Will Santa Get Us Over the July Highs?

With last week’s bond repricing, the biggest impediment to a Santa rally that was previously discussed in past notes, has been removed.

The bond market repricing makes a revisit to the October lows an unlikely proposition at this point.

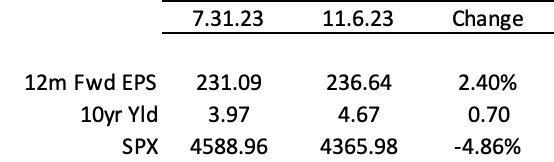

Now the question for traders is, will the market break over the annual high put in on July 31st, or is this it? It’s one thing to have an impediment removed, and another to get after the task at hand.

The two biggest fundamental drivers of equity returns are earnings and the interest rate used to discount them. So, what’s changed between July and now?

As detailed in prior notes, Q3 earnings keep improving while Q4 earnings have been in decline at almost an inverse 1:1 lockstep ratio.

EPS cuts at the start of any given quarter are not unusual. What is unusual is the degree to which Q4 numbers have been cut, with minimal spillover to subsequent quarters.

Q4 estimates are down -4.16% since the start of the quarter, and Q1 and Q2 2024 have been reduced by -1.43% and -.76%, respectively, in the same time frame.

Per Factset, the 5, 10, 15, and 20-year average of initial quarterly cuts are 1.9, 1.8, 2.0, and 1.7 percent, respectively.

The point is, the Q4 cuts are running 2x above the historical average across any time frame. And this is happening as basically a one-off with little momentum spillover effects.

One inference is simply that as Q3 pulled growth forward from Q4, it stands to reason that Q4 earnings numbers should reflect the same, and things are otherwise copacetic as the market looks beyond the Q4 soft spot.

Maybe. But to be clear, what markets are currently looking at going forward are not earnings.

Earnings are not the story. Interest rates appear to be the causal driver of equity price action, as discussed in prior notes.

Under current earnings and ERP assumptions, the 10-year would have to fall to 3.465% to get back to 4582.

So How Do We Get Lucky?