Weekly Signal & Noise Filter

Runaway Economic Bull

As with term premiums and DeepSeek, this past weekend’s tariff announcement by President Trump was the noise.

President Trump's implementation of tariffs aligns with his campaign promises, making them an anticipated rather than surprising move.

While these levies may be unwelcome, companies have likely prepared by stockpiling inventory.

This strategy provides a 1–2-month window for the U.S. economy before price increases become necessary to offset tariff costs, except for Canadian energy imports.

The U.S. economy is likely to be robust enough to withstand potential trade wars without slipping into a recession, which is the primary concern for stock prices.

Therefore, the signal remains the growth impulse of the U.S. economy.

Recall the rebounding growth data that was flagged on January 23rd, in both the soft survey and hard data domains. While last Friday’s tariff announcement took the wind out of the macro sails provided by GDP, PCE, and ECI releases, on we recently received additional confirmation of the growth impulse.

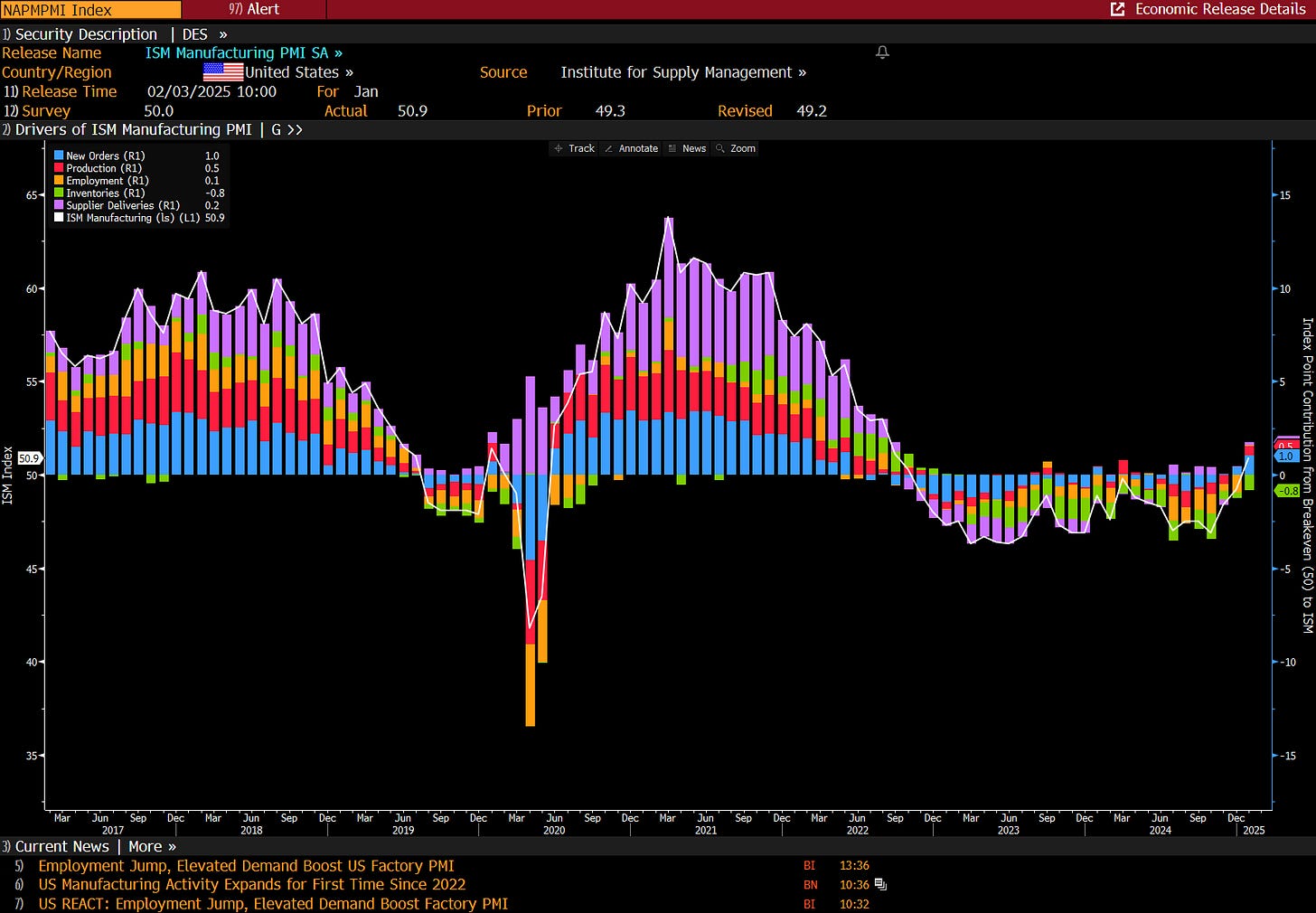

On Monday, the ISM manufacturing index came in above expectations, printing at 50.9. This was the first print above 50 since October 2022. Recall this is a diffusion index, where a number below 50 indicates contraction of the sector, and a number above 50 indicate expansion. The more leading new orders subindex rose 3 points to 55.1.

Some of the new orders strength could be attributed to supply chains front running tariff announcement, which as stated above, have been anticipated. This macro conjecture however has not been validated at micro level of the national accounts (inventory for sale by retailers and wholesalers). Also, most publicly available data is only available through November, but it may be validated in December or January.

In any case, the broadening rally that has been anticipated on these pages has now arrived. Big tech contributed nothing to January’s SPX performance, while financials were up 6.5%, industrials up 5%, and healthcare up 6.8%. Every sector in the S&P500 was up last month except for tech.

The R2K only barely missed the SPX performance threshold, coming in at 2.6% vs 2.7% for SPX.

The equal weight S&P500 index outperformed, coming in at 3.4%.

S&P400 midcaps and S&P600 small caps outperformed as well, coming in at 3.7% and 2.8%, respectively.

Now to be clear this is not a call to underweight tech. Simply an observation that other sectors of the market are picking up steam and the rally is broadening as expected.

As we look forward, we take our cue from ignoring the term premium freak-off and the Trump tariffs and focus on the inflation data, which will set the pace for the rate cutting schedule later this year. Unlike last year, the labor market is a non-issue for now.

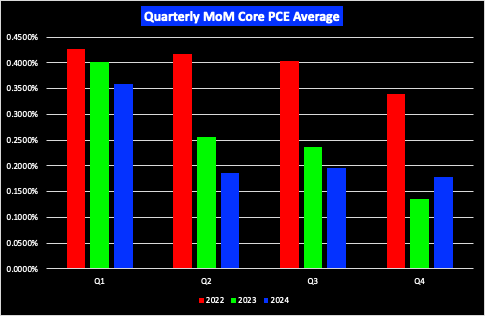

Recall that post pandemic supply chain issues have kept Q1 inflation data hot. And while not unanchored, near term inflation expectations caused firms to arb inflationary headlines and used them as a pretext for raising price – because they could.

In what is now shaping up to be a break from the three prior years, Q1 inflation data for 2025 is looking to notbe the scorcher it has previously been.

The lags in housing disinflation data have finally become more and more apparent.

Steep YoY base effects from Q1 2024 should diminish the Q1 inflationary impulse.

A common view is that uncertainty around trade policy has the potential to introduce elevated inflation pressures this quarter. Importers and producers are likely to front run and stockpile, even if tariffs are eventually talked down and walked back as they were a few days ago. Risks are risks, and they must be hedged.

Thus, the uncertainty around tariff risk makes the academic look-through of them as a one-off price increase difficult to justify on practical grounds. This will complicate the Fed’s job of distinguishing between tariffs noise and tariff effects.

In Pinebrook’s view, the bark is bigger than the bite.

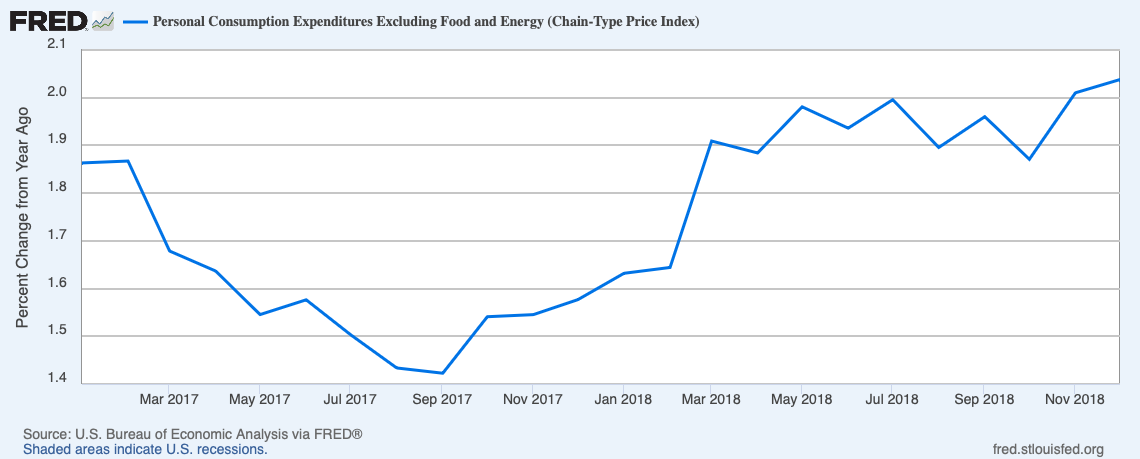

In Trump 1.0, the initial causal driver of bond and equity volatility was a sudden blast of inflation in February of 2018, when the core PCE 3-month moving average jumped 56-basis points from the prior month. Inflation kept moving upward and became more volatile throughout the calendar year.

In March 2018, trade tensions escalated when President Trump signed an executive memorandum imposing tariffs on up to $60 billion of Chinese imports, with China promptly responding with potential retaliatory tariffs.

Markets didn’t seem to care. In Q2 and Q3, the S&P500 clocked in 18.4% despite the tariff war headlines.

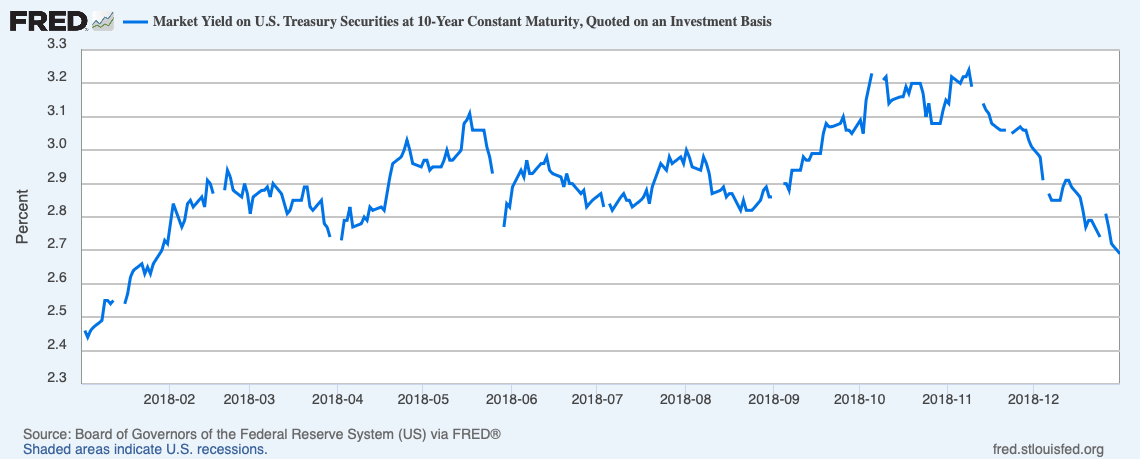

This was obviously given back in Q4 once Powell, a relatively inexperienced Fed Chair at the time, made statements about more aggressive monetary policy. Thus the real issue was an interest rate shock, not tariff talk, resulting in a swift equity bear market (-6.24% for the year on a price return basis).

2019 was even noisier on the tariff front.

In May 2019, China announced retaliation for US tariffs, increasing their own levies on American goods.

In August 2019, China devalued the yuan to the lowest levels in more than a decade, seeking to offset the effect of US tariffs.

In October 2019, concerns rose that the US manufacturing sector was slipping into a recession due to the US-China trade war.

And yet, magically, the market delivered a total return of 31.2% for 2019.

Now of course the usual macro caveats apply. Small sample size. The past is not destined to be repeated. Most importantly, the economic landscape during Trump 2.0 differs significantly from 1.0.

Unlike 2017, we lack a backdrop of robust global growth. MSCI All-Country Ex-USA (ACWX) delivered 23.4% in 2017 versus 18.4% for the S&P500.

The Fed is not combating a sudden inflation surge or proposing aggressive rate hikes, as was the case in 2018.

While 2019 saw trade war volatility, it was also coming off a down prior year and mean reversion provided some upward drift. 2025 follows a strong prior-year market performance, with the S&P 500 delivering a total return of 25.0% in 2024.

US Big Tech faces new challenges from the emergence of affordable, open-source AI.

The take-away from the above is that interest rate volatility and Federal Reserve policy uncertainty pose greater risks to equity valuations than noise about trade conflicts.

The market has anticipated tariffs as a key investment theme for 2025 since Trump's reelection, reducing the surprise factor.

2022 was a classic rate shock and markets reacted appropriated, if not painfully for most.

In 2023, nominals on 10’s were effectively flat for the first half of the year while equities ramped. 10-year rates mooned over 120-basis points from June 28th until October 25th. Equities caught a bid after the market figured out the Fed’s policy hiking campaign was on life support due to disinflation.

In Pinebrook’s view, the relationship between stocks and bonds is less tied to the arithmetic relationship between discount rates and valuations, and more about the signaling mechanism between rates, policy, and the direction of the economy.

Concluding Remarks:

Fade the Trump trade wars. Most of it is for political consumption.

Focus on the inflation and growth trajectory, and the Fed’s reaction function.

Bessent Postscript

Treasury Secretary Bessent has stated that the administration wants to focus on bringing down 10-year treasury yields.

Never mind the policy gymnastics that will be required, or if it’s even meaningfully possible without major congressional support regarding the fiscal mess that is the U.S. budget.

The key take away is that the administration is focused on non-inflationary growth. Success is another matter of course. But at least for now, markets will likely give the administration the benefit of the doubt and lower risk premiums as the risk of a fiscally driven inflationary impulse subsides.

This is positive and supportive of risk assets and supports Pinebrook’s 2025 bull thesis.

My 2025 outlook written in December is looking for +20% or more. Broader point is don’t let tariff talk dictate the cyclical narrative and this is NOT 2019 (for all the right reasons).

Why was China able to raise tariffs in May 2019 then weaken the yuan in August? What would enable the US to raise/maintain tariffs and still weaken the dollar? Would disinflation and/or 10 year rate declines weaken the dollar?