Weekly Signal & Noise Filter

Where the Hell Are We?

The market evolution is at odds with the macro developments. Headline GDP for Q4 is tracking softer as per the Pinebrook projection, from 3% on October 30th, to 2.6% now.

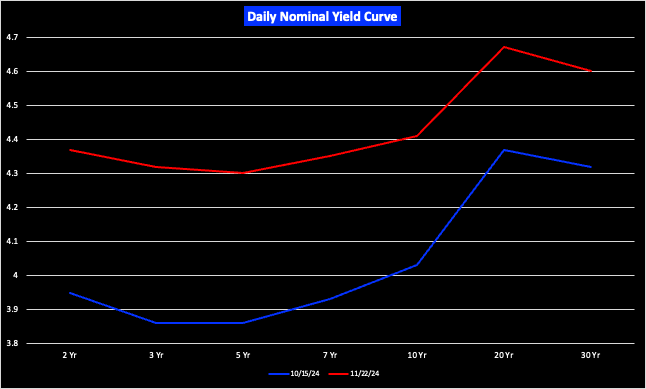

Meanwhile the 2s/10s yield curve has moved parallel up and gotten flatter – 2s/10s are now 4bps versus 8 on October 15th, and the belly has also gotten slightly flatter (this is where I self-flagellate for taking off the flattener trade ,which is now +9.32% ROC vs 195 bps where I closed 😭).

What gives? A slowing economy and a flattening, upward shifting yield curve?

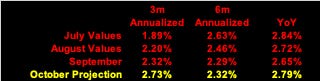

The YoY inflation data sets, which are the Fed’s preferred core PCE metric, have effectively round tripped their summer peak. The November inflation data will likely continue this trend as the post-election risk market strength will feed into higher portfolio management fees that flow into core PCE.

What this means is that a cut in December or January is no longer the issue. The issue