Market Commentary

With Shiny Toy Models

Investors are asking themselves one question right now: what is the endgame for this rally?

The uncomfortable answer is of course, no one knows. There are an infinite number of permutations for how it does.

Monetary policy mistake.

Geopolitical shock (usually something to do with oil).

Banking blow-up.

Labor market meltdown.

Something-something in the treasury market.

Investor fatigue at rally chasing.

The above is but a short list of the parade of horribles that can befall the market. Contemplating them is really a waste of time due to their random black swan nature.

What is not a waste of time, however, is understanding the pain points for buying and selling.

These pain points are best abstracted by models. While an imperfect heuristic, they are abstractions of information like canes, which provide the sight impaired with personal navigation feedback vis-à-vis signals.

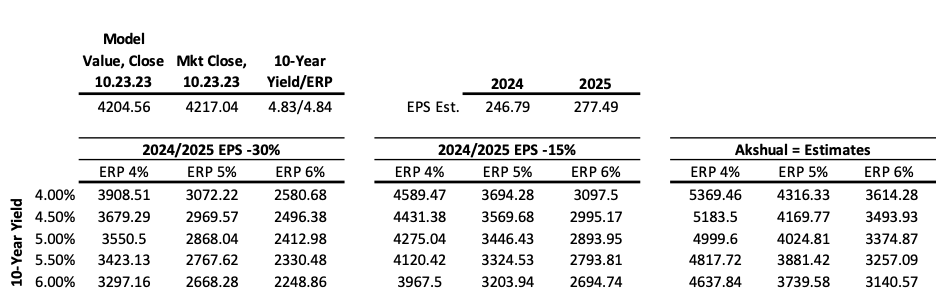

In a note published October 24, 2023, the following equity pricing matrix was offered.

The model came within a rounding error of the actual market value, which any enterprising goal-seeking analyst can do.

The signal value was in understanding the index price path dependency on three factors (ERP, long yields, earnings). In chart form below.

What is clear is that pricing is more sensitive to the ERP than to changes in bond yields. This should come to no surprise after the prior market commentary which touched on this matter.

The earnings and interest rate impacts appear to be relatively linear, as the slopes are relatively stable. What is most striking is the appearance of convexity. That is, the index difference from a 5% ERP to a 4% ERP is much larger than the jump from 6% to 5%.

What this tells you is that investor sentiment – what investors are willing to pay for a future stream of discounted cash flows - matters more than the cash flows themselves or their discounted value.