What's Priced Into Markets

Special Guest Post by Newral

The following post is not a Pinebrook work product. Newral works at a major financial institution with over US$100 billion in assets.

Any errors, editorial or otherwise, do not belong to Pinebrook!

What's priced into markets? Spoiler: it's neither a recession nor "goldilocks"

Summary: A popular narrative has emerged that bonds are pricing in a recession, whilst stocks price a "goldilocks" environment.

It's not that simple, and cross-asset pricing is more closely aligned than this view suggests. Meanwhile, elevated recession risks should lead the negative stock-bond correlation to reestablish, marking another departure from the post-Covid norm.

Start of article:

A popular narrative has emerged that particularly interest rates and some commodities are pricing in a recession, whilst other assets like stocks and credit spreads imply a “goldilocks” scenario.

This is too blunt a characterization. Cross asset pricing is nuanced currently and requires a differentiated approach which is what we will outline in this article.

Interest rates: a return to "neutral" and slightly more

There are about 250bps of Fed interest rate cuts priced by the market until March 2026. The end point is at around 2.75%. The Fed judges its "neutral rate" – the level at which monetary policy is neither restrictive nor accommodative – to be at 2.8%. The market-implied neutral rate, as derived by 10y1y forwards (so the 1y government bond yield in 10 years' time), is 3.4%.

Hence in the Fed's view, the market is pricing in a soft landing: a return towards the Fed's level of where policy restrictiveness is lifted.

In the markets' view, Fed Funds pricing suggests that there might be some economic slowdown priced in, but not by that much.

For reference, the average Fed cutting cycle has historically been about 400bps from peak to trough. If a "normal" recession were to ensure, having Fed Funds pricing a trough of well below 2% is not unreasonable.

Corporate bonds: issues aren't visible in index spreads

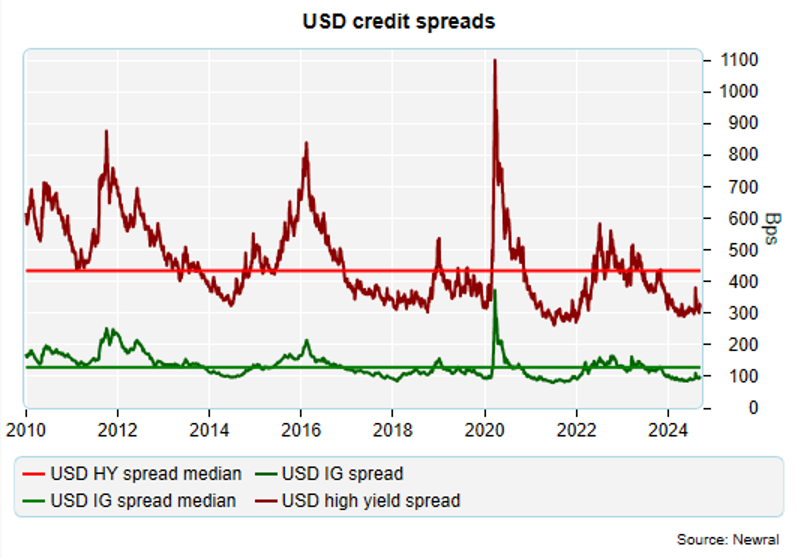

Corporate bond spreads are tight and do not signal a recession. Investment grade spreads have hovered around 100bps. The post-GFC (ie since 2010) median spread is about 130bps. For high yield, the median spread since 2010 is 435bps. Currently, high yields spreads sit at 330bps. A recession would likely see IG spreads at 180 or above and high yield above 600bps, in our view.

Even if you go down the credit spectrum to the most growth sensitive parts, CCC spreads remain pretty tight, both on an outright basis and versus high yield spreads. Indeed, the market-implied 5y cumulative default rate (assuming a 40% recovery rate) for CCC bonds is about 45%, compared to a historical long run average of about 50% for actual, realized default rates for the same time horizon.

The reason why this matters is because CCC spreads typically have predictive power for future economic growth. High yield and investment grade spreads move simultaneously with changes in the growth environment but most of the time do not have predictive power.

That said, there are pockets of weakness in credit markets that are hidden by index spreads, due to issuer concentration and index compositions.

Credit defaults are happening in private markets and not in high yield. For example, leveraged loan defaults have risen quite substantially from their lows, and roughly 60% of them are distressed exchanges.

The credit spectrum overall does not price a recession, far from it. But index decomposition also hides a lot of the weaker segments that may be firing some warning shots.

Equities: All that glitters is not gold

Yes, S&P 500 index forward valuations suggest a soft landing. However, about 30% of the total index is driven by the largest 6 stocks. Earnings growth of the index has also been entirely driven by the Tech sector whilst the rest of the market does not price in meaningful nominal earnings growth for basically the next 18 months. This is not what "goldilocks" would price in, in our view.

In other words, the index and its forward valuation are overwhelmingly driven by tech stocks. This is nothing new per se, but it's important to remember that for Q2 2024 earnings, the S&P 500 ex technology had flat (-0.1%) margin growth year over year.

Cyclicals had negative margin growth of almost 5% year over year. So just because S&P index valuations do not show a depressed state does not mean a "goldilocks" environment is priced it. If it were, particularly S&P ex-tech stocks would be higher on earnings and further multiple expansion expectations alone.

Meanwhile, and according to our fair value estimates on the back of systematic macro pricing, equities do not appear significantly overvalued at this juncture, though the fair value level is below the current index level and is trending down slightly which typically suggests a cautious outlook.

Commodities: mixed picture but something to watch

Industrial metals – as well as their equity proxy counter parts – do signal some slowing in the economy. But slowing is not crashing, and the question here is whether this is a reflection of US/China/global growth falling off a cliff, or simply leveraged investors being overly exposed.

Oil, for example, recent price action cannot be sufficiently explained by cross-asset movements which our systematic macro pricing evaluation captures. This suggests that asset-specific factors, like exhausted positioning of momentum investors, have temporarily pushed the price down further than what is warranted and reflected in other asset class dynamics.

Of all major asset classes, industrial metals appear to convey the most sober economic outlook, in our view.

Bottom line: Different shades of grey, but there is still time to hedge (if that's your thing)

For now, the popular dichotomy of one market pricing a recession whilst another one is pricing in a "goldilocks" environment is inaccurate.

Industrial metals exhibit the most cautious but not outright recessionary outlook, followed by the rates market. Meanwhile, corporate bonds and stocks also do not price in a true "goldilocks" environment. For this, the market bifurcation and behavior of sub-components is simply too erratic.

We are just seeing different shades of grey.

So where to go from here? Recession risks are most likely higher than consensus believes. A labor market slowdown is playing out, and the primary issue is that it's next to impossible to disentangle a genuine economic "normalization" from "accelerating weakness" currently and how and when this momentum would stop.

Whilst no major asset class appears like a home run from a risk-reward perspective currently, we do think cross-asset portfolio diversification will increase. Elevated recession risks will likely mean that the stock-bond correlation will revert towards negative in the medium-term.

This is yet again a change from the post-Covid norm where an aggressive rate hiking cycle and elevated bond market volatility failed a seemingly diversified asset portfolio. For allocators that got burnt through this experience, it’s worthwhile considering correlation regime change and what this means for diversification.

PS: We will provide an outline of how we approach systematic asset class evaluations in the future. The systematic asset class valuations and others approaches will be available on our Substack for subscribers: Newral’s Substack | Substack.

More to come, stay tuned!

Great synopsis - very helpful for positioning.

Amateur Question: why do you use the option-adjusted CCC spread index rather than the total return or effective yield?