Signal & Noise Filter

When Doves (don’t) Cry

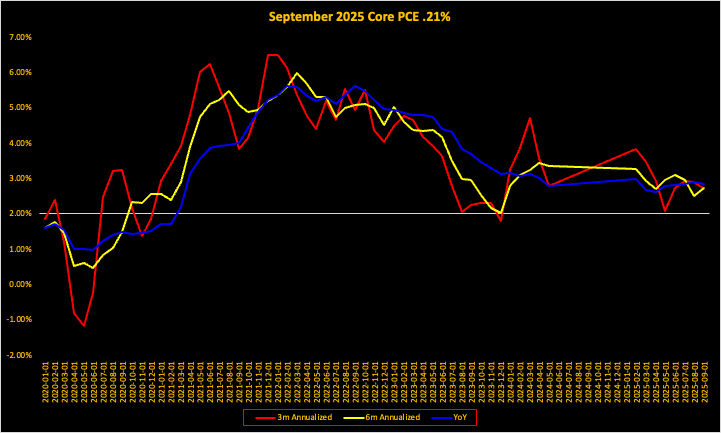

Friday’s downside miss for the September 2025 CPI print keeps expectations in place for 2 more cuts in what remains of calendar 2025.

As a reminder, the consensus was expecting a .3% MoM print, and the unrounded result was .227%.

Pinebrook’s core PCE projection for September of .21% MoM is still in play and will generate a 2.84% YoY level.

This is the noise, and investors should ignore it at this point. The forward policy issue that the Fed is confronting is one of mild, non-recessionary stagflation.

Recall the classic stagflation conditions:

Above target inflation.

Low or negative real economic growth.

High unemployment.

What makes a classic stagflation difficult to deal with is that the policy response to address one of the above results in a worsening of one or two of the other conditions. Stagflation is the ultimate policy quagmire.

However, this is not your granddaddy’s stagflation from 1975.