Weekly Signal & Noise Filter

What To Do After Santa Has Left Town

The growth slowdown that was highlighted in late September and early October has been realized and is looking to continue in the near term.

Looking farther out, Fade The Growth ScareTM continues to be the favored risk posture.

On Thursday, December 7th, the Atlanta Fed GDPNow forecast ticked down to 1.2% from 1.3%.

Friday’s job report, despite having strong headline figures such as the 20-basis point decline in the U3 rate from 3.9% to 3.7% and the +199K NFP jobs print, confirmed underlying weakness.

While construction jobs increased by 2K, residential construction jobs declined by 1.7K.

Manufacturing jobs increased by 28K, but declined by 2K when adjusted for the UAW strike.

A lot of digital ink was spilled over the hot wage data in the employment report, with average hourly earnings coming in at 4.3% annualized and wages for production workers coming in at 5%.

Under the surface however, core non-housing wages are growing much more slowly at 3.2%.

The general trend in wage growth in the areas the Fed is most concerned with is slowing.

Despite the increased slowdown, the de-growth impulse is fading, and the economy will likely be less bad in the coming weeks, and modestly improve in the coming months.

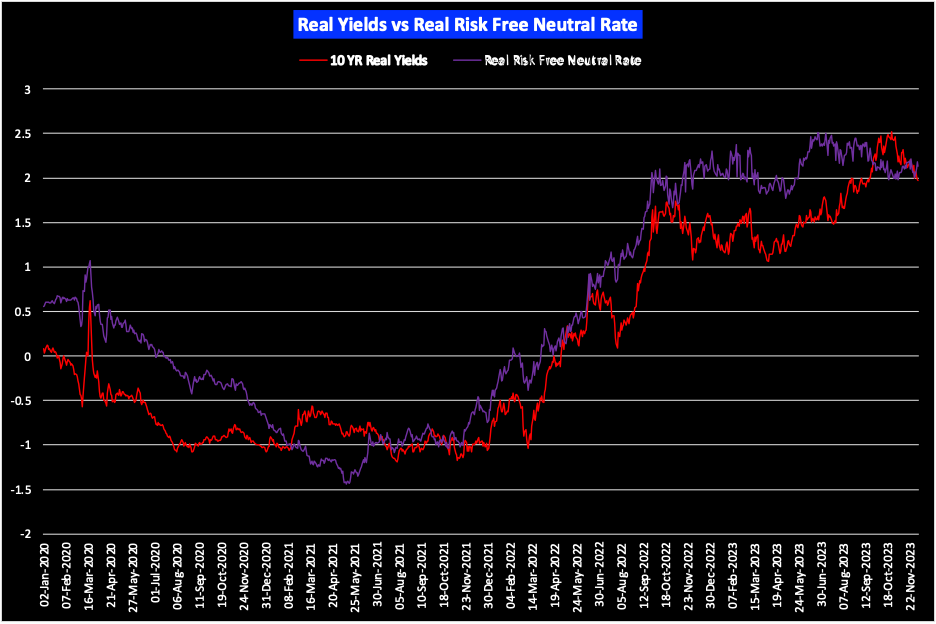

Financial conditions continue to ease, with real yields below the real risk-free neutral rate (a proxy for the natural rate).

Growth accommodative financial conditions will likely begin to show up in the data in the coming months and will likely be first seen in housing data.

The continuing disinflationary impulse along with the pricing-in of future rate cuts will be supportive of future financial condition easing.

Taken together, the healthy employment report (which incidentally took Sahm Rule trigger-risk off the table) and easing financial conditions continue to be supportive of the “fade the growth scare” trade that has featured prominently on these pages for the past 6 weeks.

The market agrees with this take, as the S&P500 made a new 52-week high on Friday.

With the FOMC’s last meeting for the calendar year this week, attention is now turned to their upcoming policy decisions and implications.

The easy part of this analysis concludes with basically zero odds of a rate hike this week, and a 97% probability (based on the CME Fed Watch Tool) that this hike cycle is done.

As for 2024, the March 2024 contract is implying the following:

53.4% chance the policy rate remains where it is now.

43.2% chance of one 25-basis point cut.

The June contract is implying the following:

30.5% chance of one cut.

42.5% chance of two cuts.

18.9% chance of three cuts.

In sum, futures are giving 93% odds of at least one cut in H1 2024, with the highest likelihood for two 25-basis point cuts at a 42.5% probability.

The implication here is that the market is signaling a repeat of the early 2019 playbook, in which a series of non-recessionary interest rate cuts will continue to fuel economic growth into 2024.

It is likely that Chair Powell will not want to confirm or signal the above this week, preferring instead to sound like a hawk while dressed in dove’s clothing.

However, the reality of a disinflationary impulse and a slowing economy will likely lead the Fed down the path of 2019.

Thus, the likelihood of strong year-end rally similar to that of late 2018 is the path of least resistance for the remainder of this calendar year.

Thanks, David, for the consistently concise and clear article.

Another banger DC. You’ve been dead on balls accurate