Weekly Signal & Noise Filter

The Risk Has Gone From a Soft Landing to a Hard Slowdown

While the above is not a foregone conclusion, the Fed is now in playing with fire territory.

The current signals from the labor market point towards a hard slowdown (not recession) for the economy if this Fed does not front run further deterioration, either in fact (aggressive cuts) or through forward guidance.

The August employment report has changed the information surface. No need to spill more digital ink on the prints everyone knows. The task at hand now is to contextualize this information surface, develop a new projected information surface, and front run the Fed’s reaction function to it so we can make some cash.

We start with the U3 rate itself. On the face of it, the decline from 4.3% to 4.2% seems like a cause for celebration. It is not.

The three-month moving average for the U3 rate moved up from 4.13% to 4.2%. This represents a continued acceleration (though less so) in the deterioration of the labor market.

The decline in convexity is likely an echo from July, when markets begin to price in the Fed cutting cycle commencing in September.

This decline however, while welcome, is not enough. The Sahm indicator has moved deeper into recession zone, moving from .533 to .567.

In addition, the 3-month moving average for non-farm payrolls (NFP) declined from 141k to 116k. Here, convexity appears to be ticking up (steeper downward line).

The convex nature of labor market deterioration makes it clear this momentum will require a more forceful policy response from the Fed if it to succeed in meeting its year-end U3 target of 4.0% (from the June SEP).

The Fed is behind the curve, and it appears bureaucratic inertia is outweighing institutional decisiveness to front run additional weakness.

The question now is if this level of deterioration a feature or a bug for the forward trajectory of the economy, and assess the relative risks of the soft landing morphing into a hard slowdown.

Instead of cherry picking the data to support the narrative, Pinebrook prefers to lean on market signals at the shorter end of the curve, which closer reflect market participant expectations and gauge where Fed policy is relative to those expectations.

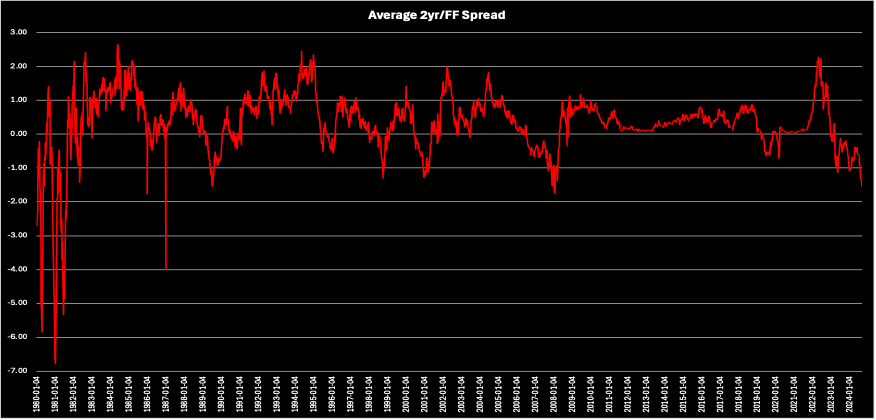

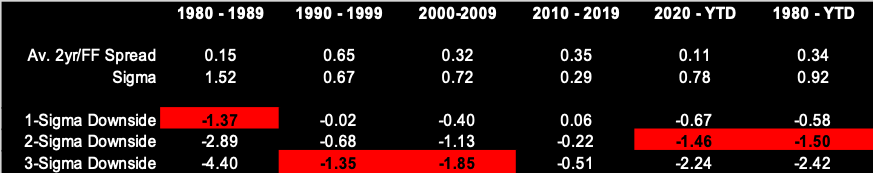

The chart below is the average spread between the 2-year Treasury note and the Fed Funds policy rate. (Geek note: weekly averages ending on Friday were used to shave down the amount of data to clean).

The table breaks down the 2s/FF relationship into the labeled time periods. As of September 6, 2024, the current spot weekly average was -1.57%.

Over the past 44 years (1980 – 2024 YTD), this average has been .34, with a standard deviation of .92.

Thus, last week’s weekly close of 1.57 is a smidgen over the 2-standard deviation downside level of 1.50 over the past 44 years of history.

It would be too easy to squint at the squiggly line and match the 2s/FF spread to recessions. Not to worry, Pinebrook does not engage in this kind of statistical sophistry – spelling and punctuation notwithstanding.

What we can do however, is infer the degree to which the Fed is behind the curve to gauge their reaction function if the economy, proxied by the labor market, continues to deteriorate in its current convex fashion.

Here, we turn to Ocam’s razor, where the simplest explanation is usually the best one.

The Fed has not been this behind the curve since the time leading up to the GFC.

This is not a recessionary call, or even a hard slowdown call. It is, however, a call to be attenuated to the increasing risks of a policy mistake.

A 25-basis point cut in September increases these risks asymmetrically. Thus, the Powell Fed will likely be forced to cut more than what is currently priced by markets.

Concluding Remarks

The negative convexity in labor market indicators suggests a more forceful policy response from the Fed than what is currently priced will be warranted before the calendar year is over.

The Fed is more behind the curve than at any point since the GFC, as evidenced by the 2yr/FF spread.

Remaining long the rates complex (2s/10s for Pinebrook) remains the preferred expression of this thesis.

The implication is that until there is greater clarity from the FOMC in September, risk markets will be rangebound and volatility will remain above normal. Whipsaw risks will remain elevated.

That said, the Fed put remains live.

New subscriber. X follower since you got the new account. Looking forward to more in depth commentary. Please accept X follow request. @The_RyanGreen

Thank you.

Loved this. Well done.

I have 2 observations and 2 questions related to your thesis with vs we’re seeing I would love your feedback on.

First: Refi boom is underway + confirmed! Not great for inflation tho. Prices are not / did not come down much and will not once rates drop barring recession. Home owners disproportionately avoided initial rounds of layoffs due to demographics and are still doing well (401ks, etc boomers). Seeing cash out and reverse mortgage inquiry that wasn’t there before. Life expectancy keeps growing, as do healthcare costs. Reverse mortgages coming back in vogue which I find interesting.

I agree inflation is ded for the fed, but what about for me, or Joe six? Inflation is still very much alive for some things: insurance premiums and home/auto related items, among other consumer essentials where im noticing pricing increase that are being taken by consumers.

Shipping costs for container freight are headed higher. Used autos fully regained the losses from earlier this year. The Red Sea supply chain related issues are causing shortages again Porsche, benz, Toyota all types and many other consumer goods from asiapac.

Conflict is inherently inflationary im sure we can agree on that. So not to be that guy, but i will be..

If a new conflict leads to more inflation or we just see inflation increases unexpectedly, what do you think the fed reaction function would be?

This isn’t priced at all (for a reason) but this tail could be be a military conflict that is inflationary, and kinda might be underway already, so to say I shouldn’t consider increased geopolitical conflict resulting in higher or reallocating inflation given what is going on in the world, yeah maybe don’t do that.

A non zero probability feels right, and ignoring it bc you can’t predict it feels like it’s doesn’t fit a shiny toy model, so “no answer.”

second question: how should one think about this rationally? impact? impact on reaction function? These wars can go on a long time. Would love some input on how you would address these types of questions if you asked, would be awesome.

Last, you know Chris Wolfe I believe? Good guy. Once told me “Sovereigns make their own rules Ringo”

Nikki T just gave jpow similar status, or tried too. He has too many tools at his disposal to use and Pavlov lives.

I got nicks message, and i think youre spot on. Btfd’s.

Great job David.