Market Commentary

The Small Caps Trade

The S&P500 is finally near break-even YTD, Moody’s sovereign downgrade of U.S. Treasury’s notwithstanding. The Russell 2,000 (“R2K”) is lagging, down 8.82% YTD. With the economic cycle seemingly saved from the jaws of defeat, is now a good time to bet on a mean-reversion catch up trade?

Waiting for the R2K to match or even outperform the S&P500 has been the Waiting for Godot Trade. After roughly similar performance, the S&P500 began to break away in 2019 and hasn’t looked back since.

A generation of MBAs and CFAs trained in the Fama-French factor school of thought have been anxiously waiting for their toy models to work for the better part of a decade now and must be quite sad given the current state of affairs.

Is Elvis about to come to the party now?

The first step in answering this question is realizing that small caps indices have become a lousy collection of SME businesses.

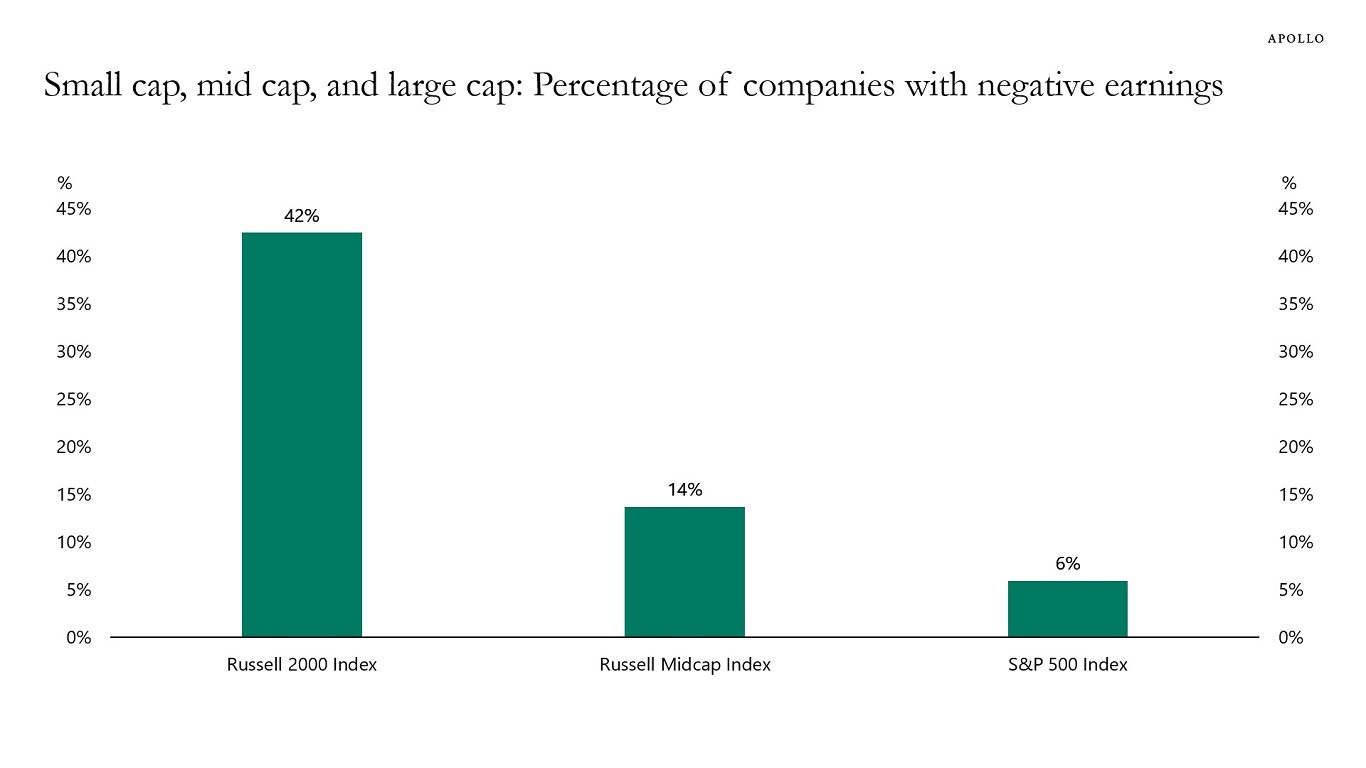

Nearly half (42%) of Russell 2000 companies produced negative earnings as of December 2024.

This is up from just 14% in 1994, as the quality of companies that comprise the Rusell 2000 Index has meaningfully deteriorated.

Source: Torsten Slok, Apollo

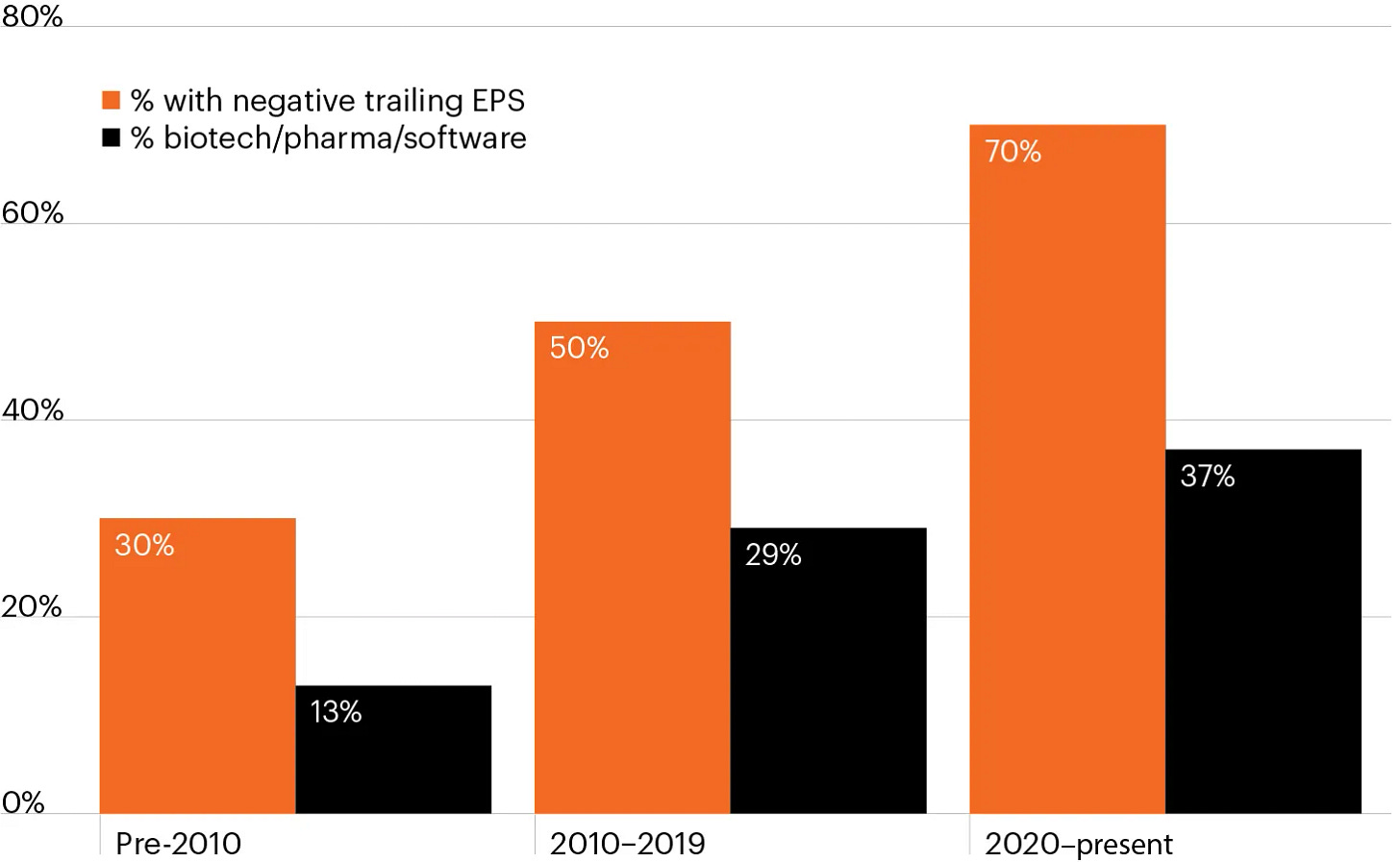

Over time, the number of post-IPO firms that are money losers has increased.

Some of this is structural and compositional. Many higher quality companies have chosen to stay private as the regulatory burden of seeking public capital has raised the cost of equity.

As shown below, IPOs have become more speculative and YOLO in nature, requiring significant investments in R&D before achieving scale.

ZIRP allowed for prioritizing growth over profits.

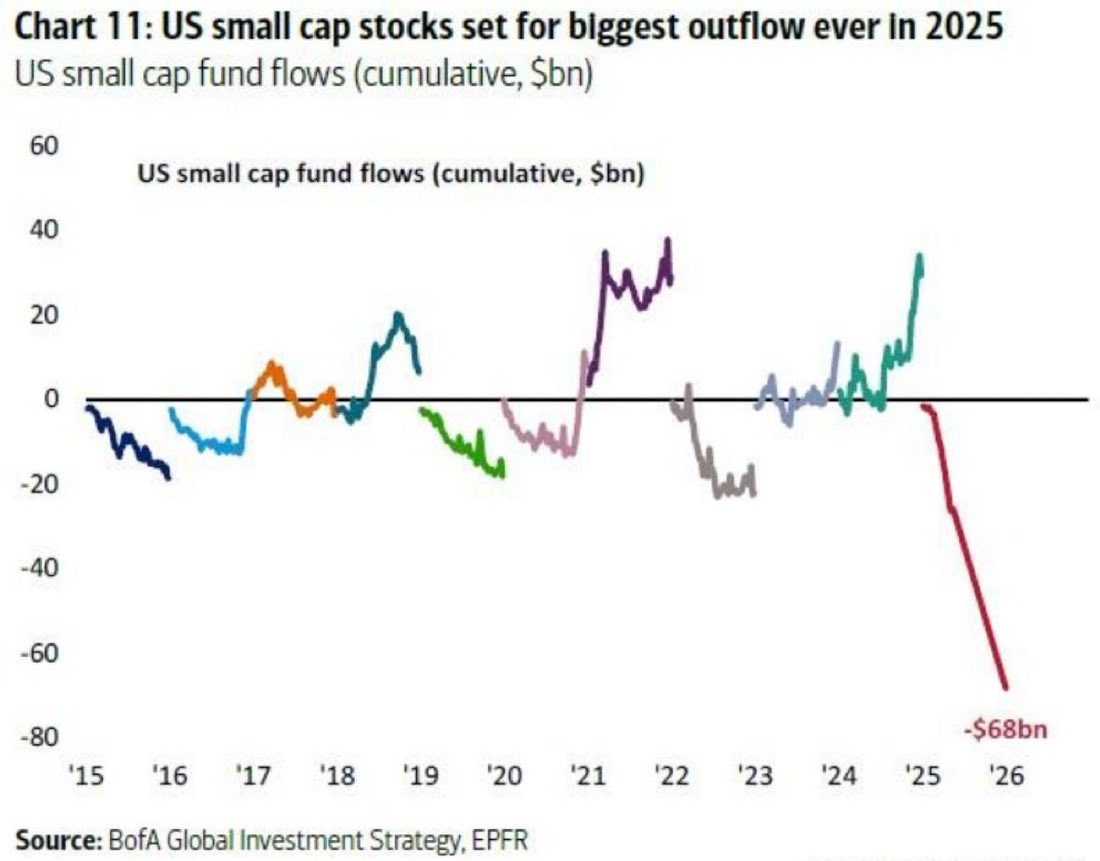

The market has not been blind or kind to these realities, as capital flows to where it is treated best.

The second thing to realize is that small caps are really a high yield trade in drag. Small caps’ lack of profitability makes them reliant on debt financing and the cost of this funding is issue number one for them.

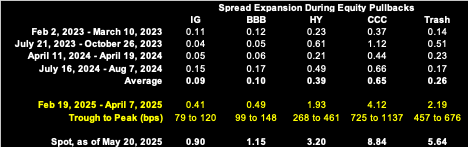

In part, the case for a small cap trade is predicated on prospects for high yield spread compression.

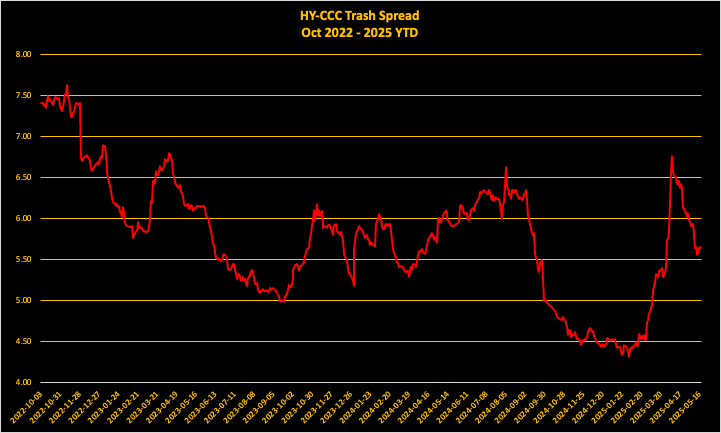

Spreads blew out considerably more in April than in any other pullback since the post 2022 bear market.

Spreads have recovered approximately half of their selloff.

Spreads working their way down to their cyclical lows will be a tailwind for small caps, just as were in the run-up leading to the U.S. presidential election - the last time smalls showed strong performance.

Whether or not spreads get there will be a function of the overall economic and policy environment, as spreads are the market’s expression of risk and sentiment.

Trade policy related noise has abated.

What smalls need is a similar unambiguous risk-on sentiment catalyst similar to the election, when smalls outperformed the S&P 500 over a 50-day holding period by more than 1 standard deviation (+4.2 percentage points) up until November 21st2024.

The Republican party won control of both Congress and the White House. Hopes for lower taxes and deregulation helped small caps outperform.

The small cap regime dominated by Fama-French factor thinking is dead.

The illiquidity premium has become the bag holder discount.

Growth is eating value.

Smalls are cheap not just for a reason, but for multiple reasons.

Inferior cash flows.

Inferior margins.

Inferior growth trajectory, etc.

There is very strong correlation between gross margins and price to forward earnings. Businesses that have high gross margins are really a proxy for:

Pricing power.

Low capital intensity.

Technology that is sustainable.

Thus, the wager implicit in owning smalls is betting on a recovery that isn't in evidence. They are inferior assets that work in a risk-on reversal trade. Since 2010 smalls have only outperformed the S&P500 in 5 years: 2010, 2012, 2013, 2016, and 2020.

With the exception of 2013 and 2016, all of these can be classified as “post-recession/early cycle” bounces.

Without anchoring to a view that earnings will grow faster, a strategic long is non-sensical.

Concluding Remarks

Smalls have lagged large caps for 10 out of the past 15 years.

Betting on mean-reversion is betting on a return to advantageous factors that have structurally vanished.

The one support for smalls that argues for a tactical long would be a compression in high yield bond spreads, which lowers the cost of funding for highly leveraged small caps.

The optimal time for a long in small caps is as a post bottom/early cycle recovery trade.

Extremely informative article! You have been on fire lately with content.

Thank you! Very clear article. Also, David, do you think there is a possibility of spreads expanding recently? I went short on HYG and didn't make any money, just closed the position. I'm a bit disappointed. Haha.