U.S. Economic Growth Update

Jackson Hole Edition

The information surface of the U.S. economy continues to confuse most observers – as it always does. This is likely because analysts spend more time screaming at the economy instead of simply listening to it.

By now, the U.S. economy was supposed to be flirting with a recessionary impulse because of the Big Beautiful Trade War.

And yet, The NY and Atlanta Feds’ nowcast models are projecting 2.06% and 2.5%, respectively, of growth for the third quarter.

Goldman Sachs’ economics team, headed by Jan Hatzius, is tracking Q3 GDP at 3.1%.

In Pinebrook’s view, much of this confusion stems from a slavish devotion to indicator analysis, which is static. “When X has happened in the past, Y has generally followed”. A more fruitful approach to understanding the economy is acknowledging its dynamism.

Modern economic theory has attempted to do the above with the advent of dynamic stochastic general equilibrium models (DSGE) and real business cycle analysis. These toy models are simply newer attempts to model human behavior as a hard science, when human behavior is in fact…human, all too human, to quote Nietzsche.

Digressing from the thin line that separates economics from a science and a metaphysical religion, the concept of reconciling opposing truths and contextualizing their co-existence has been a core approach of the Pinebrook framework.

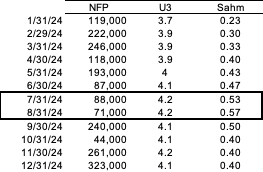

Back on June 20, 2024, it was noted that the U3 unemployment rate kept rising despite non-recessionary non-farm payroll (NFP) prints. How could it be that large payroll gains were raising the unemployment rate?

By the time the Sahm recessionary indicator was triggered in July 2024, the U.S. economy had produced over 1 million jobs, but the unemployment rate had gone up by 50-basis points in the span of 6-months. At this point, the indicator alert people were shedding tears of despair.

It was pointed out then that evolutions in the labor market were creating an illusory weakening of the economy. The post pandemic immigration impulse flooded the labor market with new job seekers that overwhelmed available jobs. While this crude thesis was heuristically developed and ideated in real time, it has since become generally accepted as a reasonable explanation a year later.

The reverse is happening now in real time, as the Administration’s immigration policies are shrinking the labor market. A shrinking of the labor market lowers the U3 hurdle requirements to maintain the unemployment rate, ceteris paribus. That is, the economy can produce less jobs and maintain or even lower the unemployment rate.

There is of course some nuance to this. As my discussion with Guy Berger, the former chief economist of Linked-In and labor market expert extraordinaire, revealed, where the weakness in the labor market originates from and how it is balanced matters.