Signal & Noise Filter

Bruh

While not quite Chair Powell’s words at the October FOMC presser, Bruh (American slang for “bro”, or brother) conveys what the market interpreted as a dismissive attitude towards an additional policy rate cut in December 2025 when Powell said that a December cut was far from a foregone conclusion.

In Pinebrook’s view, Powell’s comments were an effort at strategic ambiguity meant to preserve policy optionality given buoyant financial markets in the face of a data embargo given the government shutdown, and an attempt at FOMC member management.

As a reminder, there were two dissents against this week’s 25-basis point policy rate cut.

This is consistent with Pinebrook’s thesis of a mild, non-recessionary stagflation as the forward policy issue that the Fed will be facing in the not-so-distant future.

Powell acknowledged as much in his opening comments at the post FOMC presser: “In the near term, risks to inflation are tilted to the upside and risks to employment to the downside—a challenging situation”.

The rest of the presser danced around the issue of what the reaction function would be should one element of the dual mandate rise or fall faster and sooner than the other.

We of course know what this means in the blunt sense.

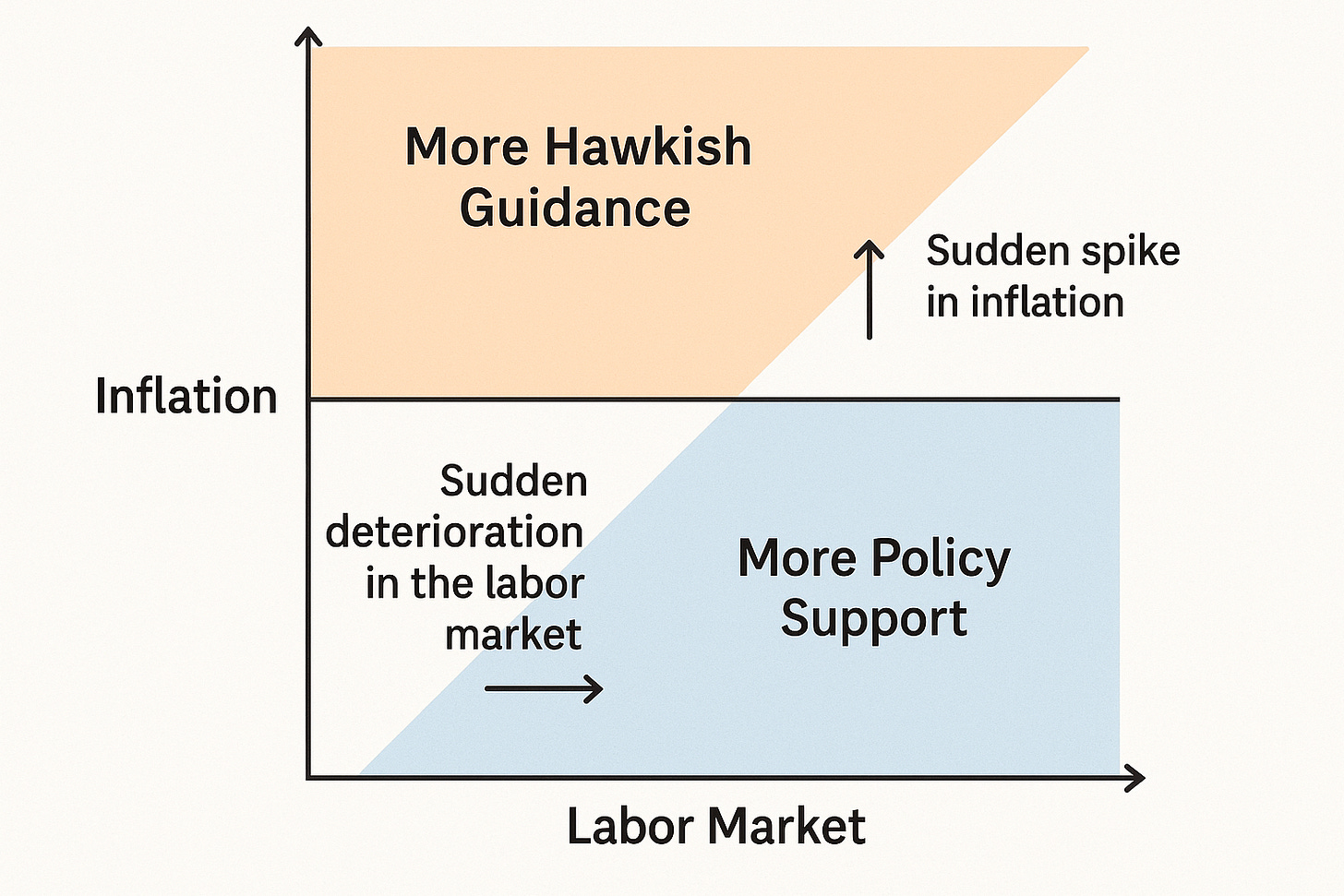

A sudden spike in inflation relative to a more modest weakening of the labor market would result in more hawkish guidance.

Conversely, a sudden deterioration in the labor market relative to a more most increase in inflation would result in more policy support.

The blunt reaction function is the known-known, and there is no marginal information value to this.