Down the Rabbit Hole of Equity Risk

or How I learned to Ignore Everything Else

In a note titled “For The Bottom Feeders”, I discussed a static framework for establishing some levels at which I would become frisky for equity risk.

Today, I want to update the levels discussed in that framework.

After doing so, I want to take the analysis a little farther and introduce a framework that takes bond yields and risk premiums into consideration.

Static Framework

Today, as then, the market today is still not officially in correction territory. -10% from the July 31st high of 4588.96 high puts the S&P500 at 4130.06.

Since the September note, 12-month forward earnings have pulled back by $1.41, and the U.S. 10-year note is up 22bps, from 4.61% to 4.83% (after breaking a 5-handle).

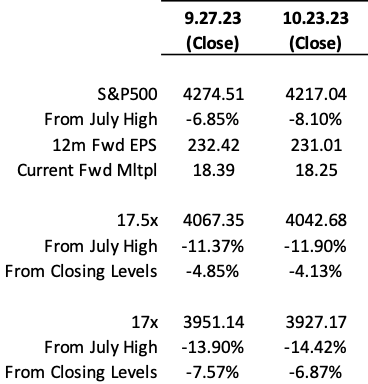

Applying the 10-year average forward PE multiple of 17.5x to the updated, reduced earnings forecast gives us a level of 4042.68.

Handicapping the multiple to 17x to adjust for the risk of additional lower earnings expectations or further interest rate increases gives us a level of 3927.17.

The table below summarizes the legacy and updated information.

This is obviously a very simple framework, but it kept me focused on value gaps instead of taking speculative taking equity risk with below average VIX levels simply to end up -1.34% poorer.

The limitation with this approach is one can hang around waiting for a market puke and a subsequent value gap that never appears.

Historical valuation metrics are a poor choice for taking risk today because of this inter-temporal conundrum.

This is the curse of the risk-averse investor: you may never get the fat pitch.

Risk Neutral Pricing

The basic premise behind risk neutral pricing is that if one is going to assume market risk today, one’s payoff should be in-line, or preferably better, than the risks assumed.

IOW, if one is inclined to take risk today, then an investor should be compensated with the appropriate premium.

Things are best judged to be cheap or expensive not in relation to their historical past, but in relation to their potential payoff.

The risk-averse investor is backward looking. The risk-neutral investor is forward looking.

To establish the economics of their potential forward payout, an investor needs to first establish a price of risk.

Looking for Sasquatch, aka the Equity Risk Premium

The equity risk premium is the price of risk in equity markets. It is the compensation investors demand for assuming equity risk.

The problem with risk premiums is that no one really knows what they are.

They are the animals in the forest no one has ever seen but are sure to exist because of the footprints and sounds that establish their existence.

If investors are to hunt for elusive returns in the forests of financial markets, they should at least know what to look for.

The maxim, “if it walks like a duck and sounds like a duck…it’s probably a duck”, applies here.

There are three general approaches for establishing risk premiums:

Historical returns, which look at a long time-series of equity and bond returns and compare them.

You will get wildly different results depending how historical data is sliced and diced. Historical methods also have zero predictive power but are nice toy models.

Survey methods, where investors basically take guesses and often make stuff up based on their vibes and biases.

Your answer will depend on who you ask and what you ask them.

Implied premium approach, where a forward-looking estimate of the premium is estimated using either current equity prices or risk premiums in other markets, such as risk-free bond markets, credit markets (default risk), or option markets.

The implied premium approach will yield different answers depending on the model or reference market used. What makes this approach the least bad from the other two is its reliance on live market pricing (which in and of itself has its own baggage).

Getting Back on Track

Our purpose here is not to go down the rabbit hole of the theoretical underpinnings of equity risk premium model construction or calculations.

It is to familiarize ourselves with the basic concept of implied market pricing of risk in relation to other risk assets.