Market Commentary

Looking Beyond the AI Trade

The prior note in the 2026 outlook series looked at how sectoral multiple expansion will have to do the heavy lifting to achieve any meaningful price appreciation next year. Not surprisingly, the bullish road is likely paved with even more multiple expansion from the tech sector.

“The most likely path to 26x would likely involve some combination of aggressive tech repricing (because it can) and some more modest repricing of the other sectors on a scale that appears reasonable enough to past the sniff test”.

In this note, we want to explore two things.

How the hell is this even possible?

What are some viable asset allocation opportunities should one not want to go all in on the AI trade.

Getting back to the core issue of multiple expansion, the biggest issue is one of anchoring bias driven by lookback windows.

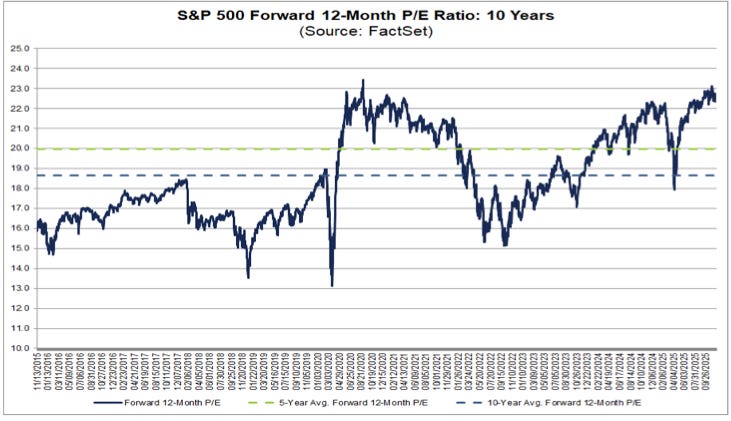

The 25-year average for the S&P500 forward multiple is 16.3x.

The 10-year average is 18.7x.

Currently 22.1x.

As the current multiple pushes up against the 2020/2021 top of 23x as well as the dot-com one of 24x, mean reversion vibes show their faces.

As with anything in life, context matters and investor sentiment, like beauty, is in the eye of the beholder.