Market Commentary

The Return of U.S. Exceptionalism (it never really went away)

This year, Pinebrook has championed two trade themes.

Mean Reversion between U.S. equities and Rest of the World (“RoW”).

With the respect to the former, the initial tactical lean was in favor of RoW assets over U.S. ones, as U.S. outperformance was historically stretched, despite a structural preference for U.S. assets over the long run.

After President Trump showered the market with TACO flavored kisses, this preference was inverted in favor of U.S. assets over RoW ones.

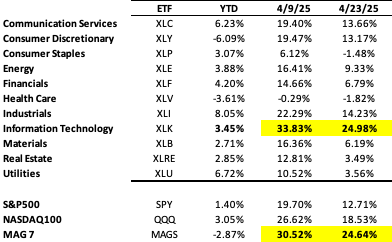

The following table shows the performance of these assets since TACO Wednesday, April 9th (technically, close of April 8th for those measuring at home) through the close of June 20th.

The performance gap has widened since April 23rd, indicating investor preferences that go beyond the standard impulse to capture the reflexive bounce by all assets not nailed to the floor.

With respect to the latter of Pinebrook’s themes, U.S. large cap tech, this table was published on May 11th.

The table showed that despite having an awful first quarter, U.S. large cap tech outperformed during the month of April and showed the strongest sectoral outperformance since the end of Q1.

Below is an update to this table, with a post-TACO look back window.

Not only did large cap U.S. bounce the most since TACO Wednesday, but the majority of those gains came after April 23rd.

Below we broaden the exercise and apply it to international, non-U.S. big tech. First with Europe.