U.S. Economic Growth Update

Looking Beyond the Fed

In our last U.S. Economic Growth Update, published on January 21, 2024, strong housing permit and fixed residential investment (“FRI”) data were flagged as growth catalysts for 2024.

“Similar to how lower rates in late 2022 eventually lead to less bad FRI prints in early 2023, which generated a growth impulse resurgence in mid 2023, it is once again highly likely that less bad FRI will have a similar effect in 2024”.

Thursday’s GDP release for Q1 2024 validated the above: FRI increased by 13.9%, the most since Q4 of 2020. This resulted in a .52% contribution to the GDP print of 1.6%, also the biggest GDP contribution for this time series since Q4 2020.

While Q1 headline GDP growth came in at 1.6%, growth ex-net trade and inventories came in at 2.8% real.

Depending on the inflation look back window used, nominal GDP has the following profile.

Side note: Pinebrook places an extra emphasis on nominal GDP, as spending by economic agents is conducted in nominal terms, and their debts are struck in nominal terms and serviced by nominal income.

The economy has clearly run hot in the last 2 quarters, but Pinebrook does not expect further economic acceleration that would reinforce additional inflationary upside risk.

For starters, the growth impulse energy from FRI is not likely to be repeated. The table below updates the FRI forecasts from Fannie Mae.

Forecasts are forecasts and subject to error. That is the noise. The signal is in the trend and expected changes in growth rates.

Pinebrook’s conjecture is that the 2024 Q1 ramp in FRI was an echo of the fall in rates that started in early Q3 2023, and that the Q1 2024 rate reversal will likely diminish the FRI growth impulse in Q2 and potentially Q3.

If so, core growth (ex-net trade and inventories) will likely be slowing in Q2 2024.

This is an out of consensus view, as the most current Atlanta Fed Nowcast is showing a 3.9% Q2 GDP projection. To be fair, these early estimates are terribly inaccurate this early in the quarter, with two more months of data that can change the projected outcome.

The slowdown thesis does not solely rely on a slowdown in FRI. Recent spending impulses appear to be driven by a decline in the savings rate.

In February it declined a sharp -0.5%.

In March it declined another -0.4% to 3.2%.

There is nothing terribly alarming in this as it signals consumer confidence in the cycle. The consumer remains healthy and is simply leaning into their savings to support consumption. However, savings drawdowns do have limits and will act as a brake on spending.

Therefore, core growth will likely come down from Q1’s 2.8 %figure to something in the 2% - .5% area. If so, real yields have or will soon peak for this part of the cycle.

Recall, the prior real yield peak on the 10-year note was 2.46% on October 20, 2023. Reals closed at 2.24% on Friday, April 26, 2024.

As pointed to earlier in this note, Pinebrook emphasizes nominal spending as the driver of the real economy (particularly as it is tied to asking rents – a subject for another day). Wage growth continues to decline.

Digging into the weeds as to why this is the case, there are two measures of margin pressures that point towards future downward wages.

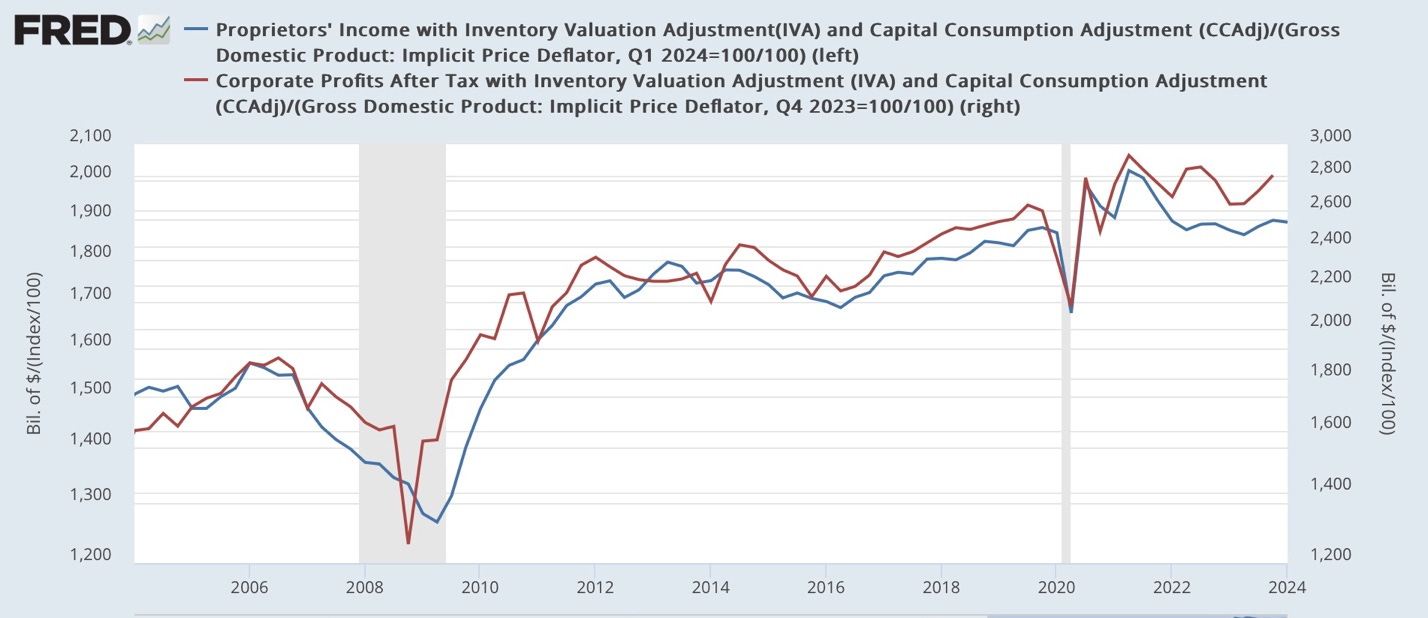

The first is proprietor’s income. This is used as a proxy for corporate profits, which are not reported in the first release of GDP, in the national income and production accounts (NIPA) used by the egg heads at the Bureau of Economic Analysis.

The proper measure deflates by unit labor costs, but those won’t be reported until later either, so the GDP price deflator is a good proxy. But since the GDP deflator increased 0.8%, their deflated income declined slightly.

Real proprietors’ income has been basically flat for the past two years.

Profits at the corporate level reflect the same dynamic. Earnings growth for the S&P500 has been flat for the past two years.

Profit margins peaked in 2021 at 12.7%.

Profit margins have been declining. In 2022 they fell 11.9% and were 11.6% in 2023.

They will likely further decline this quarter to 11.5%.

The takeaway is the stall in profit margins across the economy means that firms will continue to cut costs to manage margin pressures. This includes take a knife to labor costs.

To be clear, this is not a call for a collapse in the labor market. This is a call for continued moderation in labor costs, which will keep a lid on additional inflationary pressures.

Concluding Remarks

As expected, fixed residential investment was a positive growth catalyst for the first quarter.

This will growth catalyst will likely not be repeated as the echoes in Q1’s rate rise will dampen the FRI impulse.

Replenishment of savings will likely be a drag on the economy in coming months and moderate nominal GDP.

Margin pressures will continue to weigh on wage growth and continue to moderate the nominal spending power in the economy that is at the root of all inflationary processes.

Pinebrook has shifted its view on rates from neutral to constructive.

Last week, Pinebrook took as starter position in 10-year futures, at a reference yield of 4.68% on the underlying.

I am traveling right now. I can give this attention on Sunday.

Pls email david@pinebrookcap.com with your concerns.

Will slowing growth stall equity upside? Or will lower yields be sufficient to offset it?