U.S. Economic Growth Update

The Growth Scare Is Over

This is not to say that GDP will not continue to slow down or that the deterioration in the labor market, judging by the U3 rate, will be arrested. In fact, these two metrics may get worse, as economic momentum (positive or negative) is a real thing.

GDP for Q3 is at its lowest nowcasted point this quarter thus far.

The labor market is at its softest since the post covid economic rebound.

Some of this is a feature, not a bug, consistent with the Fed’s attempts at cooling the economy.

What should be inferred from the “growth scare” being over subtitle of this note is that the scare part should be minimized when looking at the U.S. macroeconomic backdrop.

In rationalizing the Fed’s policy pivot, Jerome Powell provided market participants with policy clarity by clearly articulating the Fed’s reaction function with respect to the evolution of incoming economic data.

“The upside risks to inflation have diminished”.

“The downside risks to employment have increased”.

“We will do everything we can to support a strong labor market as we make further progress towards price stability.”

-Jerome Powell, Jackson Hole 2024

These three sentences encapsulate the recent Fed pivot. The first two refocus the Fed’s strategic goal. The last sentence establishes the Fed’s commitment. This summer’s strategic ambiguity over the dual mandate got shot in the head and “the direction of travel is clear” (Powell).

What this means is that the Fed’s is no longer institutionally wedded to a path or pace of rate cuts, and instead has a “whatever it takes” mindset to getting the job done.

This policy clarity will lower interest rate volatility in the bond market, which will support risk assets.

Any additional economic weakness will be looked through, as firm expectations of policy support will allow investors to assume that the business cycle will remain intact.

This is not dissimilar to how an equity share can rally despite near term earnings shortfalls as long as the outlook remains positive.

In other words, the Fed Put has been repriced at a higher strike price.

This is the policy environment we are now in.

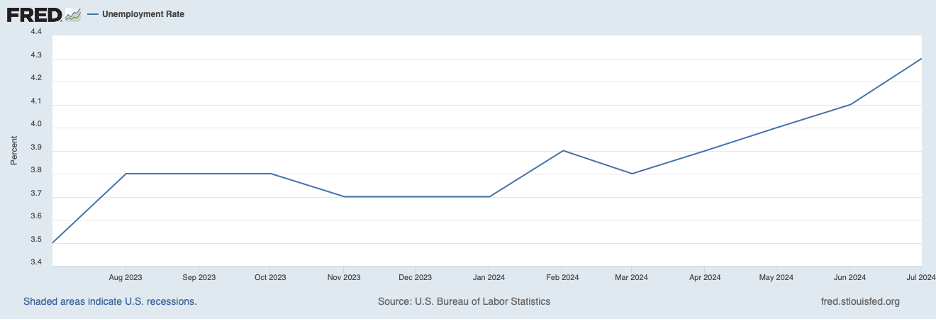

The most current concern at present with the U.S. economy is the upward slope inflection in the U3 unemployment rate. From the beginning of this calendar year, the U3 rate moved up or down in 10 basis point increments month-to-month.

This changed with the July report, which showed a new level of convexity with a 20-basis point pop. This could obviously be a one-off that stabilizes and mean reverts. It could also be something else. That something else is an acceleration in the upward movement in the U3 rate.

To Pinebrook, a 10-basis point jump with the August report would not be a thing to celebrate, but it also would not portend doom. Another 20-basis point jump or more would be a red hearing of accelerating deterioration in the labor market.

The focus should not be on the mathematical first order rate change (delta), but rather on the second order rate of change (acceleration, aka convexity).

The reason can be found below in this table produced by my friend @irvingswisher.

Once the unemployment horses are out of the economic barn, they do not stop.

Thus, the Fed has every incentive to go big if the data warrants it, and Jerome Powell has signaled in no uncertain terms that Fed will get after it and front run this to avoid the outcome in the table above.

With the policy rection function established, we turn our attention to Pinebrook’s preferred housing market-centric U.S. economic growth update.

For new readers, Pinebrook’s view is that the housing market is the marginal pace setter of economic growth and contraction.

In 2007, UCLA economist, Ed Learner, presented his paper “Housing is the Business Cycle” at the Kansas City Fed’s Economic Symposium at Jackson Hole.

His key insight was that while only around 5% of U.S. GDP can be linked to fixed residential investment, 7 out of 11 post-war recessions originated in the housing market.

Leamer was politely ignored. Likely with a few quiet laughs. Then the GFC hit, with its deep roots in the U.S. housing market. 😂

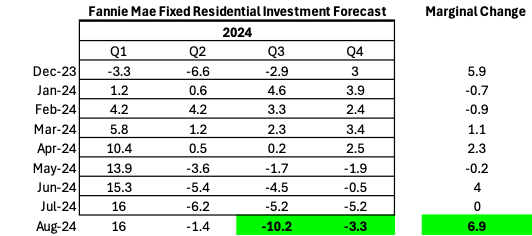

That said, the current fixed residential investment (“FRI”) forecast is out from Fannie Mae. As noted in the April Growth Update, “Forecasts are forecasts, and subject to error. That is the noise. The signal is in the trend and expected changes in growth rates”.

Thus, the signal here is that the FRI forecast has been progressively deteriorating for the past four months, but the projected marginal improvement into Q4 is now also at its highest all year.

In effect, a key source of the U.S. growth impulse has been kicked out to Q4. This “less bad” marginal improvement is, in Pinebrook’s view, linked to the Fed’s pivot to a cutting cycle which became increasingly obvious throughout the summer and will be supportive of a housing market driven growth impulse.

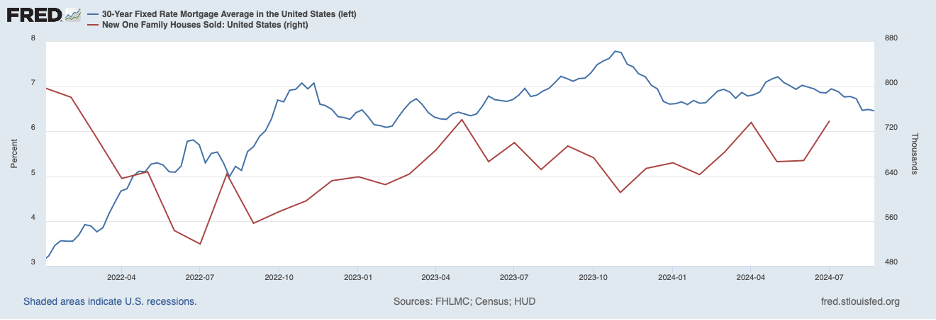

The data validates this view. Mortgage rates lead sales, which in turn lead new unit construction. New home sales are the most leading of all housing metrics, but they are a noisy time series and subject to heavy revisions.

Mortgage rates are at 12-month lows, and new home sales have predictably followed. The U.S. housing market remains plagued with supply issues. A fall in rates, and a fall in MBS spreads, will have a stimulative effect on the U.S. economy as the housing market rebalances. It is simply a matter of time.

There is of course an argument to be made against additional mortgage lows.

The current rate cutting cycle is fully priced, absent a recession freak out.

Mortgage spreads will remain elevated due to the high prepayment risks associated with a cutting cycle.

This is all true. What is also true is that markets do adjust over time and innovate to bridge the demand-supply gaps created by market distortions.

Currently, there is a nationwide housing shortage in the United States. The U.S. house building market is increasingly dominated by large, publicly traded corporations. These firms have the balance sheet wherewithal to continue to offer interest rate buydowns that will offset the slow pace of rate and mortgage spread contraction.

Concluding Remarks

While the U.S. economy may continue to cool, the scare over growth is over and should be faded.

Jerome Powell’s Jackson Hole speech has repriced the Fed put higher, as the Fed’s policy preferences and commitment to those preferences are clear.

Forecasts for increases in fixed residential are consistent with lower interest rates and a housing-driven growth impulse into year end.

Pinebrook’s previous U.S. Economic Growth Outlook (June 20, 2024) revealed a preference for rates over risk for the summer, with the following results.

While Pinebrook continues to maintain rates exposure, equity markets will continue to look past any temporary economic weakness and risk-on is the preferred lean.

The economic cycle is intact, and dips should continue to be bought.

David- I'm still not connected on X. @makemyday522

Another excellent note, well articulated thesis. Sadly I missed XHB at the local lows, perhaps another shot will eventuate.