Signal & Noise Filter

The Shrink-Wrapped Labor Market

Friday’s employment report, while impactful on the information surface of the labor market and the economy,is the echo emanating from before the tariff shock, and amplified by the tariff regime itself, as well as being impacted by the size of the labor force, which is itself impacted by immigration policy.

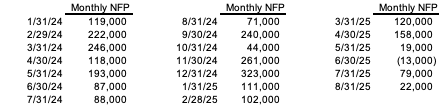

The labor market had already downshifted coming into 2025, with a significant drop-off in job creation after the December 2024 NFP print. Tuesday’s QCEW revisions confirmed this.

Tariff-related economic headwinds were a modal expectation from the Liberation-Day economic shock, potentially culminating in a late summer/early fall recession.

Playing out according to script, this dynamic accelerated post-tariff, with revised job creation falling from solid 6-figure gains through April to outright job losses in June. The current 3-month job creation moving average is 29,000 jobs per month.

For a brief summer it looked as if this weakness would not materialize, but alas it has and it is here. The question is, where from here?

Those labor market reports you incinerated your week reading will not help you answer the question above. The hair splitting over prime working age employment, or unemployment by cause, or employment rate by demographic group, or unemployment duration, etc., is the noise.

They are residuals to a broader contextual economic understanding that is required for a more holistic understanding of the labor market and of the economy.

Readers of these pages will recall the August 27th commentary, which indicated:

Current immigration restrictions in the U.S. are projected to reduce GDP growth by 80-basis point in 2025.

US real GDP growth over 2025 and 2026 is -0.5 pp lower each year from the 2025 tariffs. In the long run, the US economy is persistently -0.4% smaller.

All else being equal, a slower growing economy will lead to more labor market slack. Slack indicates unused or underutilized labor capacity. More slack would normally raise the unemployment rate.

However, all else is not equal. While immigration policy is shrinking potential growth, it is also shrinking the labor supply, which has a lowering effect on the unemployment rate.

A shrinking labor market with a lower supply of workers will have an aggregate impact on the demand for workers. After all, workers are consumers as well, and their consumption needs must be services by other workers.

In summary, current immigration policy is not only shrinking potential growth, but also the labor supply, which impacts macro aggregate demand. None of this is controversial and is in fact well understood.

What is controversial is the degree of immigrant-related labor market shrinkage.

The July 2025 Current Population Survey (“CPS”), aka the monthly household survey which generates the monthly unemployment rate, cited 2.5 million fewer immigrants in the U.S. in July 2025 than in January 2025.

2.5 million fewer people in 6 months, even for a country the size of the U.S., is a massive amount of people. And this estimate likely off the charts wrong.

A shrinkage of that scale means nonfarm payrolls would have to be revised down by over negative 2 million people. The benchmark revisions were well below that and within range of expectations – albeit on the higher side.

Or it means the true U3 unemployment rate would be at a 72-year low of 2.6% and the economy would be overheating as wages get bid up.

None of these things are happening.

This immigration data matters because it determines nonfarm payroll breakeven numbers for U3.

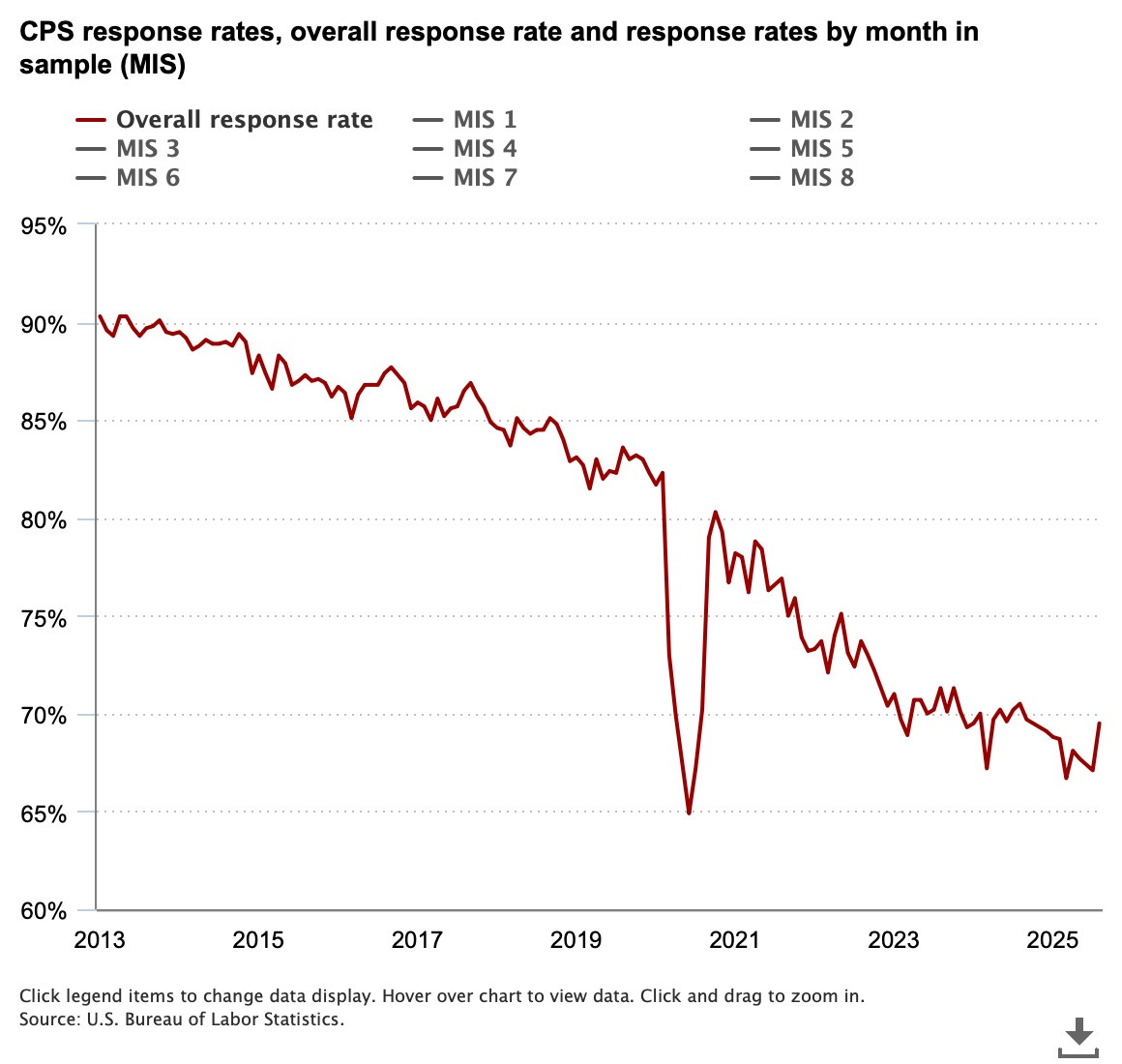

In Pinebrook’s view, survey response rates are at the heart of bad initial estimates.

It does not stretch the imagination to assume, given the current political immigration climate, that response rates have fallen more for immigrants (regardless of legal status) than the native born.

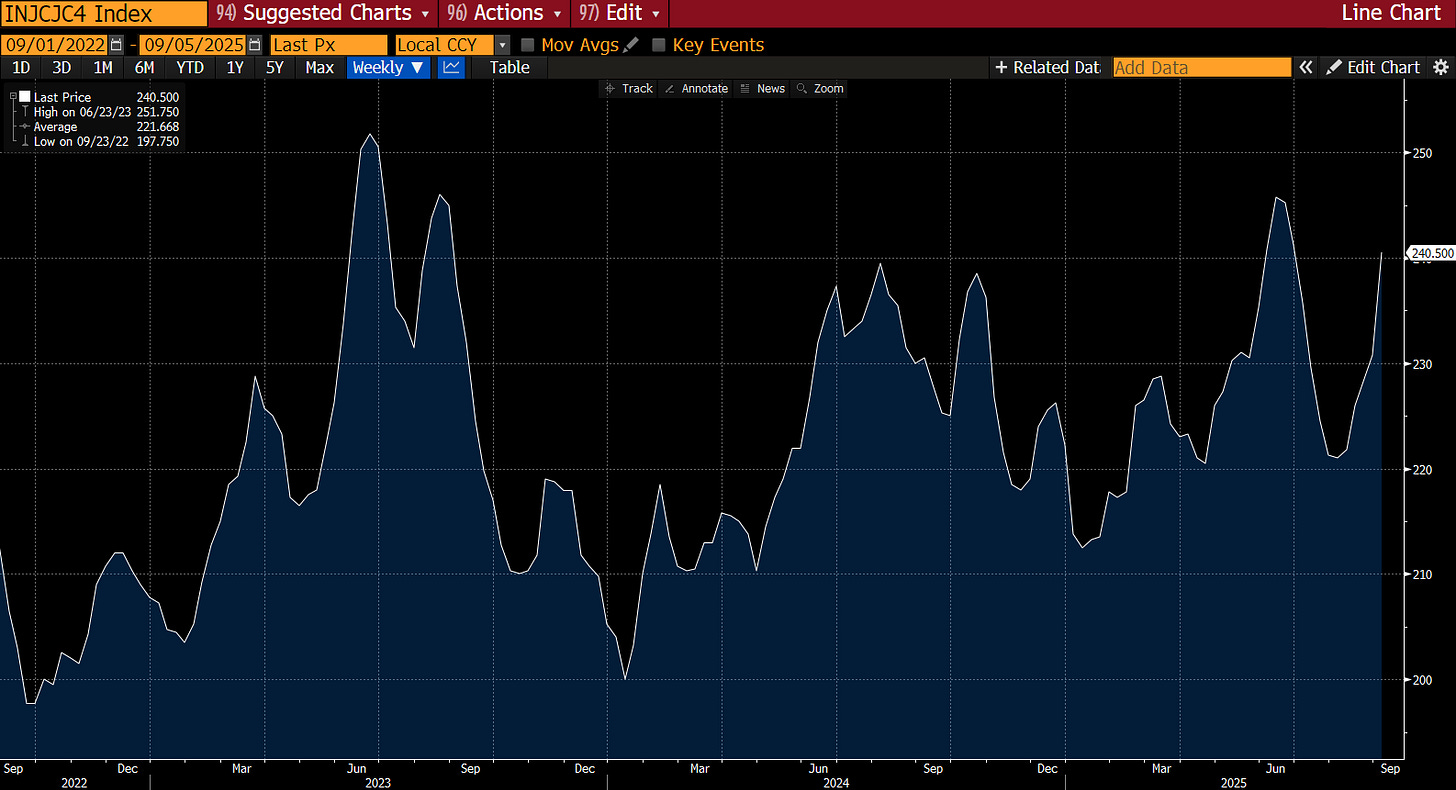

Response rates have decelerated faster in 2025. They fell at a rate of 1.5% per year between January 2022 and January 2025. In 2025, they have fallen at an annualized rate of 3.4% per year.

Assume the response rate was the same for native vs. the non-native born prior to 2025.

Further assume that for the native born, the (declining) response rate was not affected by the presidential election, and their response rate continued to decline at the same 1.5% rate as the prior three years.

For the overall response rate to be 67.1% in July would imply that the non-native response rate fell to 62.9%.

Foreign born workers account for approximately 18% of the U.S. workforce.

A response rate delta from 67.1% to 62.9% would have an outsized, proportional impact of who is assumed to no longer be in the workforce.

The point of these tortured mental gymnastics is not come up with a number that is factually correct. If the army of highly trained eggheads at government agencies can’t figure it out in real time, this writer cannot either.

The point of these tortured mental gymnastics is to direct us away from unreliable survey data that doesn’t pass the smell test, given other data, and by finding problems that can arise from the response rates.

If policy makers are confused about immigration data, they will be confused about employment breakeven rates.

Brookings and AEI recently went down the rabbit hole of net immigration here for those into this kind of kink.

If we go with the original CPS estimates, the breakeven rate is -184k (yes, minus) jobs per month. This is likely a fade.

If we assume net immigration of zero, the breakeven rate to falls to 27k jobs per month, which is not far from the current 3-month moving average of 29k jobs per month.

If we assume net immigration levels implied by the Census Bureau, which project 545K immigrants over the next six months, the breakeven rate rises to 88k jobs per month.

In Pinebrook’s subjective judgement, net immigration is likely lower than prior years, but also not zero.

Economic and personal security incentives are powerful motivators for fence hopping despite increased risks, and an increasingly polarized body politic that is less welcoming of foreigners.

No one knows the exact immigration numbers and won’t for months. Or years, to be definitive. But now we have a basic set of guardrails for understanding NFP prints.

The midpoint NFP breakeven rate between net zero immigration and the Census Bureau estimate is thus 57.5K jobs per month.

The monthly average for 2025 YTD is currently 59K.

Perhaps it is a coincidence that the current 2025 monthly average is near the midpoint of the NFP breakeven points resulting from the projected immigration range for the rest of 2025 (0 to 545K).

What is not a coincidence is that NFP and U3 are behaving much as one would expect given reasonable assumptions around immigration policy, the resulting negative impact on GDP, and demand feedback loop resulting less demand for labor.

If so, then the labor market is actually roughly in balance, and responding dynamically to the demographic and economic (tariffs) and immigration (less people) policy changes coming from the Administration.

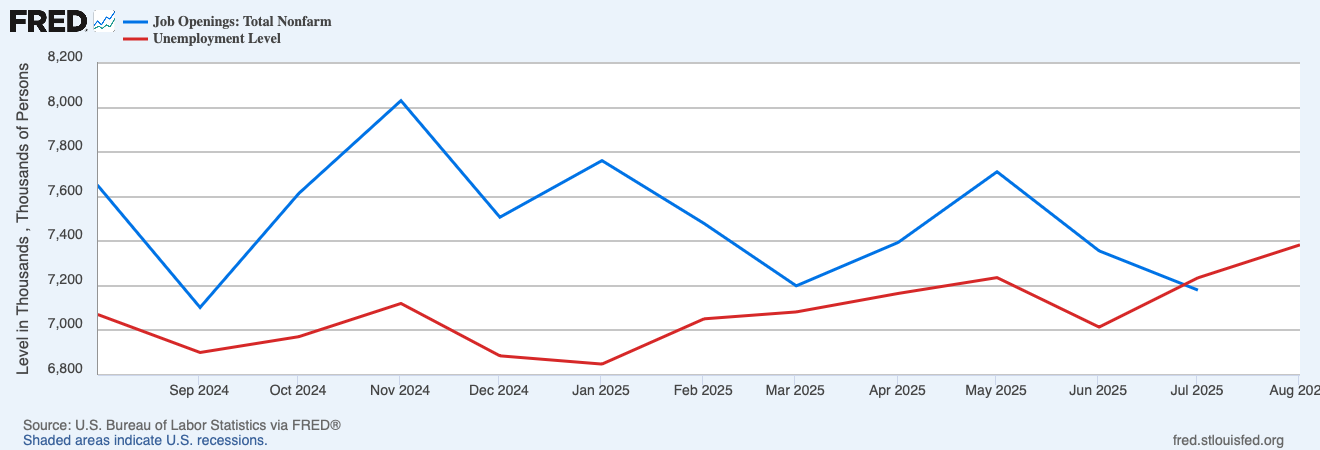

The number of job seekers is slightly over the number of job openings.

Of course, today’s balance could be tomorrow’s disequilibrium disaster. This morning’s new jobless claims highlight this risk.

However, to get a doom loop of falling output driven by declines in employment, the one or more of the conditions below must be satisfied or on the precipice of being satisfied.

Tight financial conditions – markets have shifted in their aggressiveness for lower rate expectations and credit spreads are near 40-year lows. There is finally some movement in the mortgage complex. The stock market is near all time highs. Current financial conditions are stimulative for growth.

Weak consumer spending – real retail sales are the opposite of this.

Weak Business Investment - hello AI cap-ex cycle.

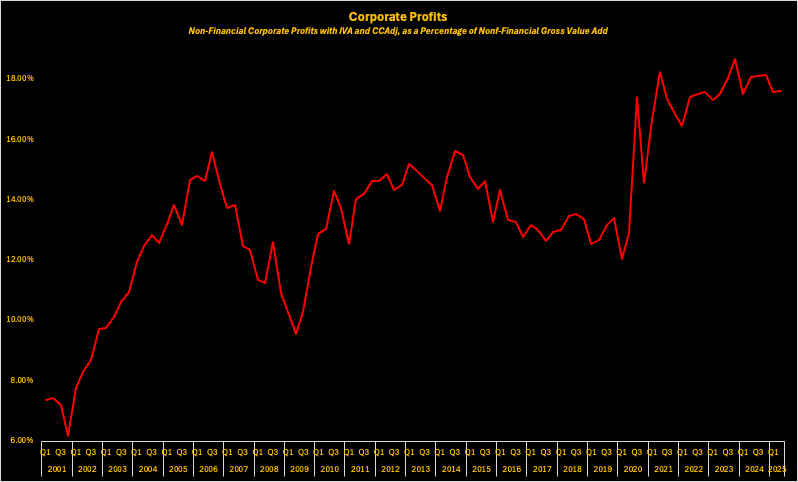

Weak or weakening corporate profits – forward earnings, and most importantly, forward margins, keep melting up. The margin story is consistent with growth in procyclical productivity, which is rare and has not been experienced since the 1990’s. Corporate profits (in the macroeconomic sense, not S&P500 sense) are at 17.1%, above the long-term average of 13.64%.

None of the above is to deny that the economy, and the labor market with it, is slowing. Pinebrook does not scream at the moon or put lipstick on pigs.

The purpose of the above is to highlight:

A labor market that that is balancing the new demand with the new supply of labor.

A lack recessionary conditions that would motivate the labor market to move from adjustment to actively shedding jobs.

This is the signal.

Concluding Remarks

The labor market has been softening all year, but the softening accelerated after Liberation Day.

Breakeven NFP prints that generate a stable U3 unemployment rate are at best a guess, but the bounds can be reasonably approximated.

Non-zero, but certainly decreased immigration from prior years suggests a NFP break even range of 27k – 88k jobs per month, with a 57.5k mid-point.

The current YTD monthly average is 59K per month.

This is a shrinking labor market that is roughly in balance and should not be conflated with one that is actively shedding jobs.

While the line between a balanced labor market and one that is actively shedding jobs is a thin one, broader macro conditions do not suggest a tipping point that would lead to a labor market that shed jobs on the scale to affect output, and ultimately, a recessionary outcome.

Pre-Publishing Postscript

This morning’s weekly claims are the highest since October 2021. This data is very noisy. The more relevant number, the 4-week moving average was higher this past June and in the summer of 2023. Seasonal’s are a thing.

Sorry. I deleted the comment because I saw the correction from "do" to "do not" in your last paragraph.

Dave didn't include fiscal stimulus in his list of doom loop conditions. There are major tax incentives to accelerate capital spending and R&D from OBBBA. If we get Cheetos Housing Emergency declared, then we could see residential construction take off as well.