Market Commentary

Starting 2026

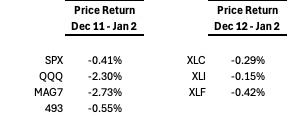

Back on December 11, 2025, these pages took the view that the 493 were set to narrow their performance spread versus the Mag7.

Based on the above, Pinebrook deployed capital to communications services (XLC), industrials (XLI), and financials (XLF) on December 12th.

Two of the past three weeks coincided with year-end holiday celebrations and vacations, and attendant low volume liquidity, resulting in a sideways trading chop. Nevertheless, here is how things are stacking up.

The Mag7 and big tech have underperformed and the sectoral plays have outperformed, although neither the spread nor the levels are nothing to get excited about. It can even be chalked up to noise in a shallow, illiquid year-end market.

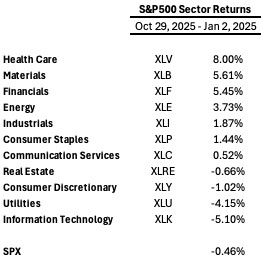

Expanding the lookback window for a wider view to when the rotation started on October 29, 2025, healthcare has emerged as the clear leader, up 8% since late October, and big tech has been the laggard.

Side Note: The tails of the rotation away from Mag7 actually started in the summer of 2025.

On July 22, 2025, XLV was established as a long after being oversold by 2-standard deviations relative to XLK.

By July 30, 2025, this became 3-standard deviations and a short was established on XLK.

This trade went through different evolutions last year. Using the dates above, this pair trade is now +4.2% in favor of XLV.

With thesis confirmation out of the way, we want to understand the direction and strength of the forward rotational move.