Market Commentary

Apparently, There Was More to Go…. How ‘Bout Now?

In the July 28th Market Commentary, the answer to the above was, “We don’t know of course”. The note was subsequently closed with “….we are in a BTFD regime of risk taking and equity accumulation as we head into the fall and year end”.

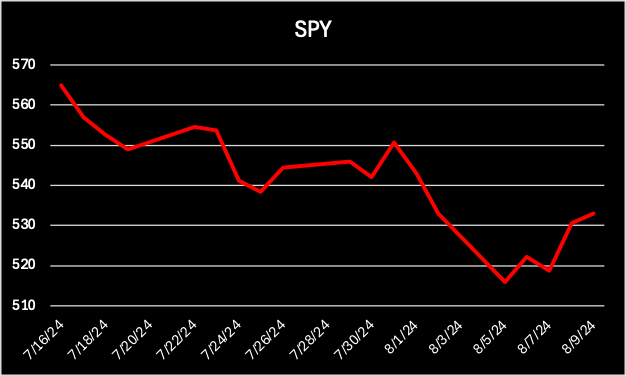

If a retail investor had bought the next day’s (July 29th) opening price of 546.02 for the SPY ETF, the price return as of Friday’s close (532.99 on August 8th) would be -2.39%.

After the hurricane combo of a partial unwind of the Yen carry trade and a disappointing Employment Report on August 2nd, Pinebrook bought the resulting dip on August 5th, as announced on X (formerly Twitter) at 10:07 am.

Allowing for terrible executions and delays on a volatile day, assuming SPY was purchased around 10:30am that day at 516-ish, the price return on that trade as of Friday’s close (August 9th) would be 3.29%

Netting out the two dip trades generates a positive .45% return as of the close on Friday, August 9th.

As the saying goes, past performance is not indicative of future returns, which is why this issue will explore market dynamics beyond the equity volatility risk that was examined in the prior iteration of this note.