Weekly Signal and Noise Filter

Greetings from JFK. Keeping this one short.

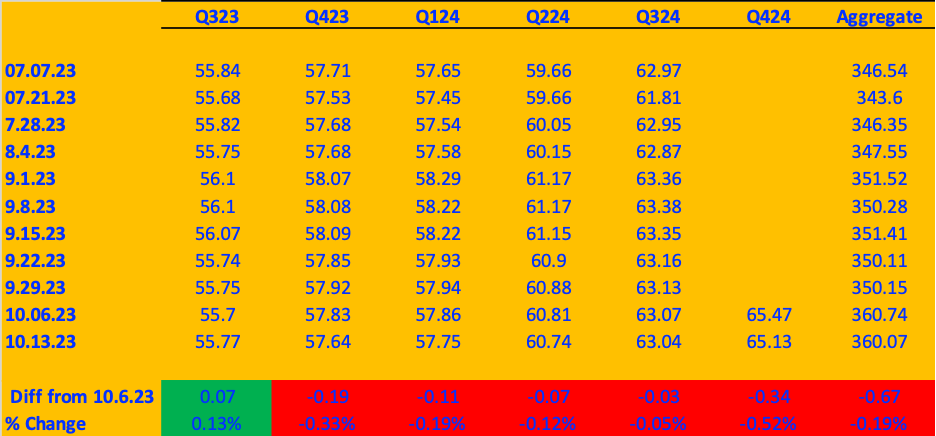

No material updates to the Factset ‘s numbers. Forward 6-month aggregate earnings estimates went down a smidgen by 67 cents. See below.

Unclear if this includes the JP Morgan and Wells Fargo prints from Friday. In any case the JPM and WFC numbers were expected to be good as mentioned in the equity review last week.

The tell will be on how the lesser ranked names deliver in the coming weeks.

Obvi we can expect lots of geopolitical noise this week. Stay focused on the things that matter: the earnings outlook and interest rates.

We will get lots of macro data on Tuesday and Thursday - retail sales on Tuesday and home sales on Thursday.

Although I am travelling, I will be working on two notes this week.

The first will be a follow up to the equity note, which will explore how valuations are affected by changes in nominal rates and bond risk premiums.

The second note will update the growth outlook for the rest of the year, with a revisit to the housing market. This note will inform my view on the bond market for the next few weeks.

I remain long a ½ position of 10-year futures at a yield reference of 4.74%.

I will out of pocket most of Monday, as I am delivering a presentation at the Stansberry Research Investment Conference at 1pm PST in Las Vegas.

Hi sry I missed this. Don’t know if you saw on Twitter I got out this morning at a ref yld of 4.79.

Thanks for the update.