U.S. Economic Growth Update

After the Landing

The sub-title of the last U.S. economic growth update was. “We Have Landed”, published on November 19, 2023.

For new readers, the criterion for the above is defined as follows:

A strong labor market that continues to create new jobs.

Inflation at or below the Fed’s 2% core-PCE target (assuming live market rents for core inflation).

Since then, the U.S. economy has:

Added 314K new jobs (NFP).

Inflation has underperformed the Fed’s own inflation target for year-end 2023, with core PCE coming in at 3.2% instead of 3.7% as listed on the September 2023 release of the summary of economic projections (SEP).

As investors and traders, we seek to front run developments before they are priced. This week we got important forward-looking growth data.

Retail sales.

Housing permits/starts.

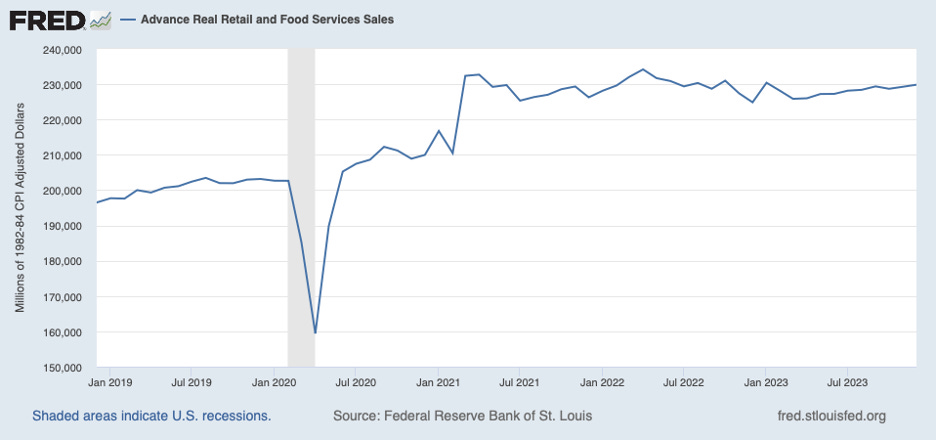

The first area of attention is on real, inflation adjusted, retail sales. Real retail sales have a solid track record of leading employment trends, as consumer spending supports employment.

Adjusted for inflation, real retail sales rose .2%. This print extended the record of consistent monthly increases in this data series since March 2023.

To be clear, this is still below 1.9% below the post pandemic peak in April 2022, which was likely stimulus driven.

However, our concern here is with rates, not levels, and the consistency with which these rates manifest themselves which gives us a picture of a resilient labor market with declining cyclical volatility.

Real personal consumption on goods reflects this robust economic activity, up 1.8% as of November.

These spending and consumption time series suggest that any slowing in the labor market will not be fast.

Au contraire, it will take more than a can kick in the rate cutting cycle to crack the labor market, and the Fed now knows this.

The labor market has given the Fed the green light to delay the rate cut cycle, which was previously based on prior labor market concerns.

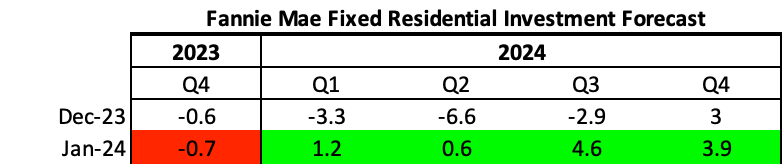

Housing permit and starts for December reiterated the forward growth impulse embedded in the economy.

In the near term, housing unit construction growth – what actually matters for economic activity – will likely slow in Q1 2024 due to embedded lags from the spike in mortgage rates in the Q3 2023.

However, markets are seeing through this, and pricing in future economic activity that is suggested by the December permits and starts data, which will likely kick-in during Q2 2024.

This is confirmed by updated forecasts for fixed residential investment (FRI) – a core driver of the economic cycle – which was released Friday, January 19th.

Recall, the lag sequence is:

Lower rates

Increased permits

Starts

Increased FRI

Actual economic activity

Similar to how lower rates in late 2022 eventually lead to less bad FRI prints in early 2023, which generated a growth impulse resurgence in mid 2023, it is once again highly likely that less bad FRI will have a similar effect in 2024.

Between the robust real retail sales data, and the increased housing/investment data points, the policy trajectory has been altered.

Strong underlying real growth now appears to offset declining nominal GDP (NGDP) resulting from rapid disinflation. In other words, real growth will likely partially fill in the NGDP hole created by disinflation.

Stabilized nominal GDP short circuits the disinflationary doom loop thesis.

Our understanding of the above is confirmed by the market.

Credit spreads

Investment grade (IG) and the BBB credit sub-segment spreads made post-hike cycle lows, at 1.01% and 1.24%, respectively.

The junk market (HY) and CCC credit sub-segment spreads have stabilized after their spikes in early January.

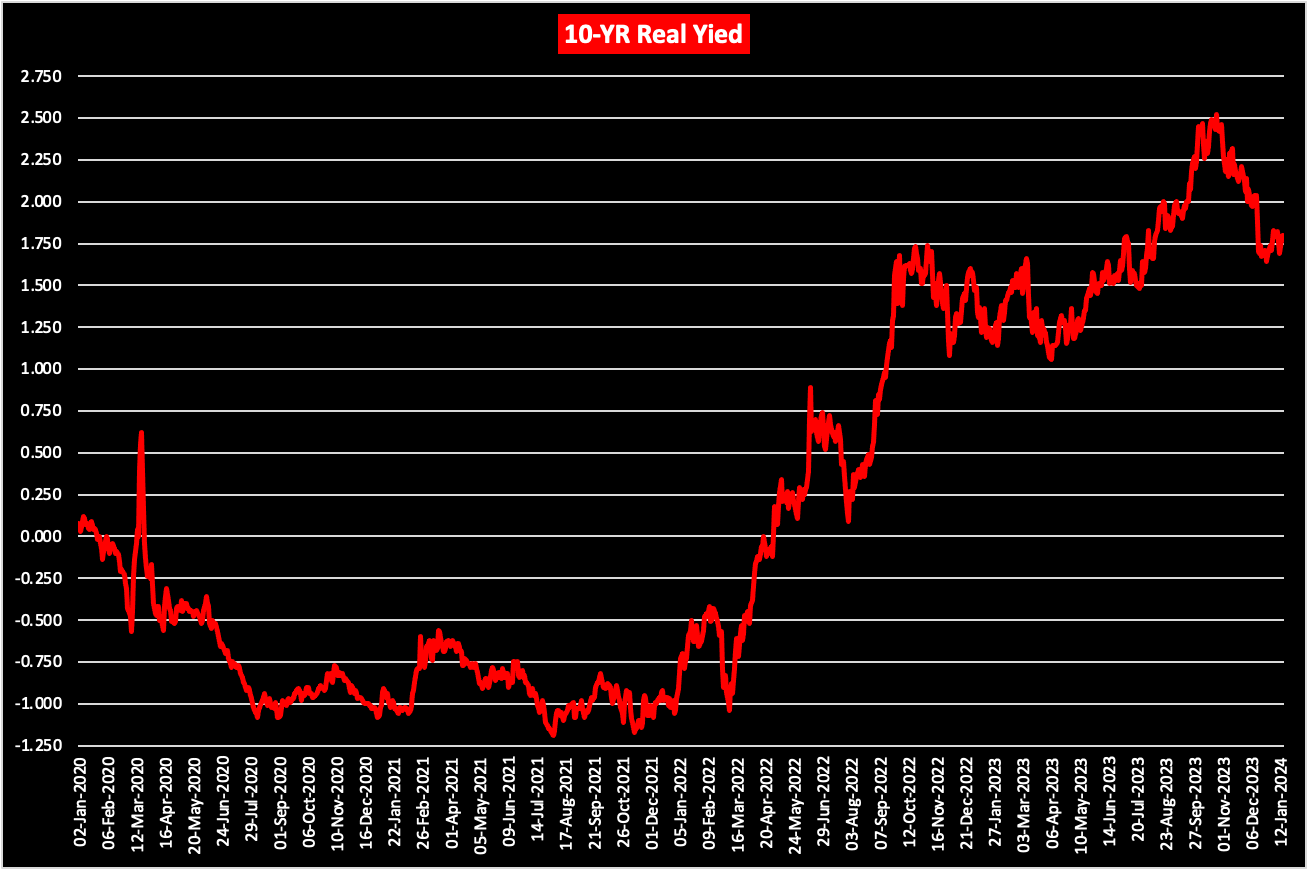

Yields

Real yields have stopped their late 2023 decent, suggesting an arrest in the decline in real growth from Q4 2023.

To be clear, an altering of the policy trajectory is not a cyclical game changer. A cut in March or June marginally impacts risk assets more than it affects the real economy.

Disinflation is an empirical reality. The question is if real growth can continue to fill the NGDP hole created by disinflation. For now, the answer is yes, and the judgement of the market should be respected.

There is one area of concern: inflation break-evens and 5y5y forward inflation expectations have rising since making local bottoms on December 27, 2023. They are up 21 and 22 basis points respectively.

In terms of price action, the market will likely continue to ignore this in anticipation of a cool core PCE report this week. Investors should not.

Concluding Remarks

Real retail sales suggests that the labor market will remain buoyant.

Housing and fixed residential investment will provide a growth impulse to the economy in the coming months, and at least partially fill in part of NGDP hole created by the disinflationary impulse.

Credit spreads reflect strong corporate and cyclical fundamentals (cashflows).

Real yields have stabilized and suggests the de-growth impulse of Q4 2023 has done the same.

Investors should be mindful of rising inflation expectations despite the current disinflationary impulse.

Pinebrook remains constructive risk assets, and neutral on rates.

Very clear article. Thanks. However, David, I am increasingly puzzled: if the economy is so strong, why would the Fed consider cutting interest rates? Also, if you were to give a percentage, how likely do you think it is that there will be a rate cut in the first half of the year? Thank you.

Good stuff David. Glad I’m here! And sorry for all the Twitter hassle for you. Is the private feed intact or do we need another? Thanks for all the great info!