capital.

Throwing shit at the wall is a not a real strategy.

Take for instance the idea is that the third year returns of a bull market are historically meh and sub-par. Intuitively this has some appeal, as an acceleration in economic growth rates tends to be strongest as the economy bounces back after a downturn.

Physics envy is real in this business, and it will cause some investors to misprice risk if they conflate cars with economic outcomes, or narrowly focus on the math of declining marginal change (1=>2 is +100%; 2=>3 is +50%, 3=>4 is +33%....) as a proxy for market outcomes. More so if a random historical pattern of returns supports the argument.

The basic math behind most S&P500 targets starts with the historical price return of 10.4% per year since 1928, and a total return of 11.7% per year in the same period. Thus, Friday’s S&P500 close of 6032.38 becomes 6659.74 (or something close enough) by YE 2025.

Pass Go and collect the year-end bonus. While not terribly imaginative, the argument above is historically defensible and will not get anyone fired.

The problem is this is not how real life plays out. Real life returns look like ‘dis 👇

Source: macrotrends.net

As the outperformance of the MAG-7 versus the other 493 components of the S&P500 and the rest of the world (RoW) have illustrated, returns from normal growth are not normally distributed.

Relying on average historical patterns does not consider changes to the economy, financial markets, regulatory structure, or technology over the course of cycles. Historical patterns also don’t consider the accelerating rate of evolutionary change in the aforementioned domains.

Think of Moore’s Law here, and how it is an experience-curve law where efficiency gains follow from experience and effort.

Why should an expected marginally declining economic growth rate in 2025, relative to 2024 and 2023, express itself today in the same way that a third-year expansion expressed itself in prior cycles from thirty or forty years ago? Industries have died and been born. Technology has advanced to mind boggling speeds where AI is writing its own software.

While sell-side analysts’ earnings estimates are often the target of cocktail party jokes, one of the ironies of the past decade is the underpricing of aggregate earnings growth fueled by FAANG stocks prior to the pandemic.

This underpricing manifested itself again as the Mag7 names smashed earnings expectations in the post pandemic period, despite concerns over rising interest rates. As we approach YE 2024, the average 2024 S&P500 target is now over 23 percentage points in the rear-view mirror from current reality.

To be clear, things could have gone the other way - for multiple reasons – namely the recession that never came. But what these projections reveal is unimaginative herd thinking that resulted in an underpricing of market outcomes relative to economic growth expectations.

Remember, the market is not the economy despite having a symbiotic and reflexive relationship with the economy. One must recognize that while sales and revenue growth are highly correlated to nominal GDP growth rates, market returns are driven by return on capital.

After the GFC, S&P500 profit margins hovered around 10% for almost a decade. Since the pandemic, they have averaged 12%. This, despite higher interest rates. Higher margins mean higher returns on capital, which lead to higher valuations. Today’s elevated valuations are a function of investor comfort and ongoing confidence in the dominance, scale, market share, and profitability of U.S. firms.

Higher returns on capital means is that there is an embedded operating leverage to growth, where incremental topline growth results in greater marginal earnings.

The above is corroborated by the data we have on increased post-pandemic productivity in the U.S. Long run productivity growth has averaged 2.1% since 1948. That number fell to 1.3% in the decade after the global financial crisis. The 2010’s were a period of low productivity growth despite the introduction and adoption of new technologies in the United States.

The one thing that changed bigly in the post-pandemic period is the labor market.

Full employment

Tight labor markets

Going back to Moore’s Law, it is Pinebrook’s imaginative conjecture that today’s labor market at full employment will have more efficiency gains in the third year of a bull market than the post GFC labor market did in its third year of recovery, and more efficiency gains than were had in prior cycles…if the labor market remains at full employment.

The reason is that labor market slack results in lost skills to the economy. The slow labor market recovery after the GFC is not only linked to a host of social issues, but also to a fall in productivity. This makes intuitive sense. If one has a protracted, involuntary separation from the labor market, it takes years to make up for lost pay, skills, and professional prestige (i.e., mobility).

Having a holistic appreciation for these economic nuances and their links to market outcomes contrasts with the third-year return dogma which represents a technical analysis approach to economic forecasting and market prognostication.

This is not to say that 2025 cannot offer sub-par returns. A lot of things can go wrong and off the rails. But going wrong because of yea the third year is quite literally astrology, which is what is filling people’s in-boxes across the global financial community as this note is being written.

It is here that Jan Hatzius and David Kostin of Goldman Sachs enter the chat, by establishing a year-end target of 6500 for the S&P500. They lay out their thinking in the “Odd Lots” podcast with Bloomberg’s Joe Weisenthal and Tracy Alloway.

They explicitly call for 5% topline revenue growth, derived from an expected 5% nominal GDP growth rate. Then they call for an 11% earnings growth rate for 2025.

Both foundational building blocks for their projection are exactly what one would expect given the historical experience of GDP and earnings growth. There is no new marginal information here.

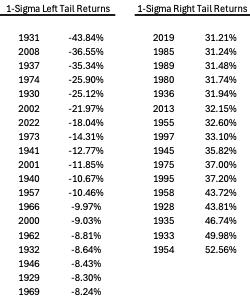

As can be seen in the first chart, the range of market return outcomes that make up the averages is wide. The standard deviation around the mean 11.7% total return is 19.6%. Any total return for the S&P500 that is between is between -7.9% and 31.2% is within an average central distribution and unremarkable. Forecasts that lie between this range are intellectually equivalent to an 11.7% mean return.

The next step to a more robust analysis beyond a reliance on averages is examining the tail distribution of returns and contextualize and correlate them to their economic causality. Returns that are at the tails of the above range are the remarkable ones. Therefore, what is of interest to us are return years less than -7.9% and greater than 31.2%.

On October 16, 2024, commentary was offered on these pages about the commonality that links deeply negative return years: recessions.

“Only two recessions, the one that started in January of 1980 and the deep but quick one of 2020, did not lead to negative return years. The S&P500 returned 25.77% in 1980. That number is 16.26% for 2020”.

“Thus, we know with a fair amount of certainty that recessions have a high probability of generating negative return years, and the returns tend to be deeply negative”.

“…..the remaining 7 years of negative non-recessionary returns occurred when events reduced investor sentiment and confidence”.

Unlike recessions however, these events led to market losses that mostly ranged from the low single digits to the low double digits in the tweens (not a typo). 2002 and 2022 are exceptions where non-recessionary years generated deep market losses.

Thus, most non-recessionary, negative return years are not destructive to balanced and diversified portfolios. The recovery math to break even and resume positive compounding is favorable to investors with a time horizon of as little as 12-24 months.”

Since we in are in the third year of a bull market and economic expansion, what interests us is what conditions bring about positive return years near or more than 1-standard deviation?

One-sigma-plus returns tend to happen in mid or late cycle markets, which is what we are currently in.

Contextualizing market returns to the market cycle is a more useful framework for understanding market prognostications and price targets than thinking about returns in terms of their historical averages.

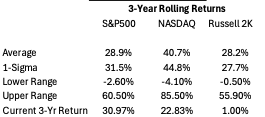

Smoothing returns helps here. Instead of looking at 3rd-year returns in a linear fashion for what happens next, Pinebrook prefers to smooth out data across cycles by looking at rolling 3-year returns.

By this metric, the S&P has rallied by an average of 28.9% over any rolling 3-year period over the last 50 years, with a standard deviation of 31.5%. Thus rolling 3-year returns between -2.6% and 60.5% are normal and to be expected.

At -2.6%, the left tail is small over any three-year period, as the index has posted a positive return 82% of the time over the last 50 years.

Now let’s have a look at the NASDAQ. The NASDAQ has rallied by an average of 40.7% over any rolling 3-year period in the last 50-years. Th standard deviation is 44.8%, thus 3-year returns between -4.1% and 85.5% are normal and expected.

Like the S&P500, the NASDAQ is generally not down over a rolling 34-year period, posting a positive return 84% of the time.

This information is summarized in the table below.

By the above metrics, the post-2022 bull run is unremarkable, with 3-year rolling returns for the S&P500 slightly above average, below average for the NASDAQ, and significantly below average for the R2K.

Contrary to the dogma of slowing market returns as the bull market ages, market returns have been better for both the S&P500 and NASDAQ in 2024 versus 2023.

How these indices will perform in 2025 is obviously unknown. What is known is that their return trajectories since 2022 are very unremarkable, not bubbly by any stretch despite their valuations, and contrary to dogma 3rd-year return dogma…. are more likely to accelerate given how right tail returns manifest themselves in mid to late cycle environments.

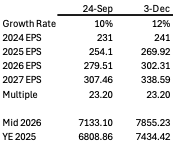

On September 24, 2024, when the S&P500 closed at 5732.93, these pages said 6000 was a foregone conclusion and laid out a price target of 7133.09 “in two year’s time” – thus mid 2026.

Any year-end target is really a target on the following year, as markets look forward. Thus a 2025 YE call is really a call on 2026 earnings and onward. 2025 is already priced and discounted though at least the middle of the year. The uncertainty that is being handicapped on these pages is really H2 2025 and onward.

Pinebrook is going to front run the market and pull forward the mid-2026 price target of 7133 to year-end 2025 and raise it to 7434.

The following tables lays out the math and the thinking behind the adjustment between September and today.

The biggest adjustments are in:

Raising the earnings growth rate from a below consensus level of 10% to 12% due to increased efficiency gains because of full employment, which will raise returns on capital (margins).

A higher 2024 earnings level to start.

Every estimate cross the Street is riddled with assumptions that may or may not hold. Projections such as these are guesses laced with an element of voodoo.

The purpose of this exercise is not to get married to the accuracy of a numerical target, but to explore the cyclical nuances of returns and contextualize them with what is happening in the broader real economy.

Doing so allows on to explore a direction and speed of travel (rate of return) for risk markets which is more likely to surprise investors to the upside, as investors remain anchored to historical averages.

Concluding Remarks

Ignore the unimaginative lazy thinking of 5% top line growth and 11% earnings growth.

Ignore historical 3rd-year returns during past bull markets.

Focus on the causal drivers of market outcomes (return on capital) and their economic linkages (labor, capital, technology).

An economy that avoids recession and maintains full employment will likely lead to market outcomes that surprise to the upside.

The exactness of the number itself is irrelevant.

Risk On for 2025.

Great article as always. What's not lazy is Dave's use of generative AI to check his writing as this article is surprisingly free of spelling and grammar errors.

A splendid article, David.