Market Commentary

The Road to 26

Spoiler alert. This is not a 2026 outlook. It’s better than that.

One of the conclusions of last week’s note was that a low volatility/high valuation macro backdrop was a feature, not a bug, and should not be fought.

With that as a foundational premise, this note seeks to explore what conditions will elevate current valuations above 22x next year’s consensus earnings estimate of $306/share given that the 5-year average forward PE is 20x.

This is an important exercise, as the commentariat keeps tripping over itself over making comparisons between the current AI-fueled trade and the dot-com one from 25-years ago, when the PE ratio hit 23x.

To make a real bullish call from here, one must believe that the S&P500 can get to a 24x forward earnings, and maybe even tag 26x.

Clip-in and lez go cuz you ain’t seen ‘nuthin yet.

The path to 26x starts with that foundational building block, earnings.

So far, the Q3 2025 earnings season has been a banger and one for the record books.

91% of S&P500 firms have reported.

Of these, 82% have reported earnings per share (EPS) above estimates, which is above the 5 and 10-year averages of 75%. An 82% rate has not happened since Q3 2021.

Earnings have come in 7% above expectations, which is below the 5-year average of 8.4% but in-line with the 10-year average.

Normally, earnings beats come in on the heels of downgraded expectations, which make for an easy hurdle. In this reporting cycle, earnings came in after expectations were being raised.

At the start of the earnings season, analysts were penciling in $67.24/share for Q3 in September.

Currently at $70.65/share.

This season ranks as 10th best among beats in the 155 earnings seasons since Q1-1987.

Firms entered Q4 2025, and will be entering calendar 2026, with strong earnings momentum.

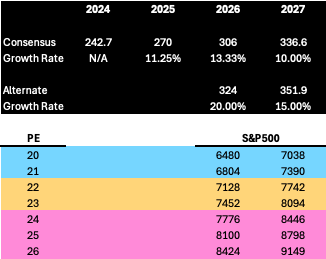

Below is a table with the usual throw shit-at-the-wall estimates everyone makes up. Consensus numbers are taken from FactSet, but any source such as Yardeni is fine. We’re not looking for exactness here.

2025 is mostly a done deal so we will take $270/share EPS as gospel.

The $306 figure for 2026 represents a 13.33% increase from 2025. Not unreasonable.

2027 is not officially available, so we will use the approach that never gets anyone fired – 10% earnings growth.

As 2025 is priced, markets are now looking at calendar 2026 for current pricing. The closing price for the S&P500 on November 11, 2025 was 6846. 6846 divided by 306 gives us a current multiple of 22.3x.

If projected earnings are increased from 13.33% to 20% in 2026 vs. 2025, and from 10% to 15% in for 2027 vs. 2026, we can see what multiple re-rating does to the math.

Even with assumed increases in earnings, from 13% to 20%, it’s really going to take multiple expansion to move the needle on price targets for 2026.

Anything below 24x will generate single digit price appreciation in 2026 over 2025.

24 times 20% earnings growth of 324 takes us to 7776, which is 13.58% vs. Tuesday’s closing SPX level of 6846.

SPX multiples of 24, 25 and 26 give us of 13.58%, 18.32%, and 23.05%, respectively, of appreciation for calendar 2026.

To make a strong bull case for 2026, one must believe valuations, more than earnings, will not only stay elevated, but go beyond dot-com levels of crazy.

The question is not “can this happen”, but rather “how does this happen”?

This is the true purpose of this note.