Market Commentary

New Trade Discussion

This note is a follow up to the trades Pinebrook initiated Tuesday, as well as an update on some existing positions.

Homebuilders

The home builder trade is a black whole of domain understanding, from individual builder unit economics to regional and local markets, to national trends in fixed residential investment, to post GFC and post pandemic housing market economics.

As the entire industry, from builder to buyer, runs on borrowed money, mortgage rates are the simplest broad aggregate for approaching the trade.

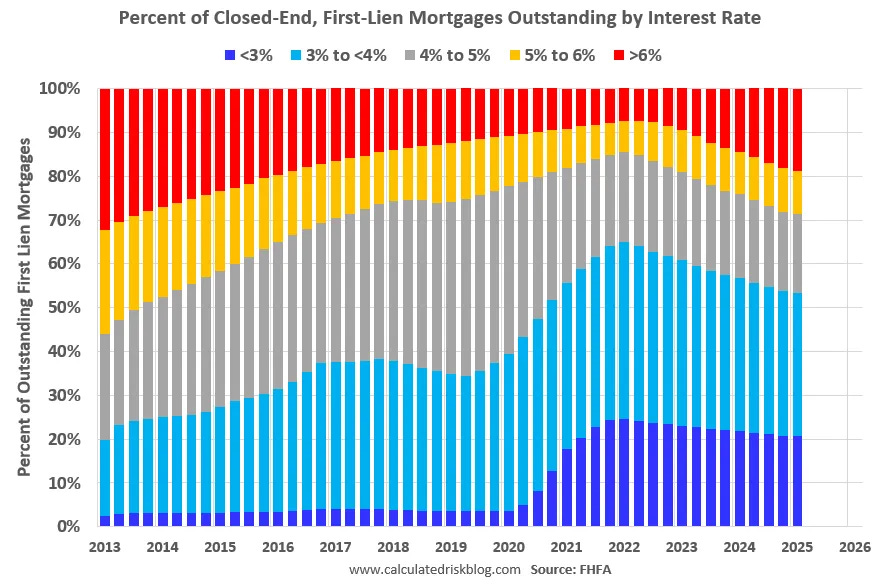

Roughly 40% of U.S. homes are owned outright and mortgage free.

Of the remaining 60%, the vast majority are struck below a 6% mortgage rate.

The current rate for a conforming, 30-year fixed rate mortgage is 6.57%.

Fixed mortgage rates need to fall significantly to get people off the fence and refi legacy rates.

When the Fed began its interest rate cutting cycle in September of 2024, there was a hope that this would kick off a mortgage re-fi cycle. However, instead of mortgage rates falling, they bottomed at 6.08% about a week after the Fed cut in September and then drifted up to 7.04% in January 2025.

With Fed cuts priced in, there does not appear much scope for mortgages to fall very much, at least not as long as the 10-year treasury is concerned. Some simple back of the envelelop math will reveal as much.

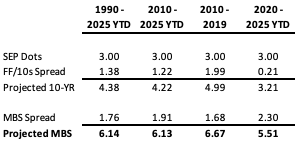

Simply take the Fed long run dot projection of 3% for fed funds found in the June 2025 SEP.

Add in the historical average fed funds/10-year treasury spread of 138-basis points since 1991.

This gives a 10-year note projection of 4.38%.

Add in the historical average MBS spread over treasuries of 176-basis points, for an-all in MBS rate of 6.14%.

Womp Womp.

The can be simulated with averages from different regimes and lookback windows, but the differences are rounding errors, or in the case of the 2020 – 2025 lookback window, unlikely because of the yield curve inversion that started in late 2022 which skews the FF/10s spread.

There simply isn’t much juice in the 30-year fixed/fed funds channel to make an impact on the housing market.

There is however another path to lower mortgage rates.