Weekly Signal & Noise Filter

Wen Buy?

In the March 15th Market Commentary, a 4.50% 10-year treasury note and 4700/4800 downside targets for the S&P500 were flagged as risk targets.

To be clear, these were not base expectations or forecasts, but rather risks to be mindful of in the event the disinflation narrative was questioned and replaced by a reflation narrative due to hotter inflation prints.

The 10-year treasury note blasted through these levels two weeks ago, and the 4900-handle was reached last week in the cash-market.

In addition to approaching or surpassing these risk points, the sector rotation that was highlighted in the April 1st note has arrived. The NASDAQ is now underperforming the S&P500 YTD.

In Pinebrook’s view, the driver of price action will be developments in the (dis)inflation narrative. To monetize the price action, the (dis)inflation narrative must be front run.

We start with the proposition that the Fed has a composition problem with inflation measures, not a reacceleration in general prices problem.

Dispersion indicators are showing fewer percentage of good with prices increases.

Bullwhip echoes continue to manifest themselves, such as in the auto insurance market, where insurance prices are catching up to prior increases in car prices.

Inflation is, and remains, a shelter issue.

Of the three points above, shelter inflation generates the most confusion. Current discourse in social media points towards increases in rents that then feed into the shelter components of CPI and PCE, and therefore higher future inflation prints.

The subject of rent indexes and how they feed into inflation measures is a complicated one and beyond the scope of this note but suffice it to say that official shelter gauges are plagued with measurement errors and are not useful for forecasting purposes.

The basis of the above is the “all-tenant rent index”. The all-tenant index includes new and old leases and do not match actual rent series very closely and should be faded as they are not useful for forecasting purposes.

Fed officials recognize that the official rent inflation components of CPI and PCE lag current rents and they themselves are fading these inputs.

Ultimately, demand for housing is premised on the ability to afford it. It has been pointed out in prior editions of this note that wage pressures continue to decline.

The Atlanta Fed’s wage growth tracker was released last week for March. It showed that wage inflation moderated to 4.7% YoY, the lowest reading since November 2021.

Similarly, average hourly earnings were up 4.2% YoY during March, the lowest rate since June 2021.

In addition to the above, the labor market continues to soften.

Job leaver’s share of unemployed is back down, suggesting that fewer peoples are quitting without a job lined up.

Labor market ratio of quits to layoffs continues to come back down.

Provided wage and labor market conditions continue to soften, official gauges of shelter will ultimately reflect the lower nominal wage growth which drives official shelter prices. It is simply a question of time.

Pinebrook remains of the view that the current inflation scare is temporary and will revert to its disinflating trend, despite the current market assessment of Fed policy rate cuts being delayed possibly through September.

What Is the Trade?

Every major equity index has been down every week of this quarter.

The NASDAQ initially outperformed the S&P500 but gave up most of its YTD gains last week (-5.5% last week and now up only 1.8% YTD).

When previously strong parts of the market come under pressure, such as NVDA’s -13.6% drop last week, selloff pressure is gaining momentum.

The R2K has been a dramatic laggard YTD, with every week in April seeing 3% drawdowns.

The week will remain choppy due to geopolitical noise, and mean reversion as this noise dies down (or increased volatility should it go up).

Ultimately, the market will get positioned for the PCE release on Friday. In the meantime, 40% of the S&P500 will be reporting earnings this week.

The major dip buying target remains mid-way through the 4700/4800 targets that were flagged a month ago.

4800 on the S&P500 is the prior peak just before the bear market that started in 2022.

4729 on the S&P500 is a -10% decline from the index high watermark of 5254.

The 200-day moving average is around 4700, which would be a -10.6% correction from the most recent high.

The ideal setup for Pinebrook would be an increase in volatility above the VIX long-run average of 20 and a continuation of weak price action through the week before taking a speculative risk-on position into Friday’s PCE report.

If the PCE report comes softer than expected, the rout in the bond market will pause, if not end, and the bull market will likely resume.

The reason is the market does not care about higher for longer.

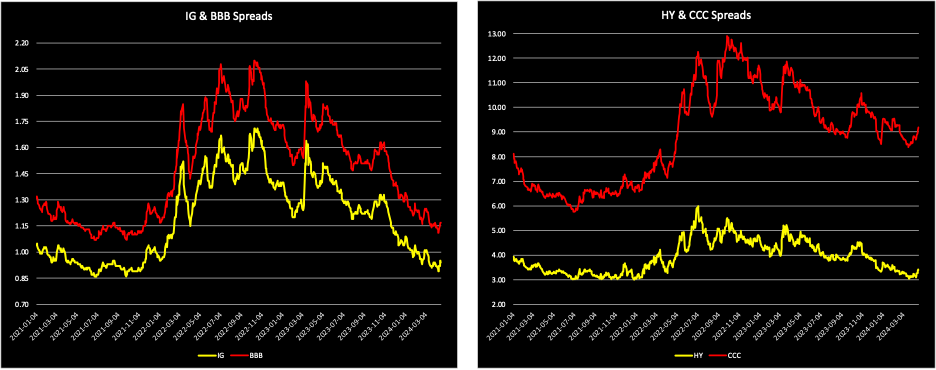

In 2022, 2-year yields went from 1% to 5%, and credit spreads blew out across the credit spectrum.

Since the start of 2023, 2-year yields have remained high, but investment credit spreads have returned to their 2021 values.

High yield credits have followed the same pattern.

The recent increase in treasury rates has yet to spill over to the credit space or affect corporate fundamentals. Markets are digesting the rise in risk-free rates by maintaining a constructive view of the growth cycle.

On the earnings front, U.S. large caps continue to beat (lowered) expectations mostly due to cost cutting, not marginal increases in revenues.

Only 58% of companies have beaten revenue estimates for Q1 2024 so far.

This is a horrible result that pales in comparison to the 1, 5, and 10-year averages of 67%, 69%, and 64%, respectively.

It is early days in the earnings season, with only 14% of firms having reported. However, investors prefer to see increases in revenues vs. cost cutting as earning have no limit if revenues keep rising but are capped under cost cutting regimes. A firm can only cut so much before it starts to chip away at its earnings capacity.

Concluding Remarks

The market is currently experiencing an inflation scare that will likely dissipate over time.

Hair pulling over policy rate cuts and Fed policy will continue to play second fiddle to the broader macro cycle.

BTFD dip targets suggest the equity correction is around mid-way complete.

A benign PCE report would nullify the above provided corporate managements deliver reassurances over future revenue and earnings prospects (no one cares about the past).

Pinebrook will likely take a speculative risk-on position going intot the PCE report.

A benign PCE report would also get Pinebrook long duration in the 10-year rates area.

excellent note