Weekly Signal & Noise Filter

Back to the Real Economy

The bucolic information surface of the holiday season was interrupted by the first major data point of the new calendar year: the employment report on Friday, January 5th.

In addition to the high frequency data noise, there is viral noise concerning shipping lane interruption due to piracy in the Gulf of Aden. We are being told this is a goods inflationary supernova in the works.

Finally, a speech by Lorie Logan is making the rounds in which she discusses financial conditions and the implications for monetary policy.

Shipping & Piracy

Peeling the skin of the low hanging fruit – shipping – we have a template on how the economy and risk markets will adjust to shipping disruptions.

The pandemic supply chain disruptions contributed to goods and services inflation. However, now as then, the inflationary impact around future transitory supply shocks has been figured out by the market.

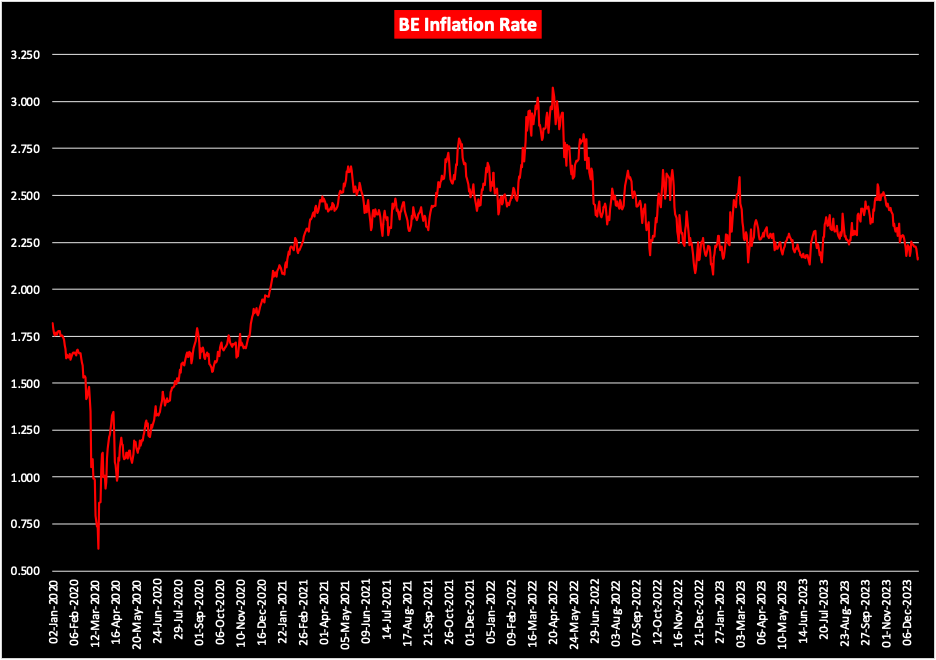

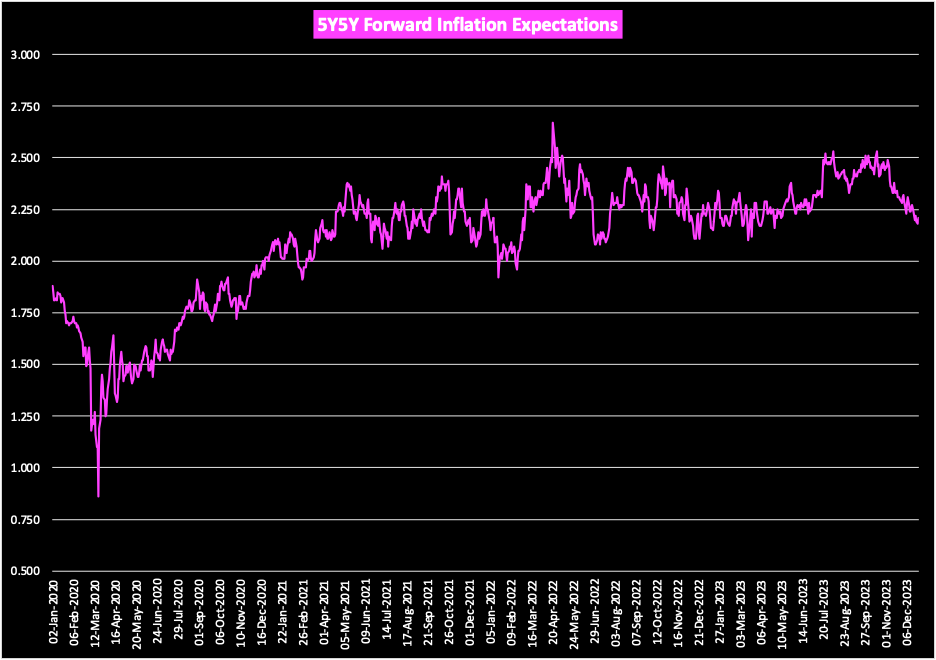

Recall that market-based views of future inflation never became unanchored. Inflation expectations were able to look through the global supply shock. This is visible in treasury break-even pricing and 5-year, 5-year forward inflation expectations.

Break-evens and 5y5y forward inflation expectations both peaked in April of 2022.

The market was never convinced of a 1970’s-style unhinged inflation supernova.

The most likely outcome is that the market will once again see through the inflationary impact of future supply chain disruptions.

The real wild card will be how the high frequency soft data will respond to this. Survey data related to orders, inventories, production, and sales will likely suffer from the bull whip effects that were experienced in 2022 and 2023.

Purchasing managers will likely struggle with order fulfillment schedules; inventories will balloon after over-ordering; then collapse with fire-sale liquidations, and on and on.

The neurotic soft-data volatility should be understood for what it is and faded, if not outright ignored just as it was in 2023.