Market Commentary

L’État du Marché

Is this the market pullback we were all waiting for? 👇

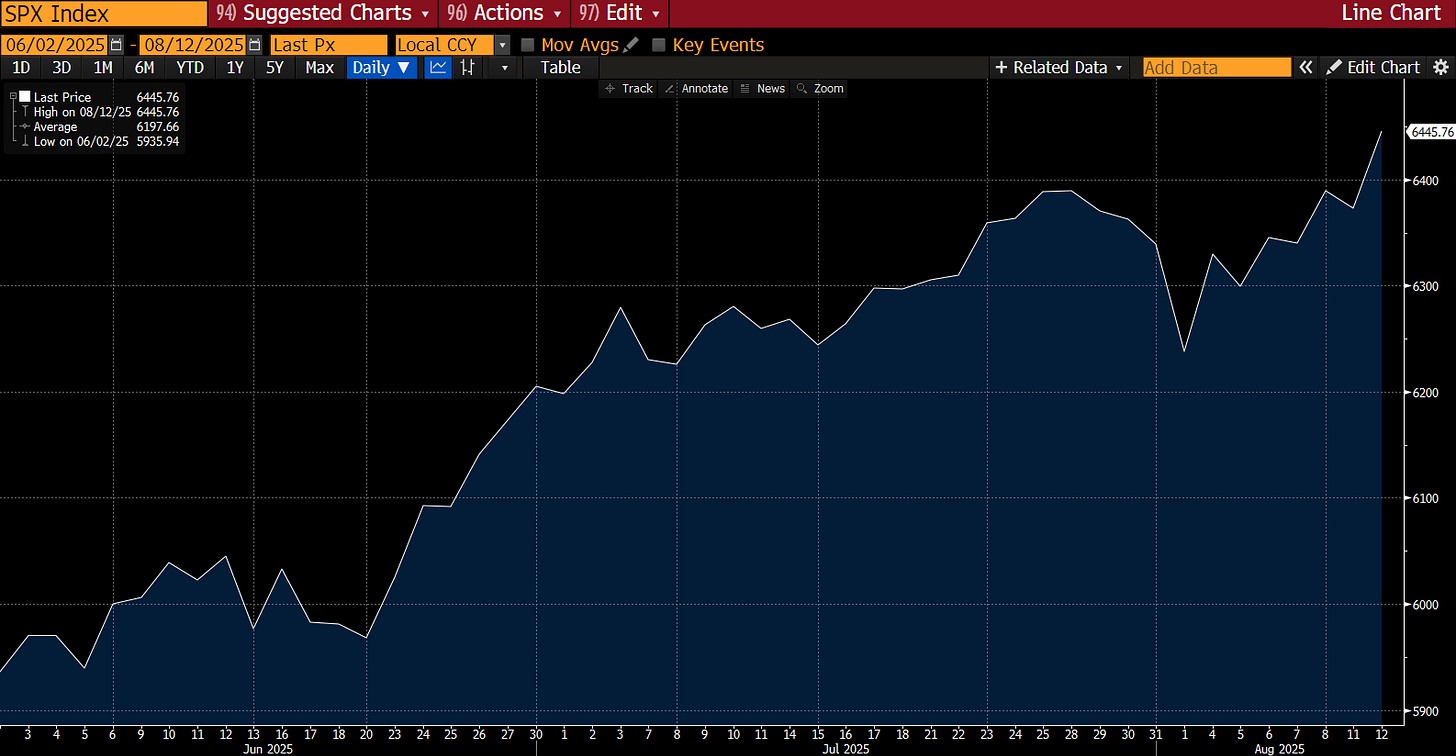

It is too early to tell if August 1st was the late-summer low we were all expecting. More telling than single line-chart voodoo is the macro comparative price action.

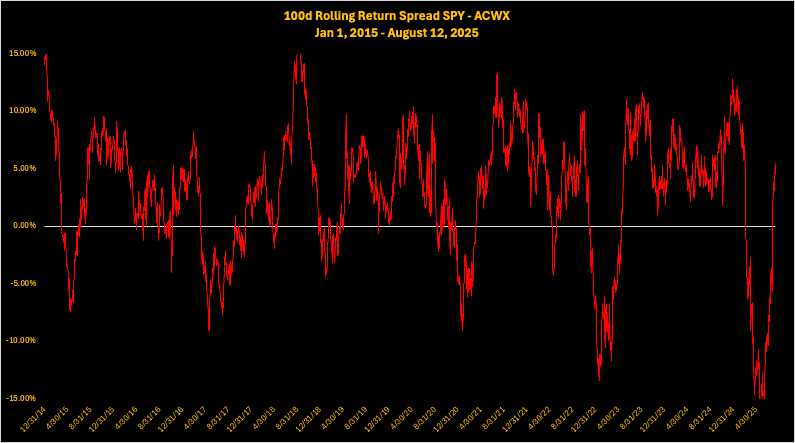

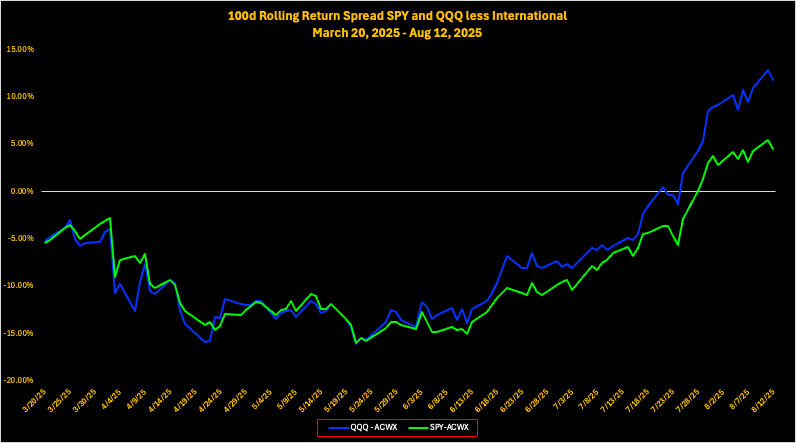

Regular readers will recall the pre and post Liberation Day mean-reversion price action.

Prior to Liberation Day, Rest of World (“RoW”) assets outperformed U.S. ones in 2025 as they made up for relative underperformance in late 2024, and in response to a loosening of a German-imposed fiscal straight-jacket.

After Liberation Day, U.S. outperformance returned with a vengeance.

Through July 31st, U.S. assets have been the winning trade since Liberation Day.

U.S. assets have underperformed RoW, ex-China, in August. As of August 12, 2025. 👇

In Pinebrook’s view, the pullback is happening under our own lying eyes. However, it is a relative performance pullback when benchmarked to RoW assets.

Given the strength of U.S. earnings season for Q2, and more importantly, the outlooks and forward guidance for H2 2025, waiting for the sky to fall in August has been the trade with the worst risk-reward.

Ninety percent of S&P500 companies have reported.

81% have beat estimates, which is well above the 1,5, and 10-year averages of 77%, 78%, and 75%, respectively.

On average, the winners beat estimates by 8.1%. This beat margin was above the 1 and 10-year average of 6.3% and 6.9%

In aggregate, Q2 earnings is shaping up to be $3.53 better than the $62.86 expectation (+5.61% better).

Q3 and Q4 earnings estimates are rising. This runs counter to the trend of over-optimistic analysts quietly ratcheting down their estimates as the year progresses. This is unusual and very bullish.

During Q2 2025, only 4% of S&P 500 companies mentioned "recession" in their earnings calls, with the term cited on just 16 out of 442 calls conducted between June 15 and August 7. This reflects an 87% decline from Q1 2025, when "recession" was cited in 124 calls.

The percentage is significantly lower than the five-year average of 74 calls and the ten-year average of 61, indicating recession concerns are at historic lows among large US firms in the latest quarter.

The above begs the question of why U.S. relative underperformance in August given the strong outlook.

In global macro, most roads lead to the dollar.

The August 1st jobs day report shifted Fed policy cut probabilities higher, which lowered rates across the curve.

U.S. economic growth expectations shifted lower with the softening labor market.

The above may be fine economic/market journalism, but it leaves open the lingering question of “what is the trade?”.

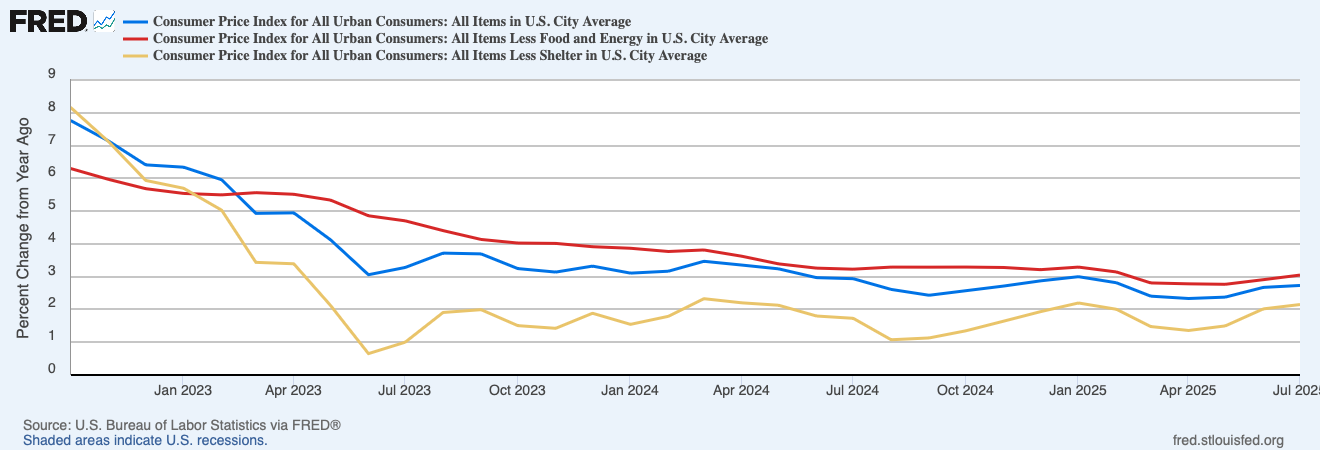

The forward macro context is the appropriate starting point. Inflation remains the dominant risk to Pinebrook’s thinking.

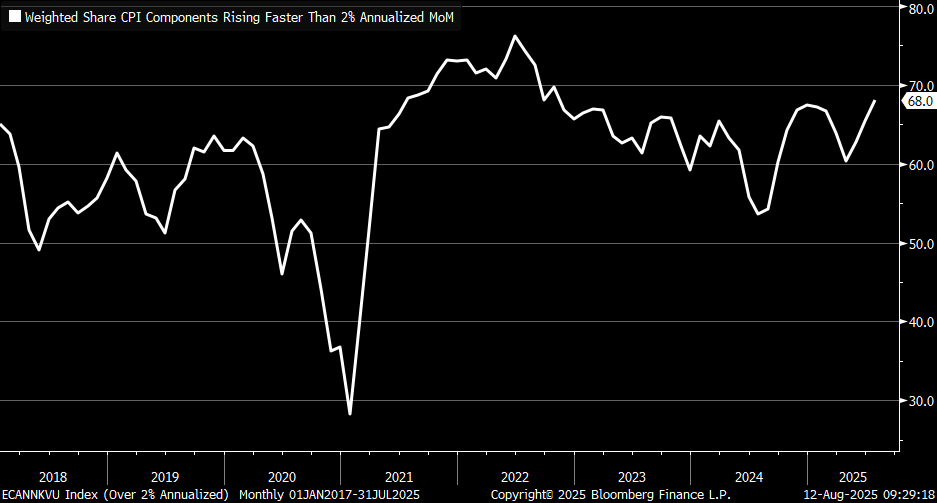

The market narrative is that tariffs are not a thing or are simply one-off price shocks. The internals of yesterday’s CPI release disabused us of this narrative. The reason is that inflation is broadening.

68% of total CPI components are now increasing at a rate consistent with more than 2% inflation.

Narrowing the field down to core CPI, 52% of a basket of 83 items within core are rising at a rate consistent with 3% inflation. (The chart below states 82, but that is the author’s error; Github data code reveals 83 items).

Source: @mtconkzal, used with permission.

Different people will have different views on the inflation data, with emphasis reflecting their own biases. The old adage of finding what one wants in the data comes to mind.

For example, shelter is of course falling and that is an inflationary relief. But category lines obfuscate the gray matter that separates them. i.e., auto insurance is rising, reflecting the increased costs of car repairs from imported goods which have been tariffed.

It is these passthrough effects of tariffed goods making their way into non-tariffed services which is an underpriced risk by the market. The subtle passthroughs are the catalyst for a rising and broadening inflationary impulse.

The bottom line is that non-shelter inflation is increasing.

This is reflected in Pinebrook’s core PCE projection for July 2025 of