January Blotter Highlights

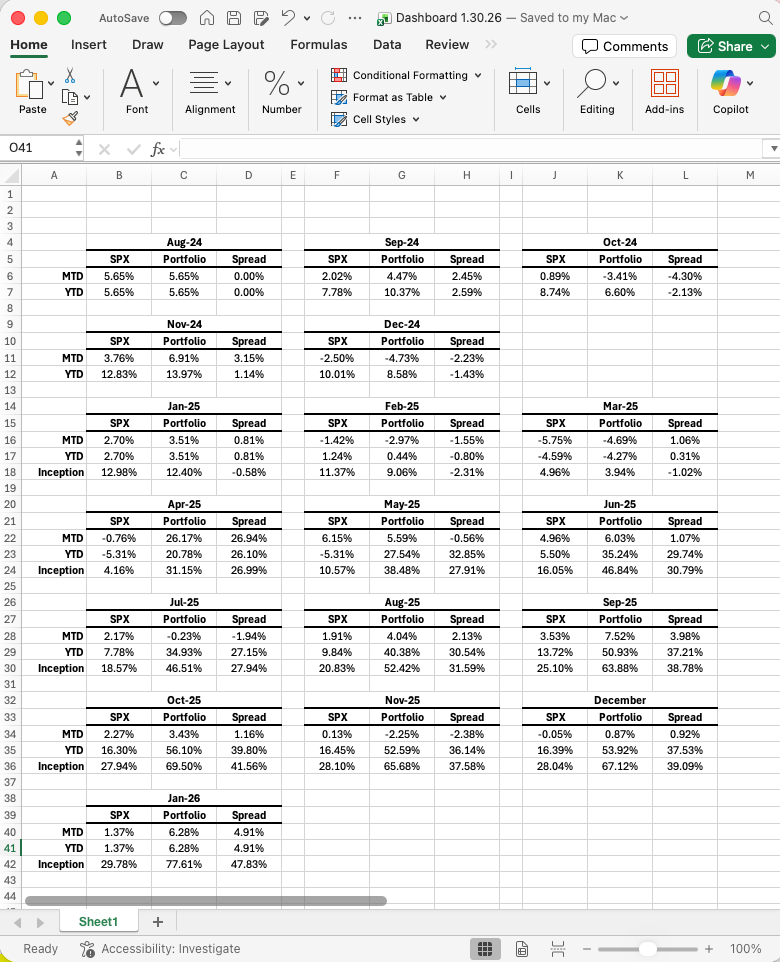

Second Best Month since Liberation Day April 2025

The month started with some mild underperformance, lagging SPX by 56-basis points as of January 6th.

On January 14th, this turned into 25-basis points of outperformance by Pinebrook.

On January 28th, Pinebrook was outperforming by 128-basis points.

By close of trading on the last trading day of the month, Pinebrook generated a return of 6.28% vs. 1.37% for the S&P500, outperforming by 491-basis points for the month.

Most positions were run of the mill first and second base hits, that returned about high single digit to mid 50’s in basis points in terms of PNL contribution. Over the course of over 20-trades in a month, these do add up provided the hit-rate and margin of winners over losers is positive.

Two home run trades stand out:

Long S. Korea, which returned 18.88% on the position and 169-basis points in positive PNL.

Short silver, which returned 106.44% on margin and contributed 221-basis points in PNL.

Strategically, the biggest value add was a significant reduction in U.S. equity exposure in favor of international exposure.

Thank you for being on this journey. Very excited to start the year strong, roaring out the gate.

Keep an eye out this weekend for more position updates!