US Economic Growth Update

We Have Landed

While many observers may not see it, the U.S. economy has soft landed.

The labor market has not broken, remains robust and is secularly tight.

Outside of shelter/OER, core inflation is now below the Fed’s 2% target.

Recognizing the above allows us to contextualize the current growth and inflation matrix so that we may better anticipate the Fed’s reaction function to incoming data.

The Fed’s job now is to shift away from the inflationary fight, which previously anticipated recessionary conditions, and focus more on keeping the expansion going by aligning its policy stance with that of a sustainable expansion.

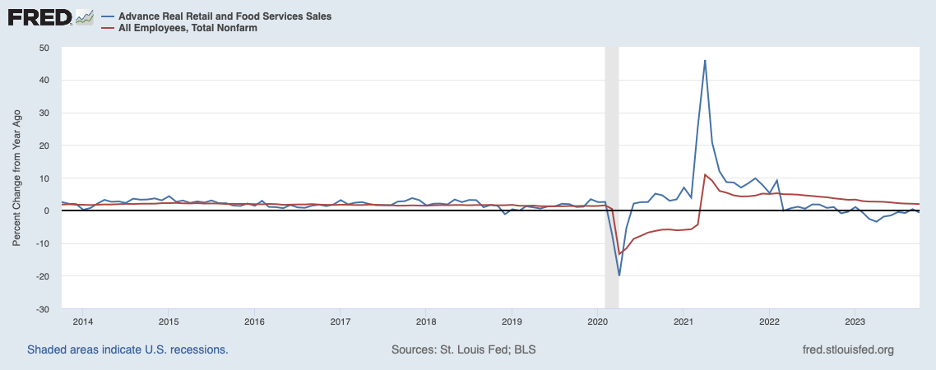

Based on the retail sales report released earlier this week, a softening labor market is now baked in the cake.

Real, inflation adjusted, retail sales have a strong record of anticipating and leading employment trends.

Real retail sales printed at -.2% for October and are -.7% YoY.

This softening trend points to non-farm payroll prints in the sub 100k range in the coming months.

This expectation is consistent with a potential false-positive of the Sahm Rule, which indicates a recession in real time when the three-month moving average of the U3 unemployment rate rises by .5% or more relative to its low during the previous 12-months.

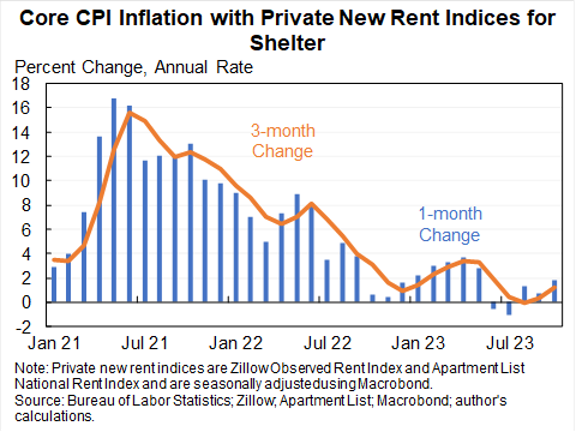

The softening labor market will be offset by the continued disinflationary impulse. Outside of headline and core-CPI, the internals of Tuesday’s CPI report have revealed a dramatic change in the inflation information surface.

Both headline and core-CPI are below the Fed’s 2% inflation target once shelter (OER) is removed.

My personal calculations reveal headline ex-shelter at 1.8% and core ex-shelter at 1.2%.

Jason Furman has a different numerical result with a similar read, using live market rents (chart below).

The downward trend, while noisy, is undeniable since the summer of 2021.

Although lagged, the official OER/shelter trajectory will continue to disinflate, consistent with what is happening in the Apartment List National Rent Index.

Forward looking rent data suggests these rent disinflationary trends will continue (h/t @jayparsons).

With inflation effectively DOA, and a resilient yet cooling labor market, the soft landing has taken place.

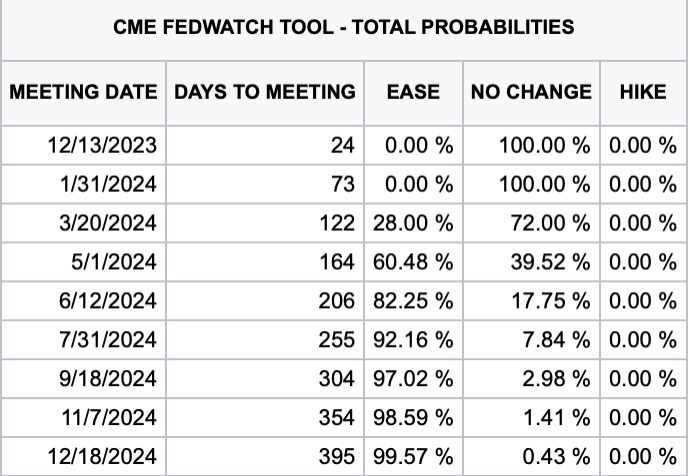

Markets agree with this assessment and are laying out a path towards easing. Below are the combined probabilities for action through 2024.

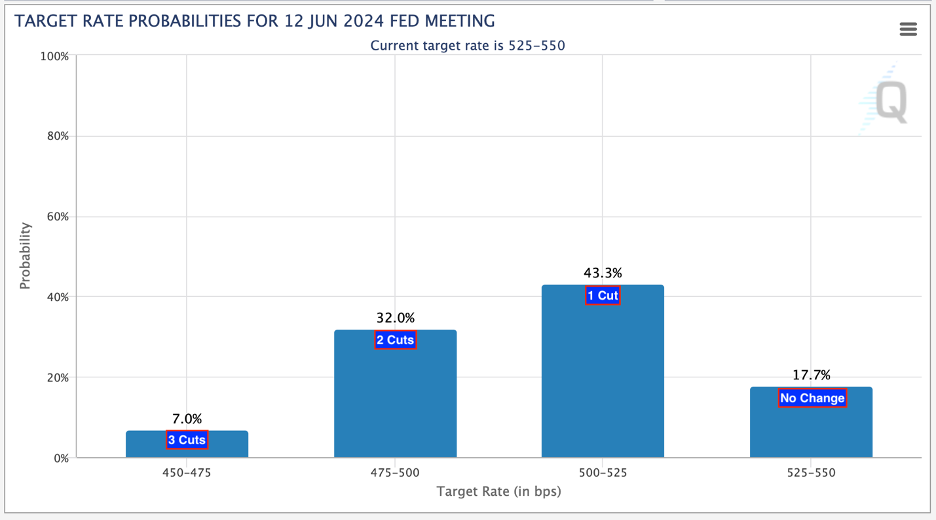

Below are the distributional probabilities for action for the June 2024 meeting.

These probabilities are fluid and will evolve with the incoming data. They are what they are for today and nothing else.

The question for market participants is, what are the catalysts that could accelerate or delay these cuts?

The Housing Market is the Pivot Hinge

Last month, unit construction volumes and construction employment were discussed as real economic activity that make their way into the national accounts for GDP accounting.

On Friday, we got further confirmation that while peak construction volumes and employment are likely in the rear-view mirror, they continue to support the expansion.

Most importantly, permits rose by 1.1% for the month. Single family permits – the most economically leading housing indicator – rose by .5%. Multi-family permits rose by 2%.

Keep in mind the above data is for the month of October, prior to the big bond moves that started on November 1st.

The key inference is that demand for housing remains strong, and reductions in rates will likely stimulate economic activity in this highly cyclically sensitive sector.

While the economy may have soft landed based on labor market and inflation criteria, how the housing market responds to changes in Fed policy will likely determine the future direction of the business cycle.

In last month’s growth update, I wrote, “Now the trajectory of new home construction will meet the immovable object of high mortgage rates”.

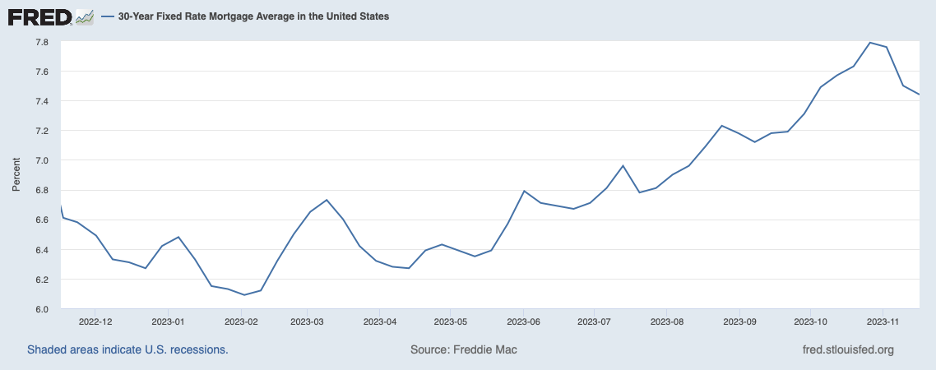

Newsflash: The average 30-year mortgage is down 35 basis points between October 26th and November 16th. This is the biggest decline in mortgage rates since they dropped 46 basis points between March 9th and April 13th of this year.

Marginal declines in mortgage rates will likely be met with increases in economic activity in the housing sector, and keep a floor on growth.

Concluding Remarks

The U.S. economy has soft landed, as evidenced by shelter-adjusted inflation and a sound labor market.

Forward-looking real retail sales data suggests a softening labor market that is not recessionary, contra to a potential false positive Sahm Rule recession trigger.

Trends in market rents point towards a continuation of the disinflationary impulse, which will put pressure on policy rates and feed through the long end and pressure mortgage rates down.

Lower long rates will stimulate real economic activity in the housing sector.

Growth panics should be faded for all the reasons above.

The Fed reaction function will likely shift from inflation fighting (“hawkish”) to supporting a sustainable expansion in the context of a continued disinflationary impulse (“dovish”).

With a recession being a low probability event between now and the end of Q1 2024, the growth impulse remains alive in the context of a disinflationary impulse and an accommodative monetary authority.

Risk On.

I agree with the view that we must be risk-on however struggling with any view that the Fed cuts rates in this environment outside a crisis. Isnt this just evidence that the market has one foot on the gas and one on the brake i.i. Gothilocks and therefore we truck through to 2H2024 with no recession whatsoever but also no need for Fed cuts. Perhaps the right trade is MBS and credit together as long, but this is still negative Russell 2000 (where financing costs eat at equity) and positive Mag 7 where no recession and fortress capital = strong demand/multiples. What upends this? lack of demand for US treasuries therefore spike in 10s? Well with lower inflation and reasonable growth cant see a buyers strike there. Trades? I hate myself for saying this but banks, real estate (per your view) but also perhaps old people stuff versus young people stuff.

Exactly this. Many housing market still very hot, so any relief in rates and fin cond will very quickly translate into more activity

https://x.com/NewsLambert/status/1725889438222303686?s=20