Market Commentary

Trading Blotter Review

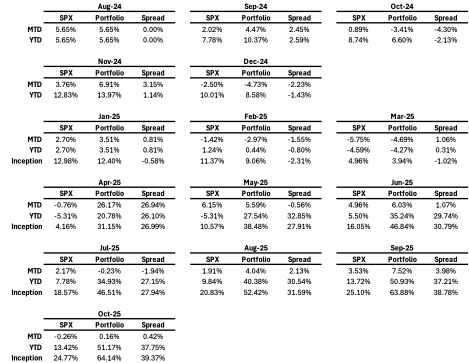

Here are the monthly performance numbers, from inception August 5, 2024, through close of trading on October 15, 2025.

The YTD figures for SPX in 2024 should be interpreted as starting as of August 5, 2024….not the actual calendar year.

Highlights

The initial approach was one of levered beta and trend following. Index hugging was a feature not a bug of risk management.

The is because everyone is a genius in a bull market until the bull market is shot in the head. 💀

Risk management caused major underperformance going into the election. ❌

The biggest success was in managing drawdown risk. As detailed on X in real time, Pinebrook hedged U.S. beta exposure by shorting RoW risk as we headed into Liberation Day. ✅

This allowed for a massive risk-on pounce on TACO Wednesday, using max intra-day leverage to get long risk and short volatility. ✅

After some cooling off to digest the policy pivot, risk went back on on April 23rd and never looked back. ✅

Outside of leveraged beta, there were successes in the personal lending space, home builders, and catching the epic gold run. ✅

Current positioning is short Argentina, short gold miners, and short Chinese tech vs long U.S. tech, long USA beta, and Japan (as a Yen trade in drag).

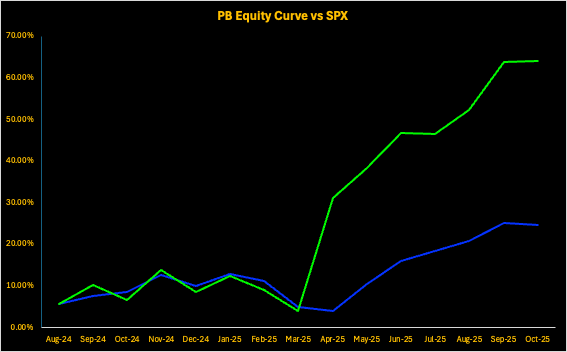

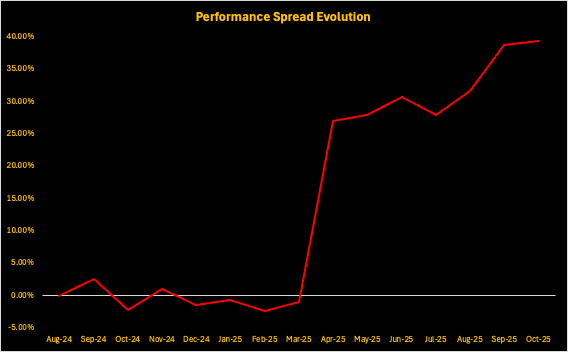

The second biggest point of pride has been consistently increasing the performance spread over the S&P500, which reflects positive compounding and risk management. ✅

By far the biggest disappointment has been missing the boat on international plays. ❌

Below are a chart of the equity curve and the performance spread.

Sharpe Ratio 1.79

Sortino Ratio 2.42

Calmar Ratio 8.86

Beta: .5

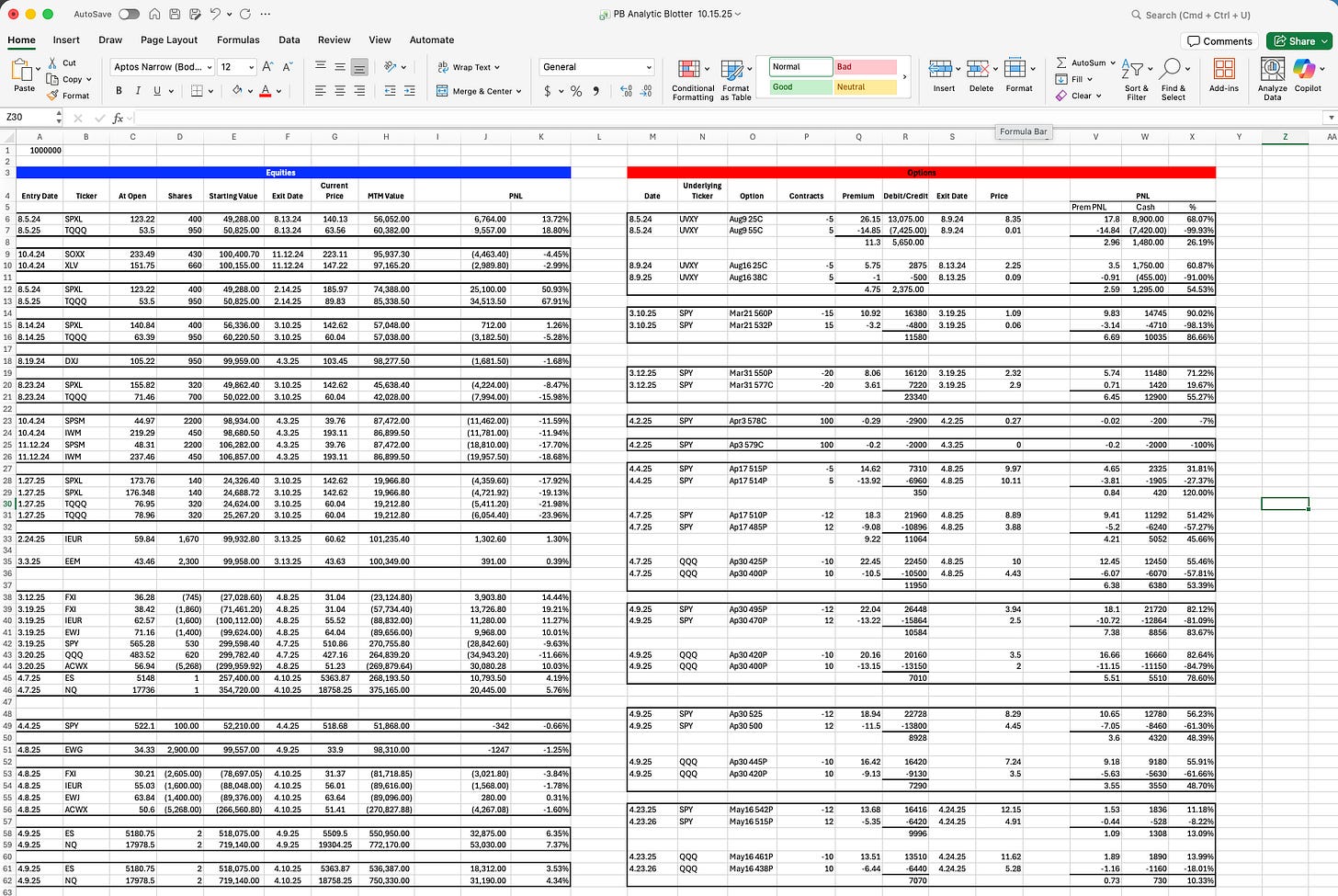

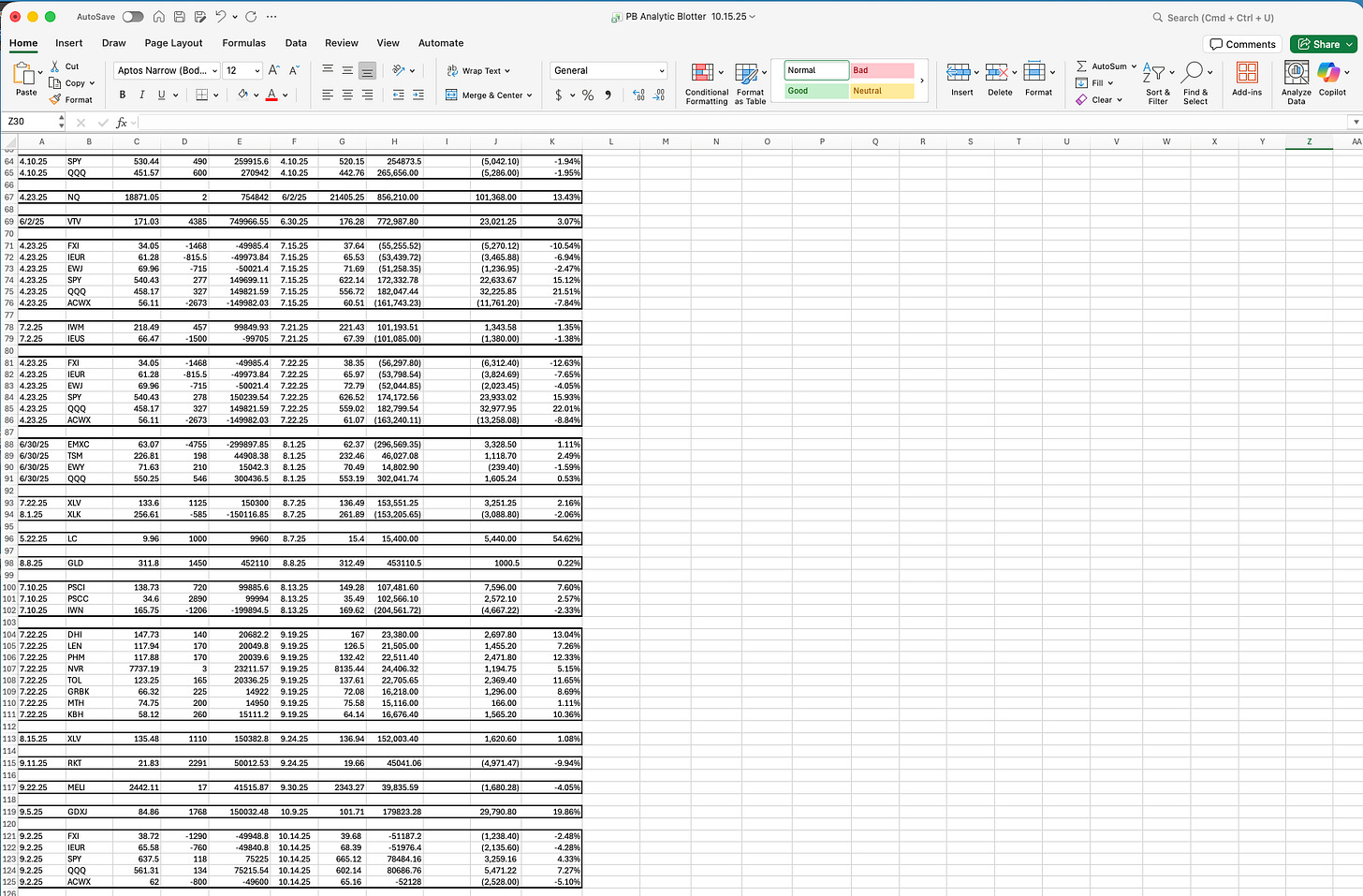

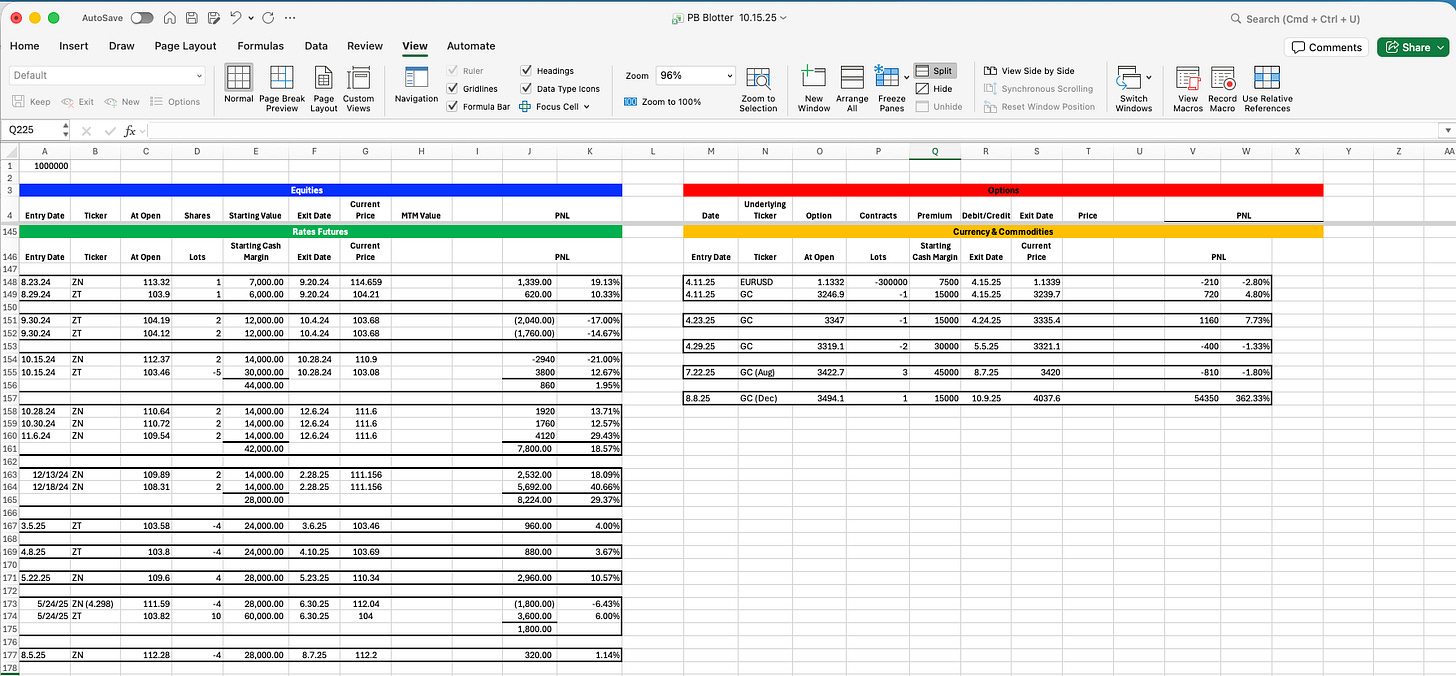

Below are screen shots of every single position taken, sizing, entries and exits, and resulting PNL. All trades had alerts given either on Substack or X.

Current positions will be paywalled for paid subscribers. Closed positions have no paywall. 👇

The project above was started for subscribers who were looking for ways to monetize the macro.

This is an ongoing project, and evolutions are in the pipeline. Open positions highlighted in yellow behind the paywall.