Degen Trade Alert

Miners

The first question on everyone’s mind tonight is, are we done puking in precious metals? It’s a good question, and one that no one has a definitive answer to.

Here is what we do know.

Gold

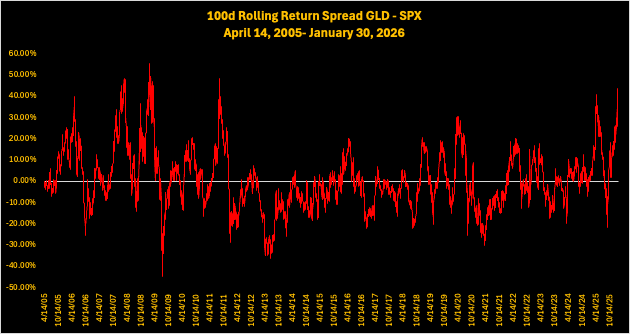

On Wednesday Jan 28th, the GLD ETF was 44.07% overbought relative to the S&P500 on a 100-day rolling basis. This was above the 3-standard deviation level of 42.91%.

Currently 26.06% overbought, just shy of the 2-sigma level of 28.92%.

On a 1-year lookback window, the levels are higher and more extreme, coming in at 78.81% on Wednesday January 28th vs. 3-sigma of 73.53, and closing on Friday at 58.13%, between the 2 and 3-sigma levels of 49.75 and 73.53% respectively.

At the 1-year lookback window, overboughtness eclipses what was seen during the depths of the global financing crisis.

One must believe that current macro instability eclipses that of the GFC.