Weekly Signal & Noise Filter

The Narrow Path to a March Cut

“In 2024, the Fed will have to navigate the between the Scylla of strong H1 growth and the Charybdis of a growing disinflationary impulse”.

The above was written on these pages on December 18, 2023. Since then, the most relevant data points have confirmed the above.

Q4 2023 GDP printed at 3.3% vs expectations of 2.1%.

The initial estimate for Q1 2024 GDP from the Atlanta Fed is 3%.

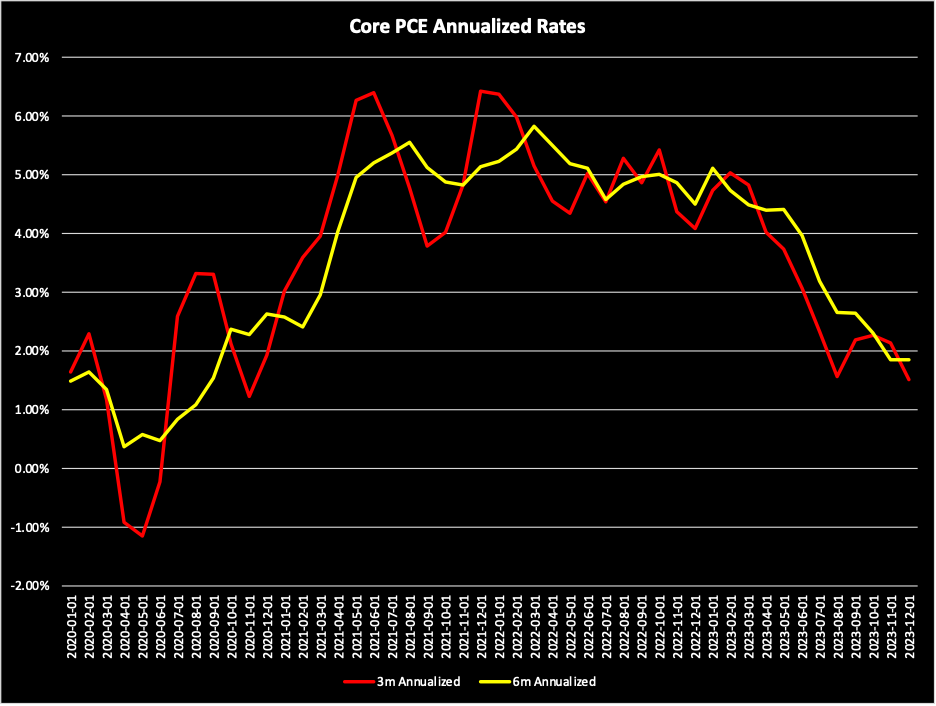

Core PCE printed at its lowest 3-month and 6-month averages since November and September 2020, respectively.

At this point, a bat can see growth is strong and inflation is declining.

Note the symmetrical shape of these annualized inflation prints.

Current consensus expectations are for a hot January core PCE print somewhere between .3% and .4% MoM.

Below is a matrix that shows how 3-month and 6-month annualized rates, as well as YoY rates, would evolve as a result of either one of these two prints.