Signal & Noise Filter

It’s the Labor Market, Stupid

The last edition of this series, back on December 18, 2025, concerned itself with finding a signal amid the economic data slop that was a result of last quarter’s government shutdown.

The core message then was that the labor market had not reached a tipping point that would motivate the FOMC to cut interest rates in January.

This posture was validated by this month’s release of the December U3 employment rate, which improved modestly from 4.5% to 4.4%, and has sealed the deal on a pass on cutting.

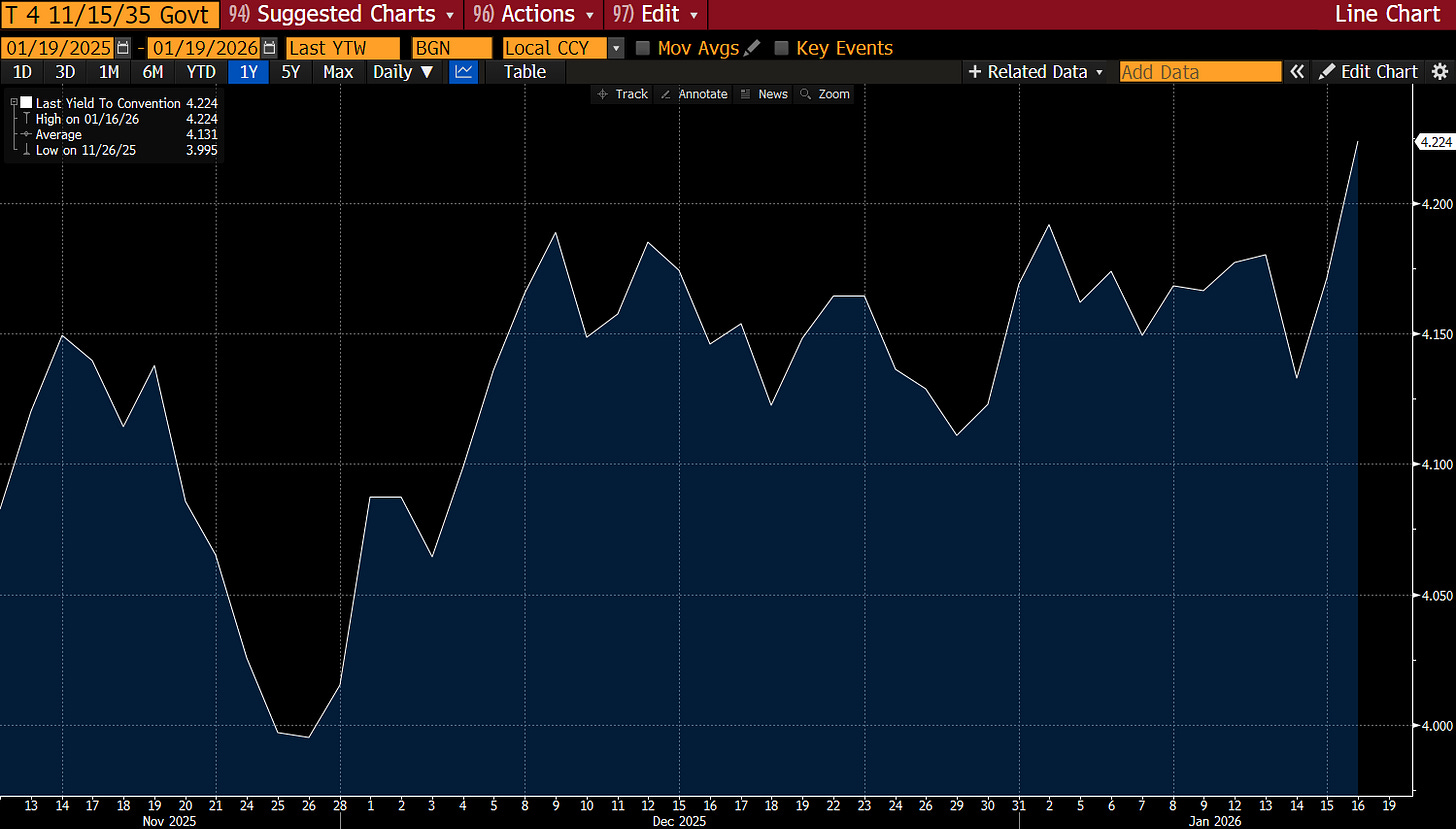

While obviously not the sole causal driver, the U.S. 10-year note has responded as expected with the evolution of the published data (labor, growth, earnings, etc.), moving from 4.12% on December 18th to 4.22% by close of January 17th.

[For purposes of this discussion, Monday’s treasury market price action is not considered as the signal value is lost to geopolitical noise regarding Greenland].