Weekly Signal & Noise Filter

Back to L’Ancien Regime?

It’s almost as if Liberation Day was just a bad dream. If one accepts the backward-looking data of a strong core Q1 GDP and an above consensus April NFP print as prima facie evidence of said bad dream, then that is probably correct. What we learned Thursday and Friday is the following:

Confirmation of higher inflation due to revisions, as anticipated here. ✅

Stronger economic growth momentum in core GDP. ✅

A labor market that is still producing jobs comfortably above breakeven replacement rates to maintain U3. ✅

The bounce in equities and in yields in the rates complex further underscores this point, n’est-ce pas? After all, the above provides additional economic inoculation that lowers the speed of economic deterioration. At a minimum, the can of doom has been kicked.

However, the regime change bell cannot be unrung. A slowing economy was subjected to an exogenous shock that will still manifest itself in the coming months despite the evolving walk back of the tariff wars.

The question on everyone’s mind now is, recession or no recession?

The view of these pages has always been that avoiding a recession will be predicated on policy pivots by the White House and the Fed and doing so before the economic tariff flesh wound turned into a kill-shot. We got the White House pivot, for now. What now?

Near term inflation risks are to the downside, driven by lower portfolio management fees during March and April. Liberation Day tariff price shocks will likely start making their way through the economy by late spring and early summer.

The resulting inflation air pocket in the May and June PCE reports opens the window to the Fed’s pivot, if not with an actual rate cut then certainly with guidance towards one. The market has front run some of this with an easing of financial conditions.

The inflationary path is mostly non-controversial at this point, unlike in 2022. Thus, the recession call hinges on the evolution of the labor market.

Many observers will focus on labor market dynamics by watching weekly claims data and NFP prints. This is the noise and will likely not provide the early recession warning signals as they have in previous cycles.

In this cycle, the signal will come from hiring rates.

The traditional unemployment farmwork anchors to worker layoffs. However, this focus ignores the other side of the coin: hirings. People get laid off all the time. In a healthy and expanding labor market, they quickly find new jobs.

Weakening labor markets provide fewer opportunities for re-entry into the labor force and subsequently expand U3.

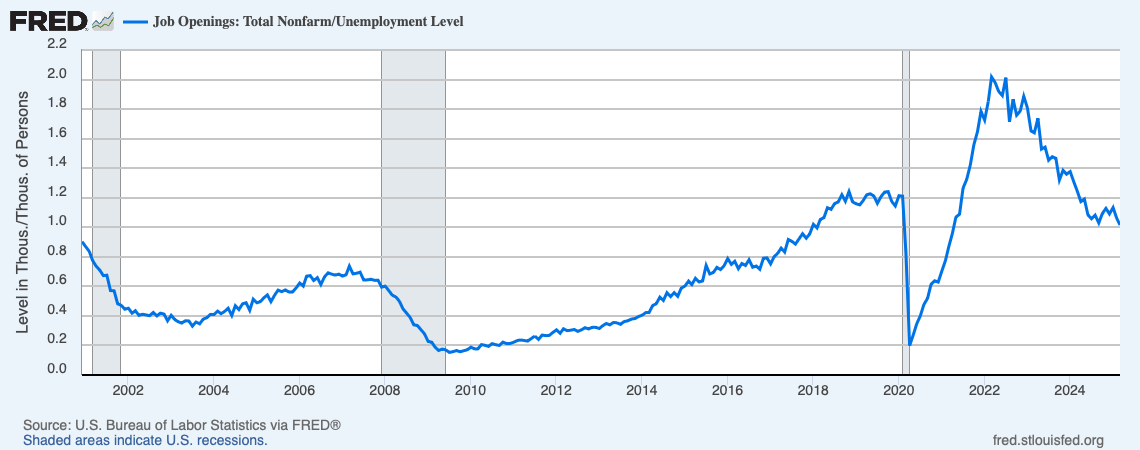

The long run ratio of job openings to unemployed workers is .7x.

The pre pandemic crisis average was .5x (lots of labor slack), and post pandemic peak was a little over 2x (little to no slack).

The current ratio is 1.01x

In the post pandemic period, with fresh memories of the recent worker shortage, employers have been loath to let employees go. The softening of the labor market has been driven by less hiring, as evidenced by less openings above. In addition:

The number short-term unemployed (less than 5 weeks) has risen by 10% since 2023.

The number of long-term unemployed (more than 27 weeks) has increased by 75% in the same period.

The compositional shift is toward the longer term unemployed who are having trouble with re-entry into the labor market, symptomatic of less robust hiring.

“The current hiring rate is 3.4%, comparable to where it was in 2013 and early 2014, when the unemployment rate was just over 7%”, per my friend Guy Berger, former chief economist of Linked-In.

Given the current strength of the labor market, and the White House tariff walk back, the May employment report (released in June) will likely not have any ugly surprises. This kicks the can on an employment extinction event caused by tariffs.

While the can is kicked, the risks are not eliminated. The template here is the 2001 recession and subsequent “jobless recovery”, where recessionary labor market dynamics were driven more by a lack of hiring and less due to mass layoffs.

The slowdown in hiring is clear and is happening into a slowing economy. Analysts looking for employment extinction events are missing the forest for the trees and will be disappointed.

As mentioned in previous notes, labor market support has been narrowly focused on healthcare, education, and government. The path to strengthening the labor market and changing the composition of its growth therefore runs though President Trump’s tax cut proposals.

Extending and Expanding 2017 Tax Cuts and Jobs Act (TCJA), which primarily benefit higher-income households. The top 1% could see annual tax cuts averaging over $80,000, while low-income households would receive much smaller reductions.

Eliminate federal income taxes for those earning below $150,000–$200,000 (details and thresholds have varied in statements), with the lost revenue potentially offset by new tariffs.

End income taxes on tips, overtime pay, and Social Security benefits.

Remove or raise the cap on state and local tax (SALT) deductions.

Create new deductions, such as for auto loan interest.

Reduce the corporate tax rate from 21% to 20% or 15%.

Eliminate the corporate alternative minimum tax imposed by the Inflation Reduction Act.

Restore and expand business tax breaks, including bonus depreciation.

These proposals are fluid in typical Trumpian fashion. Republican leaders in Congress have indicated they aim to pass their tax-cut and spending package by July 4, 2025. Regardless, this represents an increase in the current fiscal impulse which would economically stimulative, echoing sectoral balance commentary from March 31, 2025.

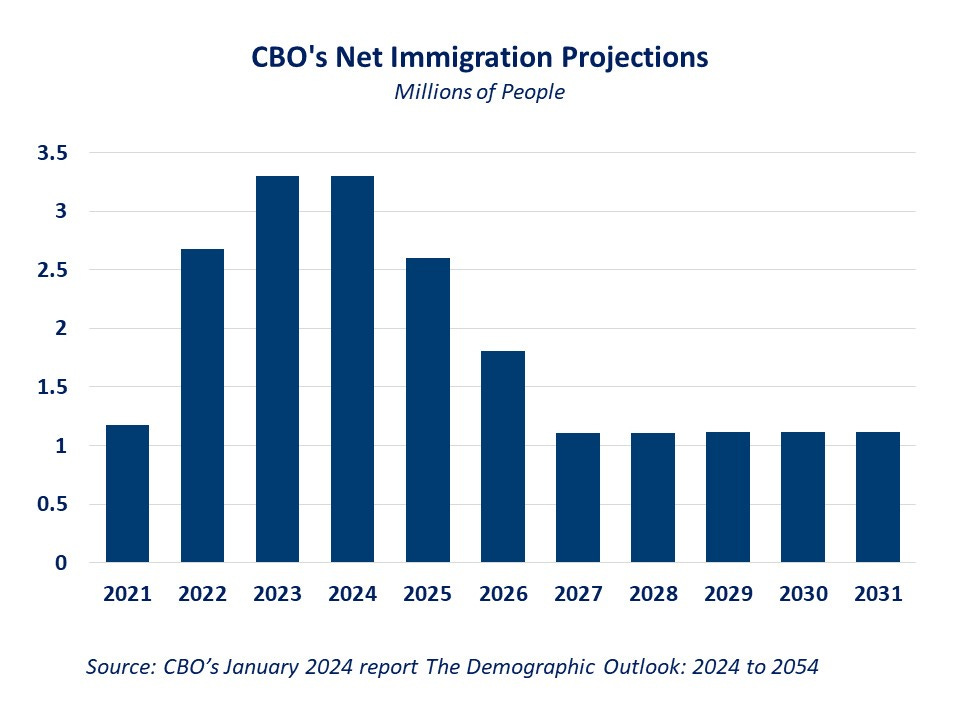

The other side of the labor market coin is its shifting size. The U.S. experienced an immigration boom after the pandemic. From Pinebrook’s U.S. Economic Growth Update, June 20, 2024:

“The U.S. economy began to cool in mid 2022, with two back-to-back quarters of zero or less real GDP growth. The labor market lagged and continued to tighten into January 2023, when the U3 rate bottomed at 3.4% that month.”

“Despite the economy rebounding in 2023 and into 2024, the labor market has continued to cool as measured by the unemployment rate.”

“Pinebrook’s view is this is due to the sudden and disproportionate jump in the size of the prime age labor force.”

“In other words, the number of unemployed, and the unemployment rate, have continued to grow despite growth in the overall economy.”

This dynamic is set to reverse given President Trumps immigration policies. While it is early and we simply do not have the demographic data to support this conjecture, an immigration reversal could provide a tailwind to the labor market by shrinking it. This would lower U3 breakeven rates, where even underwhelming NFP prints do not materially raise the U3 rate.

Given the totality of recent developments, the Fed is will likely be more comfortable waiting until summer to provide more concrete forward guidance. By then, a weakening labor market in mid to late summer will coincide with the timing of the inflationary pop from tariffs, putting the Fed in the unviable spot of prioritizing one policy mandate over the other.

Pinebrook’s view is that the Fed will want to stick to the Romer & Romer playbook and look past one-off inflationary shocks and prioritize the labor market. They may come late, but when they do, they will likely cut more aggressively than the market is expecting. This argues for a continued steepening of the yield curve.

Concluding Remarks

Regime change remains intact, as the economy has shifted to a late cycle state.

The tell on labor market deterioration will likely come from hiring rates, not layoffs.

That said, a shrinking labor market due to reverse immigration and lower immigrant inflows is set to shrink the labor market and put a cap on unemployment.

President Trumps tax propels are fiscally expansionary and would likely help rebalance the labor market away from its narrow base of support.

The White House policy pivot, and the emerging Fed pivot, will be supportive of risk assets into the summer.

Great summary. Insightful and clear. Thank you!

Buy calls then puts