Signal & Noise Filter

Of Turds & Lambos

The inflationary data is a not a signal. It’s a noisy policy echo disguising what matters. Thus, the Wall Street nomenklatura are twisting themselves into knots arguing over the distribution of (dis)inflationary forces between core goods and services and how much of that is driven by tariffs.

The current inflation zeitgeist of core goods rising as tariffs make their way into the economy, in the context of benign headline inflation prints, is old news for readers of these pages.

The above was flagged in the May 2025 CPI preview on June 10th:

Expect to see less used car inflation.

More core-goods inflation.

Less core-services inflation.

We saw more of the same in the June CPI report. The inflationary reality is that goods are a smaller weighting of the broader inflationary picture, as core goods within core CPI are 25.13% of the index weight and services are 75.86%.

Pinebrook’s inflationary concern remains the incoming impact of the electricity hike price shock that was initiated across the PJM interconnection region in June (also discussed June 10th).

As electricity prices are not included in core CPI or core PCE, it will be some time before these prices filter into core goods and services and business pass off the cost of higher energy to end customers. For now, headline inflation measures continue to be benign.

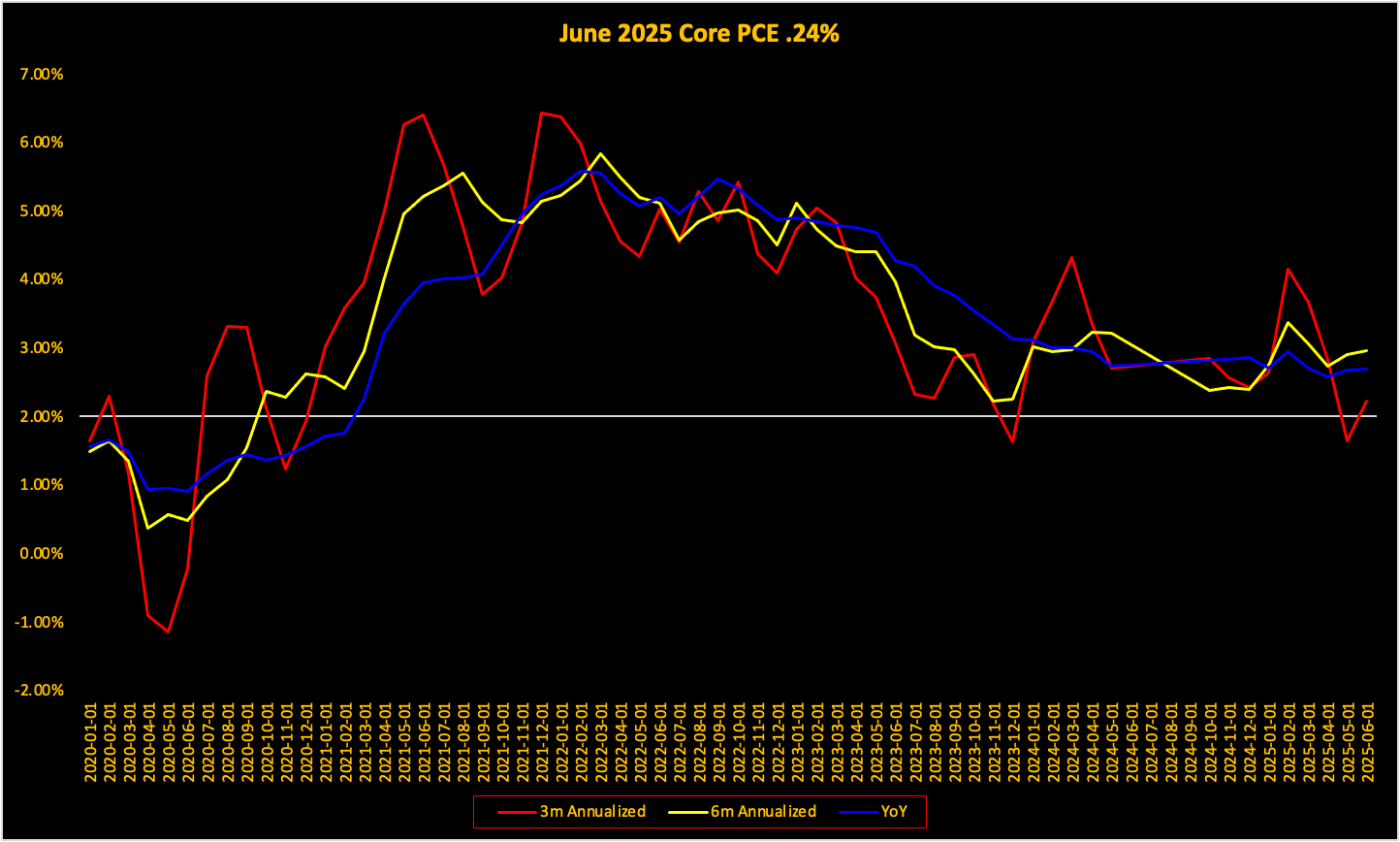

Pinebrook is looking at a .24%MoM projection for June core PCE.

Financial services inflation was better behaved than expected, despite strong capital market activity.

International air fares were softer than expected.

Healthcare inflation remains strong.

A .24% monthly core reading will take the YoY measure (the Fed’s preferred lookback window) from the current 2.68% reading to 2.70%. Effectively unchanged from the August 2024 level of 2.73% YoY.

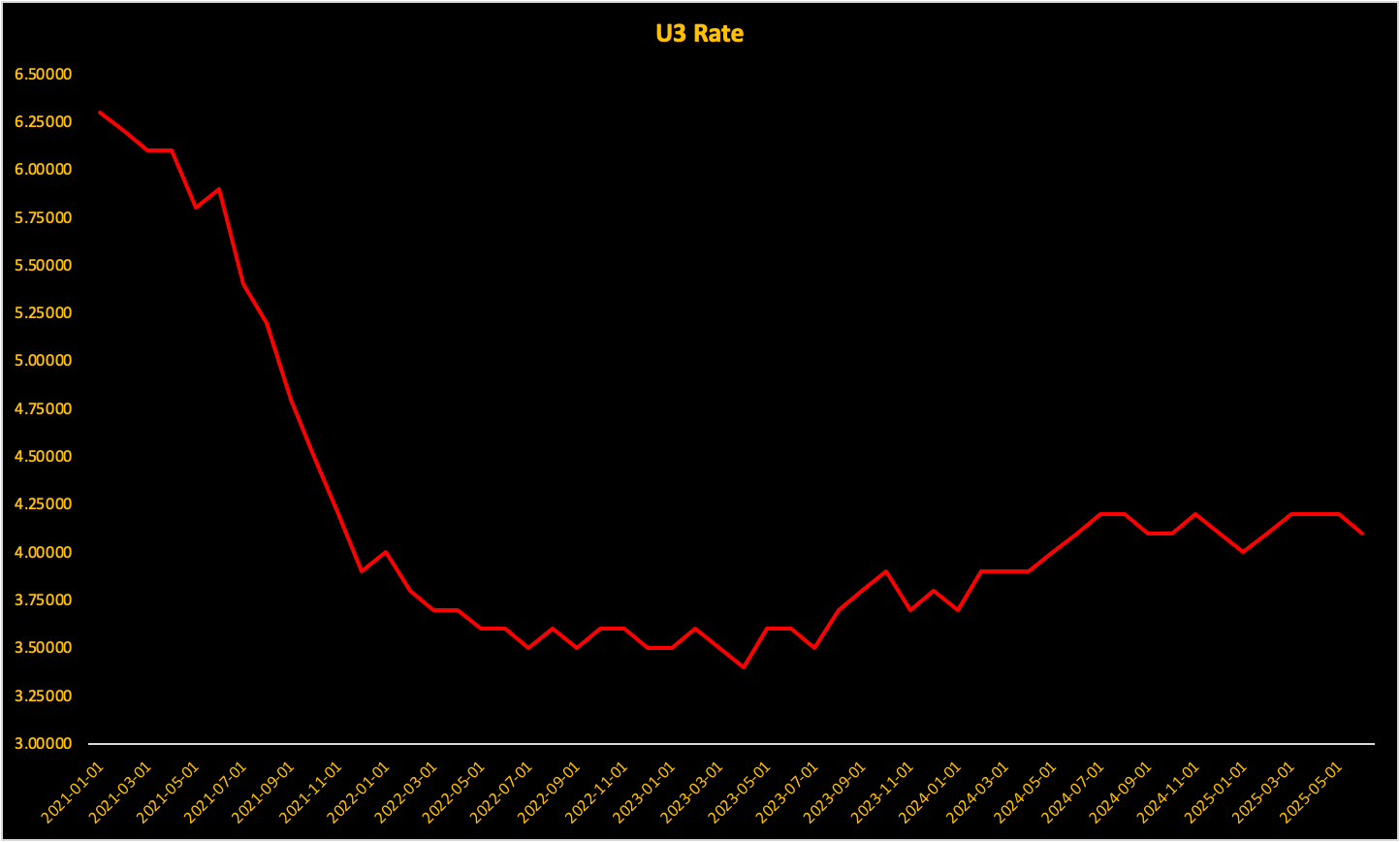

The labor market has similarly marginally improved since last summer.

U3 was at 4.2% in August 2024.

Currently at 4.1%.

This bigger evolution in macro indicator porn can be found the Sahm rule, which has materially improved.

Recall, the Sahm Recession Indicator signals the start of a recession when the three-month moving average of the national unemployment rate (U3) rises by 0.50 percentage points or more relative to the minimum of the three-month averages from the previous 12 months.

Currently at .166.

Down from a post pandemic cyclical high of .567 in August of 2024 (a false positive, which these pages flagged and faded).

It would take a six-month sequential rise of .1% every month – to 4.7% unemployment – to even trigger the Sahm Rule (.533%) by December 2025.

Absent another shock, this is highly unlikely given that the Fed’s preferred year-ed unemployment rate target is 4.5%, as the FOMC would signal a more aggressive cutting campaign than what is currently priced by markets (2-25 basis point cuts) should the labor deteriorate in a manner inconsistent with that revealed policy preference.

This immaculate macroeconomic equilibrium outcome is the textbook definition of threading a firehouse through a needle.

The internals of these datasets can be tortured to fit preferred narratives or to cope with a sad PNL. However, these broad, king-of-the-hill macroeconomic aggregates are signaling a remarkable economic resiliency in the face of:

Real-time policy making challenges (Jackson Hole 2024).

A chaotic presidential transition (Trump is more orange than ever).

An incoherent and unpredictable trade policy shift.

A highly regressive, yet broadly stimulative (and some would say irresponsible) fiscal package in the form of the One Big Beautiful Bill.

Since the past may not be prologue, the forward macro signal is found in triangulating the broad macro aggregates mentioned above with the forward nuances found in other data sets in Pinebrook’s macro framework.

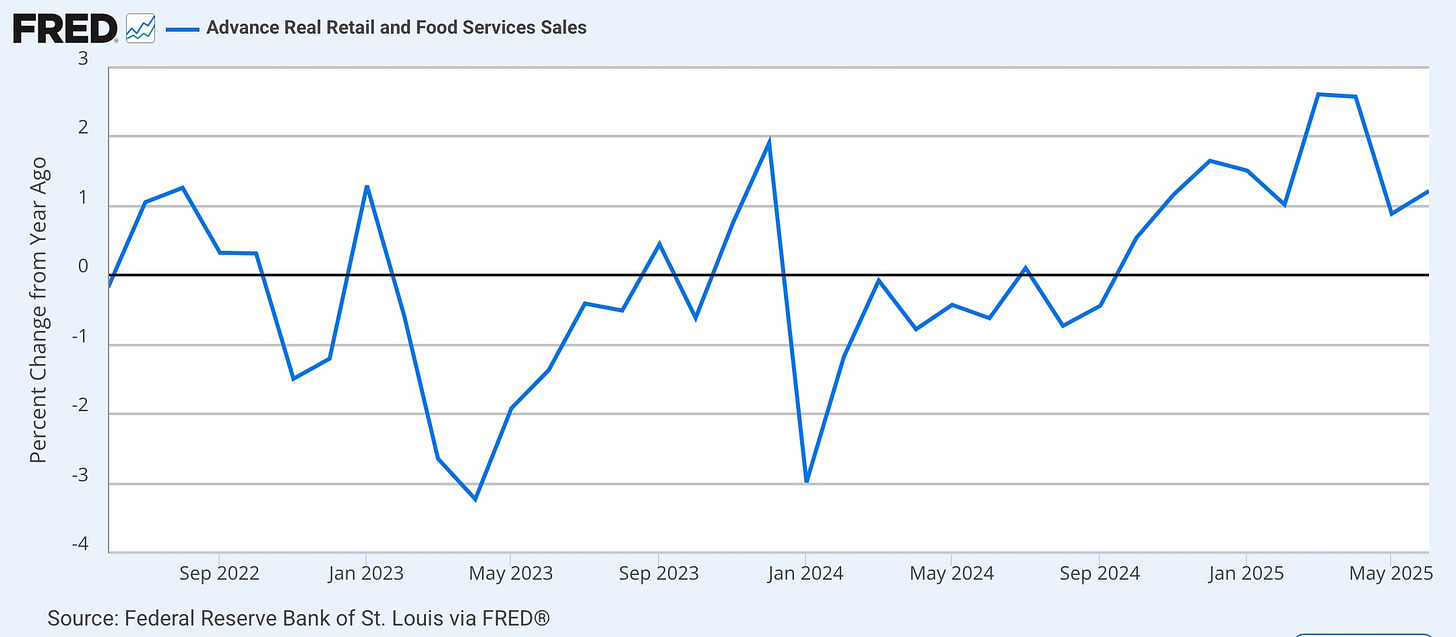

Longtime readers will recall that real, inflation adjusted, retail sales are informative of the future state of the labor market. As goes consumption, so goes the labor market.

In June, retail sales rose by .6% MoM, while CPI came in at .3% MoM. Thus, real retail sales increased by .3% MoM.

While the print did break a string of back-to-back negative prints, the trend has gone sideways since November 2024, and down on a YoY basis since January of this year. The 8-month and YTD trends in real retail sales suggest that consumers are struggling to keep up with goods spending.

Digging below the surface and adjusting for changes in population growth (immigration?), real retail sales are still .6% higher YoY, which suggests no recession over the next few quarters.

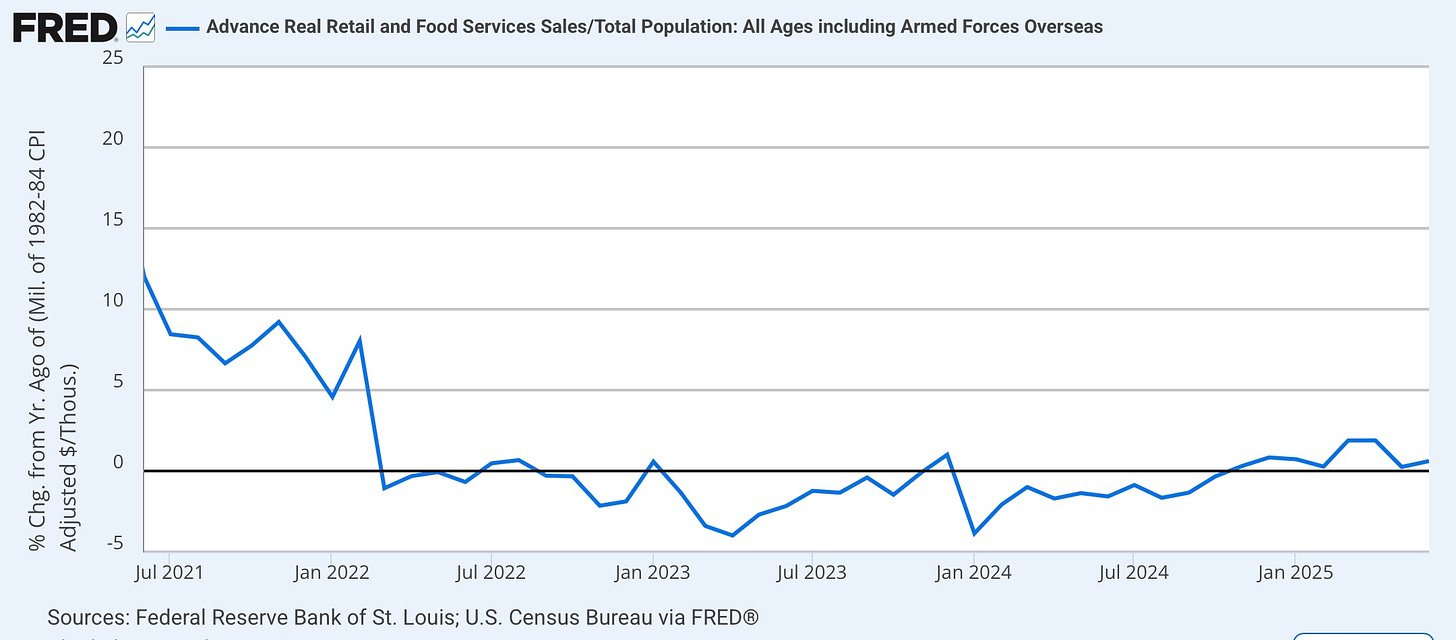

Similar to how changes in population growth have altered our understanding of the labor market, population changes need to be considered when understanding aggregate real consumption patterns.

While some observers are suggesting that consumers are barely keeping up with price increases, Pinebrook will fade these consensus views and not discount the strength of the U.S. consumer.

Changes in immigration growth have led to changes in labor market growth, and in consumption patterns.

Previously, evolutions in the labor market converged to changes to immigration patterns.

The next step is for this to be manifested in consumption patterns at the macro level.

The above may be seem counter intuitive as a growth signal. Afterall, the implication is that even if consumers are maintaining proportionate consumption, the consumption aggregate is signaling lower future NGDP growth.

This is the wrong take because it focuses on the wrong future probabilities. This is the signal.

The following brain teaser will illustrate the concept.

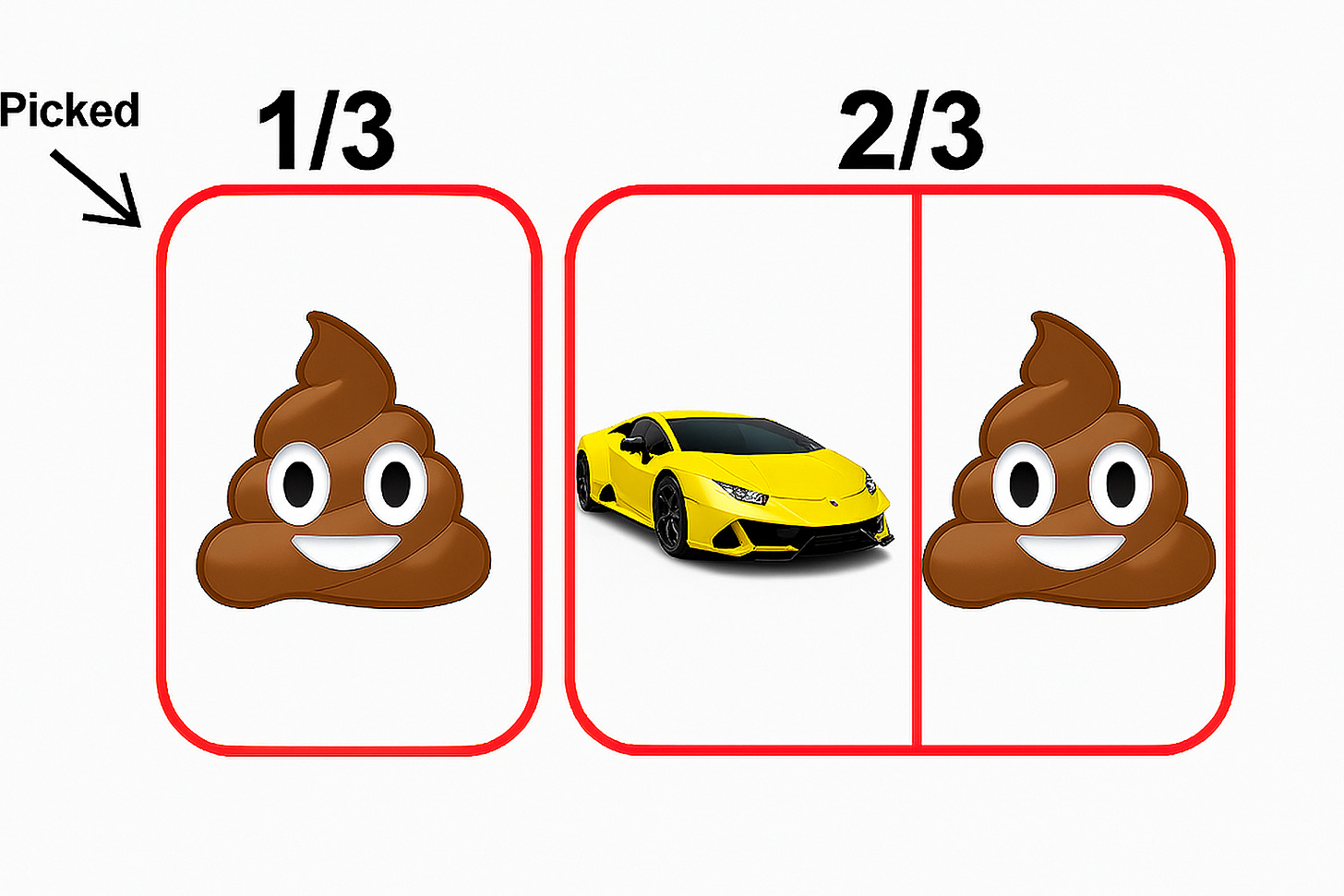

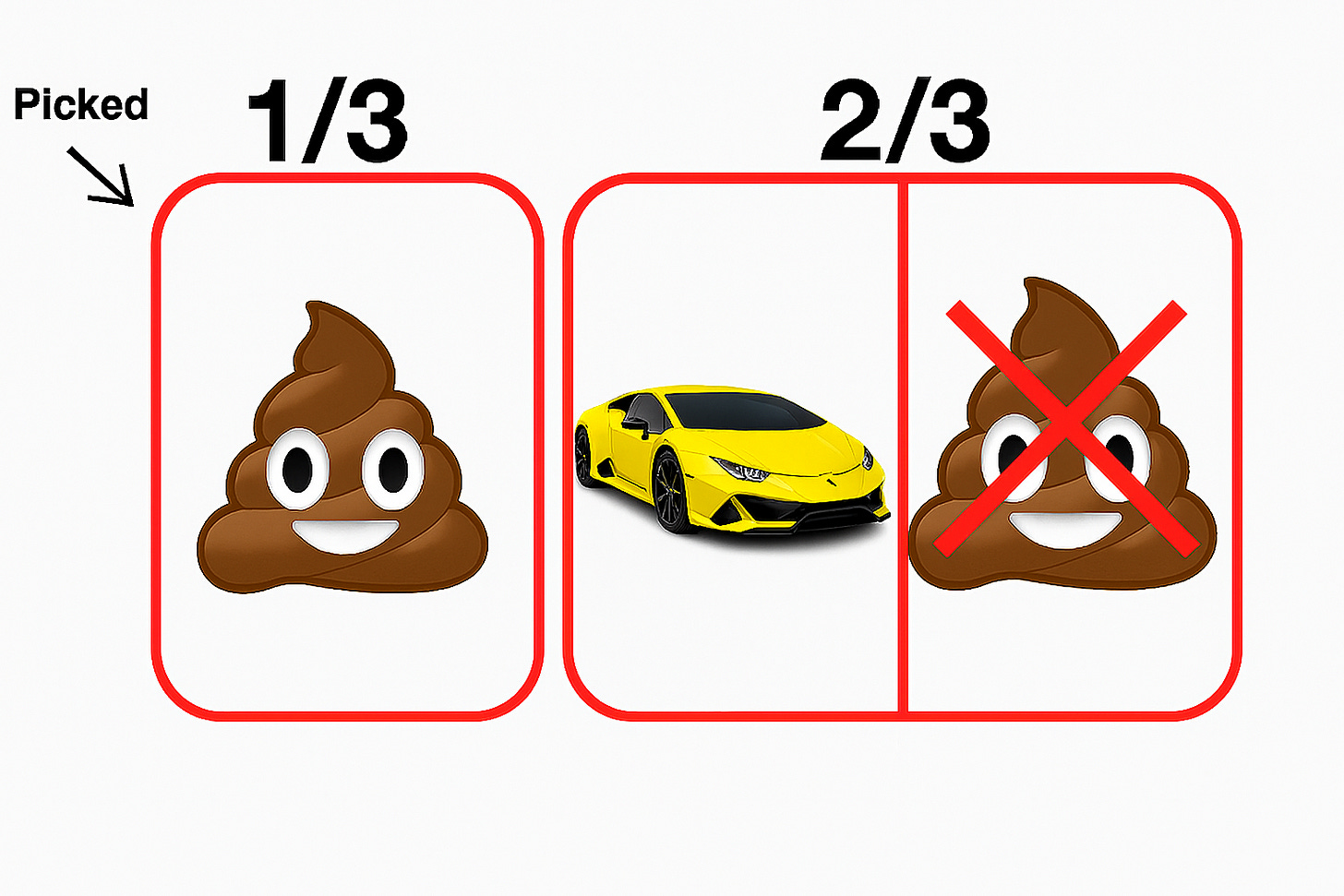

Suppose you are on a televised macroeconomic game show. You are given the choice of one of three doors. Two of the doors have a turd for a prize, symbolizing low or negative growth. Behind one of the doors is a Lamborghini sport car, symbolizing a bull market.

You pick door one, not knowing what it is behind it of course.

Meanwhile, the game show host – who has perfect information - opens door three and reveals a turd.

You now have an option to stay with door one (the unknown turd), or switch to door two (the Lambo).

What do you do?

Being the clever thinking person you think you are, you reason that left with two options, your choice is a fair value 50/50-coin toss of chance.

You will either get a turd market or a bull market Lambo.

Recall, you do not know that behind your initial choice of door one, lies a turd.

This is wrong way to think about the problem.

The reveal of the turd behind door three introduced new information: the odds of the Lambo being behind door three fell to zero.

The joint odds of the Lambo being behind door two OR door three were always 66% (1/3 + 1/3).

Eliminating door three as a Lambo door concentrates the probability of the Lambo being behind door two to 66%.

Since 66% is double the odds of 33%, the optimal move is to switch to choosing door 2.

Frederich Hayek, patron saint of free-market libertarians, emphasized that prices act as a form of information within an economy because they aggregate and transmit dispersed knowledge.

Recent price action has informed market participants that the near-term probability of a recession is at or near zero.

That is, door three has been opened and we know that a recession is off the table between now and calendar year end.

Thus the probability of a 2025 bull market has gone from 1/3 to 2/3.

With improved future probabilities, economic agents (firms and consumers) are better able to re-consider their appetite for real, economic risk to the upside, and act accordingly.

For those with physics envy, think of the above as a slow motion Lévy Flight, which is a random walk characterized by small displacements and occasional very large displacements.

In market speak, this is a repricing of market expectations, from a turd to a Lambo.

Concluding Remarks

The current inflation fetish is the noise.

Population and inflation adjusted consumption figures point to continued, but slowing, growth in the labor market and potentially some slowing of nominal GDP.

Markets have eliminated or significantly handicapped a bear market and are pricing the increased probabilities of a strong double digit return year.

Commentary that relies on recent high frequency data as a basis for future probabilistic returns should be faded as noise.

Participants are better served by Hayek’s messaging of listening to market signals.

Love the economic and financial analysis, but have to admit I find Lambo theory puzzling. Suppose the dealer opens door three, and you find the turd. You haven’t yet made a selection. The the probabilities of finding the Lambo behind door 1 versus door 2 are clearly 50/50. So how does initial selection of door 1, without actually opening the door, skew the probabilities?

First