Market Commentary

The Rotational State of the Tape

The rotation that was flagged back on November 12, 2025 and again on December 11, 2025 and again on February 3, 2026 is now common knowledge and the accepted wisdom on La Rue.

The dumping of software stocks under the pretext of being the latest Ai victim is the most recent manifestation of this thesis. While obviously not MAG 7, software is both Mag 7 and Big Tech adjacent enough to be vulnerable to the shift in sentiment that has been driven by concerns over capex ROI which then spreads into broader parts of the economy via the labor market.

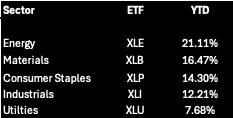

This reads like classic “late cycle” trading, where commodity-focused sectors share the limelight with defensive groups. Energy and Materials usually find pricing power after years of global expansion, while Staples and Utilities are where capital goes to hide when the macro-outlook gets murky. Industrials are the odd man out here, but they’ve got price momentum on their side.

This raises the question: does the current rotation actually line up with the fundamentals? In other words, is the market listening to earnings revisions, or just running on vibes?

Revisions vs. Reality: A Divergence