Weekly Signal & Noise Filter

The State of the Trade

There are two sets of vertical waterfalls that have massive implications for the forward pricing of all financial assets.

A collapse in real yields

A collapse in credit spreads

Real yields had a waterfall moment last week. Down 18bps in one day, if one wants to be precise. Or bonkers.

This development more than any other has knock-on effects across the entire universe of risk assets.

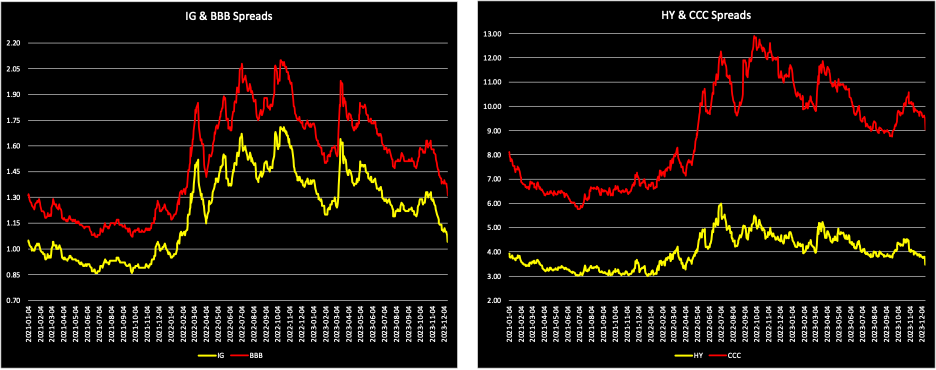

Have a look at credit spreads.

Credit spreads across the ratings spectrum are now below their 2021 – 2023 averages.

Credit spreads are at levels not seen since 2021.