Market Commentary

2025 In the Mirror

In customary Pinebrook fashion, the cope will be dismissed, the narrative will be kept to a minimum, and the numbers will speak for themselves.

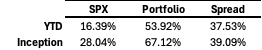

*Price Return

The updated blotter and dashboard, through close of December 31, 2025, can be found here.

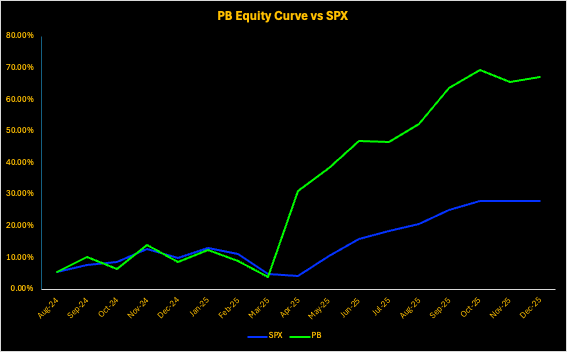

Below is the equity curve versus the S&P500, since inception in August 2024 through close of December 31, 2025.

The index was hugged until the fat pitch came on Liberation Day.

For an unbiased review of portfolio performance metrics, the blotter was dropped into Gemini AI, along with the price history from Bloomberg of the mentioned securities.

The option part was tricky because of a lack of daily closing marks on individual options positions. The bootstrap work-around was to simply use the option PNL as a “yield enhancer” and forgo daily metric analysis on that asset class.

Bean counters and quants may cringe at this approach, but options are not a big part of Pinebrook’s work in either size or frequency for this to matter. There may be some rounding errors, but the general analysis is good enough for these pages.

Without further delay, here is what Gemini AI had to say for Pinebrook’s 2025.

Beta .34: Your portfolio remains very “uncorrelated” to the market. A beta of 0.34 means you achieved returns while taking only about one-third of the market’s directional risk.

Sharpe Ratio .92: This is a strong result. A Sharpe of 0.92 indicates that for every unit of risk taken, you were handsomely rewarded.

Sortino Ratio 1.14: Since your Sortino is significantly higher than your Sharpe, it confirms that your volatility is skewed to the upside. You are being penalized by the Sharpe ratio for “good” volatility (big winning days).

Volatility 20.79%: Higher than the S&P500 at 13.91% but this is due to the “good volatility” mentioned above.

Upside Capture 56.89%: You participated in over half of the market’s gains.

Downside Capture 41.37%: You only felt about 41% of the market’s pain during selloffs.

This indicates that your returns are being driven by specific security selection and option strategies, rather than just “riding the market tide.”

Your Sharpe Ratio is healthy, but the Sortino Ratio remains higher, suggesting that a good portion of your “risk” is actually coming from large upward moves in your PNL.

This is a very favorable “Market Neutral” or “Long/Short” style profile.

You are getting nearly 3.2x the market return with less than one-third of the market’s directional exposure.

My personal take:

Mean reversion was a guiding north star to the trading process.

A focus on the labor market and on fiscal policies helped stay away from the hysteria of tariffs.

Listening to the market was more effective than listening to the voices in my head.

A big failure was on the international side. Some lucky punts were made, but nothing of consequence. Money was left on the table.

Two stupid trading mistakes that were collectively around negative 3-4% of annual PNL.

Not hedging the Argentine election. Never go all in on binary outcomes like elections. Coin tosses can end well or not. Go play roulette and enjoy lighting your cash on fire instead.

They say never short an up-trending market like gold. Pinebrook was (and still is) bullish gold and got very long in late summer.

There are exceptions such as extreme tail deviations. However, if one gets lucky out the gate as we did, don’t hang around too long. Or maintain the position and hedge it, making money on the hedge while maintaining exposure.

The mistake was not the short, which we nailed. The mistake was in hanging around too long on an asset we were fundamentally bullish about.

Thank you for your membership and support. I hope the year was profitable for all of you. Next week we are coming out the gate swinging.

David CervantesPrincipal and Managing Member of Pine Brook Capital Management, LLC.

That's pretty badass. Big lesson in patience and waiting for the fat pitch.

By the way, I think there was only one trade this year that was relatively problematic: staying short gold for too long. For a short position, holding it for such a long period is, in my view, not appropriate. I was also shorting gold during that time, but I was doing it through repeated swing trades. Even so, I didn’t make money there either.