Weekly Signal & Noise Filter

Beyond The Election (Our Belly Got Flatter)

Risk markets are at all-time highs, and rates continue to suck wind. It is the opposite of the thesis of a growth slowdown in Q4.

The questions are therefore:

Has a slowdown been annulled by the Trump Election?

Is a slowdown still in play but markets have chosen to look past this and focus higher future expected growth?

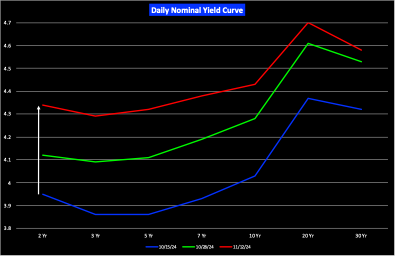

After an initial steepening, the 2’s/10’s spread is basically unchanged, while the belly of the curve has flattened since Pinebrook put on the flattener the.

The lines below reference the closing yields on the day the flattener trade was put on (blueberry line, 10/15/24), when it was closed out (spring line, 10/28/24) and marked-to-market at the close of the cash session on 11/12/24 (red line).

Recall the initial thesis for the flattener, from the October 16th Market Commentary:

25-basis point cut at the November FOMC is a high confidence projection ✅

December, however, becomes sus if the strength in the labor market and inflation data carries over into the December release of the November data sets ✅

The long end becomes attractive because growth may downshift temporarily due to the mentioned hurricanes, strikes, and FRI downtick ❌

To determine if bullet point three above is likely to be flipped from a red X to a green check mark, and thus complete the thesis, we now turn our attention to expected evolutions in the data.